The Prime Credit score Card Reconciliation Softwares in 2024

Credit card reconciliation is a vital facet of economic administration for companies of all sizes. It’s the technique of evaluating and matching credit card transactions with corresponding spends and monetary information to make sure accuracy and transparency in monetary reporting.

As companies more and more depend on bank cards for numerous bills, the necessity for environment friendly reconciliation processes turns into extra essential. On this weblog, we dive into the world of bank card reconciliation, the highest softwares to resolve this, key options to search for and challenges to beat, and the way options like Nanonets may help companies.

What’s Credit score Card Reconciliation?

Bank card reconciliation is the method of evaluating bank card statements with corresponding information to make sure accuracy and consistency in monetary reporting. It entails matching particular person bank card transactions, corresponding to purchases, funds, and costs, with entries within the firm’s accounting information. The objective of bank card reconciliation is to establish discrepancies, errors, or fraudulent actions, making certain that every one transactions are correctly accounted for and recorded.

Usually, bank card reconciliation begins with the assortment of bank card statements from numerous sources, corresponding to banks or monetary establishments. These statements include particulars of transactions made utilizing the corporate’s bank cards inside a particular interval, together with the date, quantity, service provider identify, and transaction description.

As soon as the bank card statements are obtained, the reconciliation course of entails evaluating every transaction listed on the statements with corresponding entries within the firm’s accounting information. This will embrace invoices, receipts, buy orders, or different documentation associated to the transactions. The reconciliation software program or instruments automate this matching course of, considerably lowering the effort and time required for guide reconciliation.

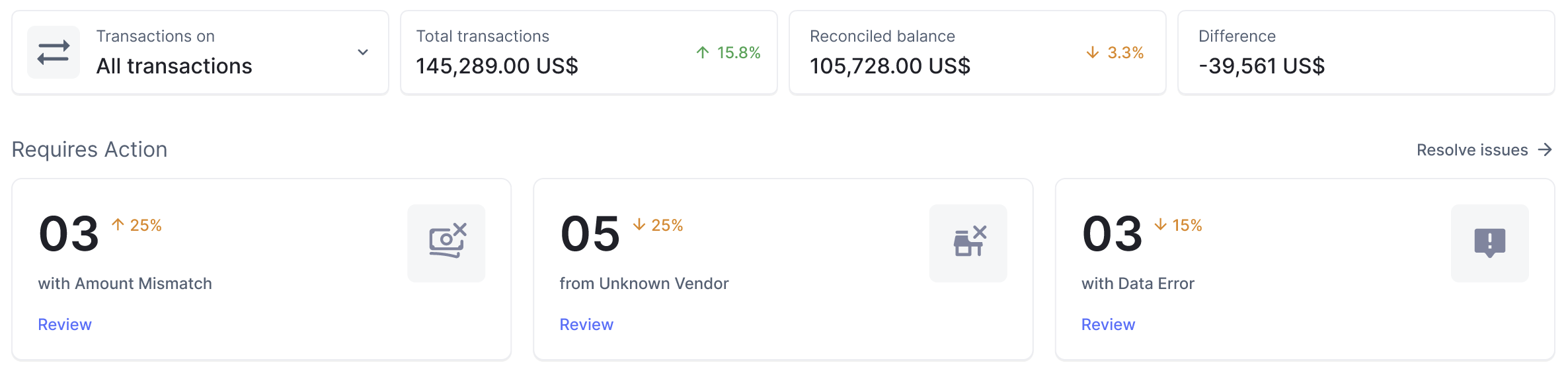

In the course of the reconciliation course of, discrepancies or inconsistencies between the bank card statements and accounting information are recognized and investigated. This will contain verifying the accuracy of transaction particulars, reconciling variations in quantities, or figuring out unauthorised or fraudulent transactions. Any discrepancies discovered are then addressed and resolved to make sure the accuracy of the corporate’s monetary information.

Bank card reconciliation is crucial for companies to keep monetary integrity, compliance with laws, and efficient administration of bills. It gives insights into spending patterns, helps establish areas of inefficiency or fraud, and ensures that every one transactions are correctly recorded within the firm’s accounting system. By automating the reconciliation course of with devoted software program options, companies can streamline their monetary operations, enhance accuracy, and cut back the chance of errors or fraud.

What’s Credit score Card Reconciliation Software program?

Credit card reconciliation software is a specialised device to streamline and automate the bank card reconciliation course of for companies. It simplifies the duty of matching bank card transactions with corresponding entries within the firm’s accounting information, serving to to make sure accuracy, effectivity, and compliance.

Bank card reconciliation software program usually provides a spread of options and functionalities to facilitate the reconciliation course of. These embrace:

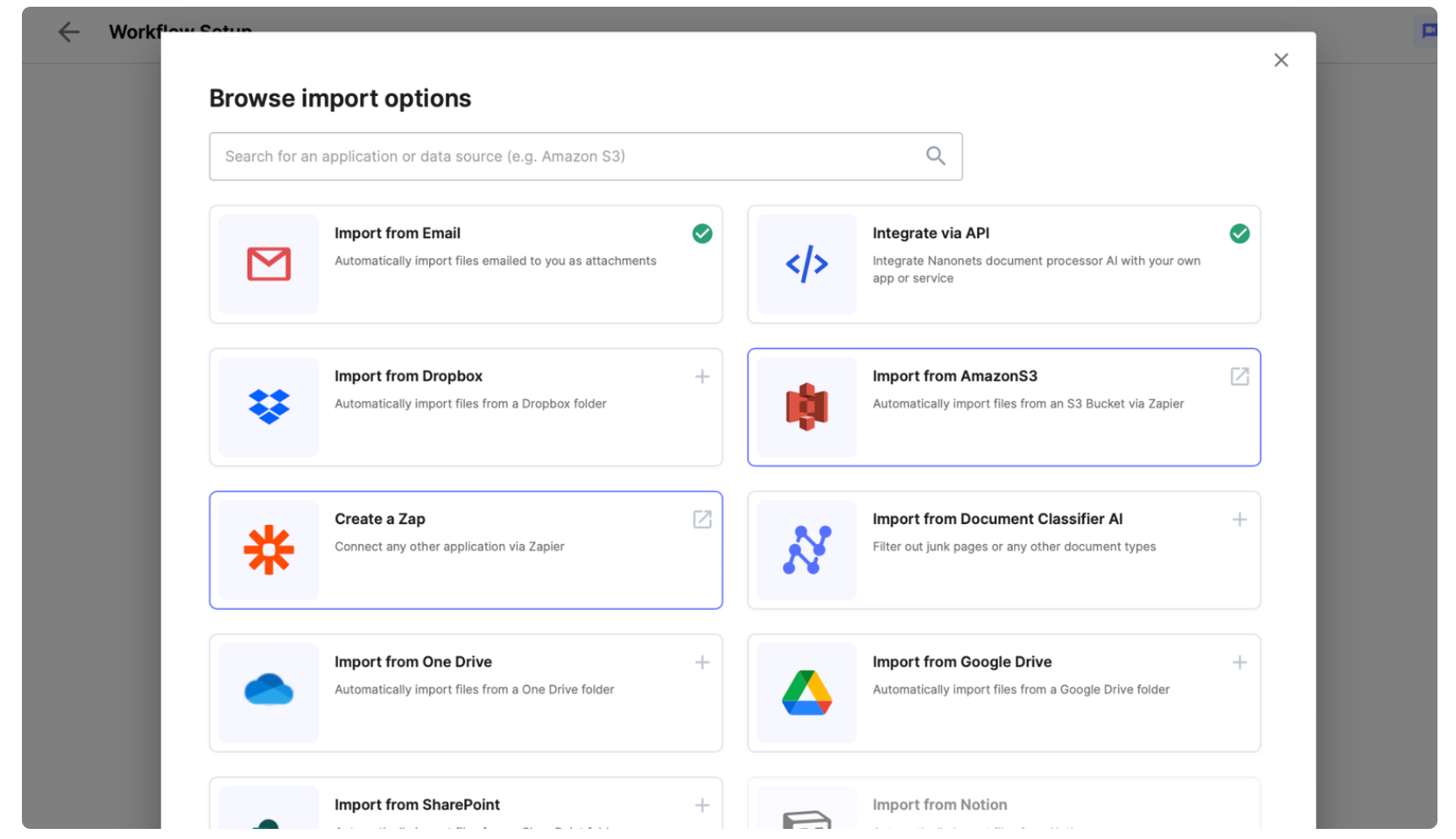

- Automated Knowledge Import: The software program can robotically import bank card statements and transaction information from numerous sources, corresponding to banks or monetary establishments, eliminating the necessity for guide information entry.

- Transaction Matching: The software program matches particular person bank card transactions with corresponding entries within the firm’s accounting system, corresponding to invoices, receipts, or buy orders. It makes use of algorithms and guidelines to establish matches based mostly on transaction particulars, corresponding to date, quantity, service provider identify, and transaction description.

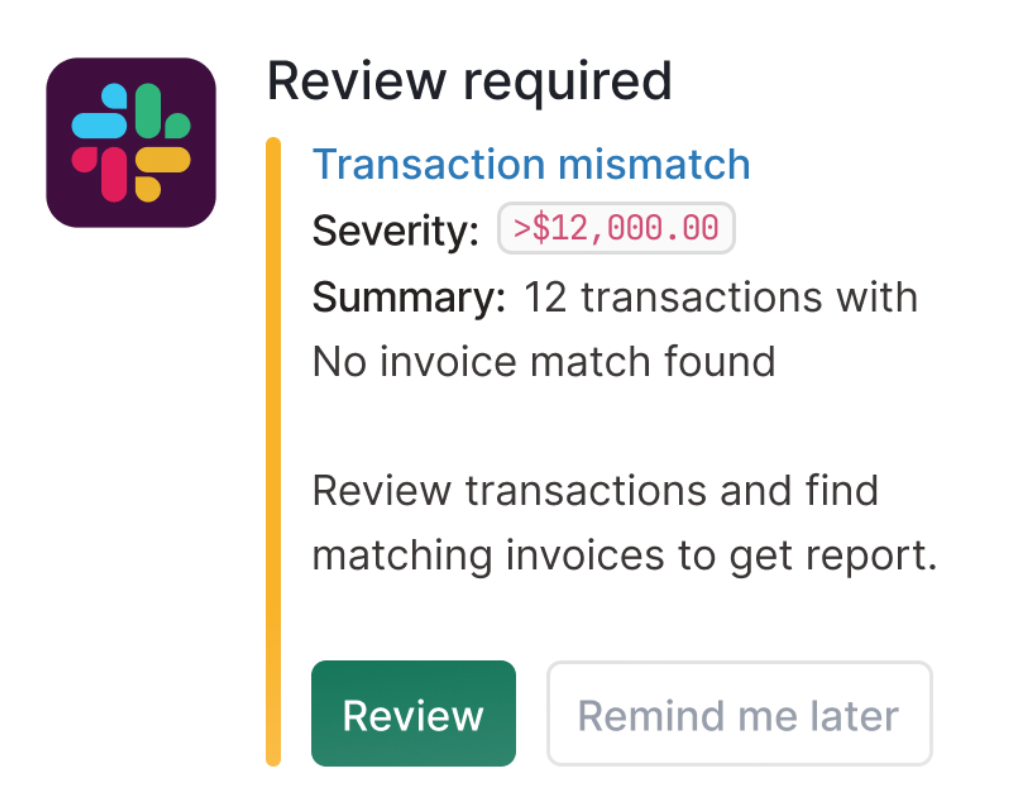

- Error Detection and Decision: The software program detects discrepancies or inconsistencies between bank card statements and accounting information, corresponding to lacking transactions, duplicate entries, or incorrect quantities. It gives instruments to research and resolve these discrepancies promptly.

- Reporting and Analytics: Bank card reconciliation software program generates reviews and analytics to offer insights into spending patterns, developments, and anomalies. It helps companies observe bills, establish areas of inefficiency, and make knowledgeable monetary selections.

- Integration with Accounting Methods: The software program integrates seamlessly with the corporate’s accounting software program or ERP system, making certain that reconciled transactions are precisely recorded and mirrored in monetary reviews.

- Safety and Compliance: Bank card reconciliation software program prioritises information safety and compliance with trade laws, corresponding to PCI DSS (Fee Card Business Knowledge Safety Commonplace). It employs encryption, entry controls, and audit trails to guard delicate monetary info.

Total, bank card reconciliation software program streamlines the reconciliation course of, reduces guide effort, improves accuracy, and enhances visibility and management over bank card transactions. It’s a priceless device for companies of all sizes, serving to them successfully handle their funds, mitigate dangers, and guarantee monetary integrity.

Advantages of Utilizing Credit score Card Reconciliation Software program

Bank card reconciliation software program helps companies streamline their monetary processes, enhance accuracy, and improve effectivity. Some particular, key advantages of utilizing bank card reconciliation software program embrace:

- Improved Accuracy: By automating the reconciliation course of and utilizing superior matching algorithms, bank card reconciliation software program minimizes the chance of errors and discrepancies. It ensures that bank card transactions are precisely recorded and reconciled with corresponding entries within the firm’s accounting information.

- Time Financial savings: Bank card reconciliation software program eliminates the necessity for guide information entry and tedious reconciliation duties, saving time for finance groups. It automates repetitive duties, corresponding to importing bank card statements, matching transactions, and producing reviews, permitting workers to deal with extra strategic actions.

- Enhanced Effectivity: With bank card reconciliation software program, companies can full the reconciliation course of extra shortly and effectively. The software program streamlines workflows, standardised processes, and gives instruments for error detection and backbone, enabling finance groups to work extra successfully and productively.

- Better Visibility and Management: Bank card reconciliation software program gives real-time visibility into bank card transactions, bills, and monetary efficiency. It permits companies to trace spending patterns, monitor price range adherence, and establish potential points or discrepancies promptly. With higher visibility and management, companies could make extra knowledgeable monetary selections and mitigate dangers successfully.

- Compliance and Audit Readiness: Bank card reconciliation software program helps companies keep compliance with regulatory necessities and trade requirements, corresponding to PCI DSS. It ensures that bank card transactions are precisely recorded, correctly authorised, and securely processed, lowering the chance of non-compliance and audit findings.

- Value Financial savings: By lowering guide effort, minimising errors, and enhancing effectivity, bank card reconciliation software program can result in value financial savings for companies. It lowers labour prices related to guide reconciliation duties, reduces the chance of economic losses attributable to errors or fraud, and optimises useful resource utilisation throughout the finance division.

Total, bank card reconciliation software program provides vital advantages for companies, serving to them optimise their monetary processes, mitigate dangers, and obtain better effectivity and accuracy in managing bank card transactions.

Frequent Challenges with Credit score Card Reconciliation

Navigating bank card reconciliation comes with its share of challenges, usually presenting hurdles that may impede monetary accuracy and effectivity. Under are a few of the frequent kinds of challenges encountered in bank card reconciliation:

Issue in Matching Transactions with Corresponding Receipts:

One of many main challenges is precisely matching bank card transactions with their corresponding receipts or invoices. This activity can turn out to be significantly cumbersome in instances the place workers fail to offer or retain receipts, resulting in discrepancies and incomplete information.

Handbook Entry Errors Resulting in Discrepancies:

Handbook information entry is vulnerable to human error, which can lead to discrepancies between recorded transactions and precise bills. Errors corresponding to typos, incorrect quantities, or misclassifications can compromise the accuracy of reconciliation efforts and probably result in monetary misstatements.

Time-Consuming Reconciliation Course of:

Bank card reconciliation usually entails a labor-intensive technique of manually reviewing and reconciling transactions, which will be time-consuming, particularly for companies with excessive transaction volumes. The guide effort required to sift by statements, match transactions, and establish discrepancies can considerably lengthen the reconciliation timeline.

Lack of Visibility into Credit score Card Spending:

With out complete visibility into bank card spending throughout departments or people, companies might battle to watch bills successfully. This lack of transparency could make it difficult to establish unauthorized purchases, observe price range adherence, or analyze spending patterns for strategic decision-making.

Addressing these challenges requires leveraging the correct bank card reconciliation instruments in addition to adopting environment friendly processes to streamline reconciliation workflows, reduce errors, and improve monetary visibility and management. Within the subsequent part, we’ll discover a few of the prime bank card reconciliation softwares that make the entire course of simpler.

Prime Credit score Card Reconciliation Softwares

The next bank card reconciliation options are highly-rated amongst customers and are merchandise made by reputed software program firms. They provide a spread of options and functionalities to fulfill the varied wants of companies.

Evaluating every possibility based mostly on its key options, execs, cons, pricing, and person opinions may help you make an knowledgeable choice in accordance with your organisation’s bank card reconciliation wants.

- Expensify

- Key Options: Funds superapp with automated expense reporting, receipt monitoring, real-time analytics, and extra

- Execs: Consumer-friendly interface, sturdy cell app, seamless integration with accounting software program.

- Cons: Restricted customization choices, occasional syncing points with financial institution accounts.

- Pricing: From solo startups to large companies, there are subscription-based pricing fashions starting from $5 per person per thirty days to $9 per person per thirty days.

- Consumer Critiques: Rated 4.5/5 based mostly on 5,000+ opinions on G2, appreciated for its simplicity and effectivity.

- Invoice.com

- Key Options: Main monetary operations app for small to medium companies, providing automated accounts payable, bill processing, cost scheduling, and extra

- Execs: Streamlined approval workflows, safe cost processing, complete audit path

- Cons: Steeper studying curve for brand new customers, occasional delays in cost processing

- Pricing: Tiered pricing plans based mostly on enterprise measurement and wishes, ranging from $39 per person per thirty days.

- Consumer Critiques: Rated 4.4/5 based mostly on 1,000+ opinions on Capterra, counseled for its reliability and ease of use.

- QuickBooks On-line

- Key Options: On-line accounting, expense monitoring, financial institution reconciliation.

- Execs: Intuitive interface, customizable reviews, seamless integration with financial institution accounts.

- Cons: Restricted scalability for bigger companies, occasional software program updates affecting performance.

- Pricing: Subscription-based pricing mannequin, ranging from $25 per thirty days.

- G2/Capterra Critiques: Rated 4.5/5 based mostly on X opinions on G2, praised for its accessibility and affordability.

- Xero

- Key Options: Cloud-based accounting, expense administration, real-time monetary reporting.

- Execs: Consumer-friendly interface, in depth third-party integrations, multi-currency assist.

- Cons: Restricted buyer assist choices, occasional downtime throughout system upkeep.

- Pricing: Tiered pricing plans based mostly on enterprise measurement and wishes, ranging from $11 per thirty days.

- G2/Capterra Critiques: Rated 4.8/5 based mostly on X opinions on G2, lauded for its flexibility and scalability.

- Sage Intacct

- Key Options: Cloud-based monetary administration, automated billing, income recognition.

- Execs: Superior reporting capabilities, customizable dashboards, sturdy compliance options.

- Cons: Greater pricing tier, restricted assist for sure industries, advanced setup course of.

- Pricing: Personalized pricing based mostly on enterprise necessities, with a free trial possibility obtainable.

- G2/Capterra Critiques: Rated 4.7/5 based mostly on X opinions on G2, appreciated for its complete characteristic set and reliability.

Nanonets for Credit score Card Reconciliation

Nanonets provides a complete and environment friendly answer for bank card reconciliation, leveraging superior applied sciences corresponding to synthetic intelligence (AI) and machine studying (ML) to automate and streamline the reconciliation course of. Listed here are some methods it stands out as an excellent choice for credit card reconciliation:

- Superior Automation: Nanonets’ AI-powered algorithms can robotically match bank card transactions with corresponding entries in your accounting information, considerably lowering guide effort and human error.

- Accuracy and Precision: With Nanonets, you may count on exact reconciliation outcomes, because the software program is able to figuring out and flagging discrepancies or anomalies in bank card transactions promptly.

- Customizable Workflows: Nanonets permits you to tailor the reconciliation course of to suit your organisation’s particular wants and necessities, making certain that it aligns seamlessly together with your current workflows and processes.

- Integration Capabilities: Nanonets can combine seamlessly together with your current accounting software program, cost gateways, and financial institution accounts, offering a unified platform for managing all points of bank card reconciliation.

- Actual-time Insights: Nanonets gives real-time visibility into your bank card transactions, permitting you to watch and observe your monetary information with ease and confidence.

- Value-effectiveness: Nanonets provides aggressive pricing plans tailor-made to swimsuit companies of all sizes, making it a cheap answer for bank card reconciliation wants.

By selecting Nanonets to your bank card reconciliation software program, you may streamline your reconciliation course of, enhance accuracy and effectivity, and acquire priceless insights into your monetary information, finally serving to your organisation obtain better monetary success and stability.

Conclusion

Bank card reconciliation software program performs an important function in making certain monetary accuracy and transparency for companies of all sizes. By automating the reconciliation course of, these software program options assist streamline operations, cut back errors, and enhance total effectivity.

On this weblog, we explored the significance of bank card reconciliation software program, its key options, and a few of the prime options obtainable available in the market. Whether or not you are a small startup or a big enterprise, investing in the correct bank card reconciliation software program can yield vital advantages and assist drive success in at present’s aggressive enterprise panorama.