The fairness danger premium is the surplus return an investor is compensated for minus the risk-free charge (six-month US Treasury). Taking a look at BRKB returns we’ll use statistical testing to drive additional insights on the fairness danger premium affecting trailing returns.

Wanting on the distribution of returns

First, we will take a look at whether or not the distribution of returns is statistically totally different from two time intervals from 1996–2010 to 2011-current utilizing the KS-test. The outcomes present that we get a p-value of .057 which is nearly statistically vital on the 5% degree.

Testing For Heteroskedasticity

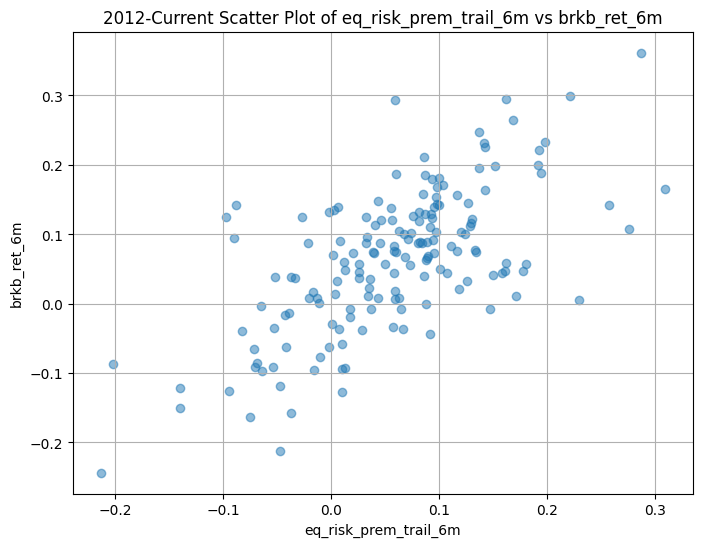

Subsequent, we will take a look at if our information is heteroskedastic, which happens when wanting on the relationship between the fairness danger premium and the returns. This implies when our x and y variables improve the space between information factors will get extra unfold out.

When conducting the Breuch Pagen take a look at we get a p-value of .693 from 1996–2011 and a p-value of .66 from 2012-current. This tells us there isn’t any heteroskedasticity within the ancient times, and no heteroskedasticity at the moment, confirming what we see from our graphs.

Testing for Structural Change

Subsequent, we will run the Chow take a look at to see if there’s a structural change within the relationship between returns and the fairness danger premium giving us a p-value of .005.

From our statistical assessments, heteroskedasticity was not current in each intervals. We concluded that the returns from 1996–2010 and 2011-currently are borderline statistically vital on the 5% degree. The outcomes from our Chow take a look at confirmed that there was a structural change within the relationship between the 6m-trailing fairness danger premium and the 6m-trailing returns for BRKB.

Code will be discovered right here

https://github.com/Gaiden-Spence/Equtiy-Risk-Premium-Analysis/blob/main/treasury_spread.ipynb

This text ought to by no means be thought of as investing steering or recommendation in any capability in any respect. It’s solely supposed to assist readers uncover intriguing theories about markets that they could or could not wish to discover on their very own.

These are my very own opinions and don’t characterize the opinions of my employer in any capability in any respect.

- The positioning and its content material don’t embrace, nor shall or not it’s construed as together with, recommendation, steering or suggestions to take, or to not take, any actions or selections in relation to any matter, together with in relation to investments or the acquisition or sale of any securities, shares or different belongings of any type.

- You shouldn’t deal with any opinions or views expressed on this web site or its content material as a advice to make any specific funding.

- Must you take any such motion or choice primarily based on info from this web site, you achieve this totally at your individual danger.