Seven Best Practices for Environment friendly Account Reconciliations

From Mesopotamia’s rudimentary ledgers monitoring livestock and crops to the second-century BCE Indian treatise “Arthashastra“, accounting has been a cornerstone of monetary administration in any civilized society. In the meanwhile, amidst burgeoning world commerce and rapidly growing enterprise operations, the importance of accounting operations endures. On the core of accounts administration lies account reconciliation, the tactic of evaluating quite a few financial paperwork to verify accuracy and accountability.

On this text, we are going to uncover the fundamentals of accounts reconciliation, discussing its significance, processes, and biggest practices.

What’s Account Reconciliation

Account reconciliation is an important course of in financial administration that ensures accuracy and consistency in financial operations. It presents essential insights into a company’s financial effectively being and effectivity. There are quite a few sorts of account reconciliation, each offering distinct benefits: Monetary establishment Account Reconciliation aligns cash balances, Accounts Payable Reconciliation matches vendor portions, Accounts Receivable Reconciliation confirms purchaser funds, Inventory Reconciliation validates inventory valuation, Payroll Reconciliation ensures right employee wage recording, Credit score rating Card Reconciliation verifies transactions and Mounted Asset Reconciliation tracks asset actions and values, aiding in financial planning and administration.

Need for Account Reconciliation

Account Reconciliation ensures the accuracy and integrity of financial knowledge by determining discrepancies and errors, thus fostering perception amongst stakeholders and facilitating educated decision-making. It aids inside the detection and prevention of fraud, safeguarding in opposition to financial losses and reputational harm. Environment friendly Account Reconciliation promotes compliance with regulatory requirements and accounting necessities, mitigating the hazard of penalties and approved penalties. By providing a clear and clear picture of an organization’s financial effectively being, account reconciliation empowers firms to optimize helpful useful resource allocation, streamline operations, and drive sustainable progress.

conduct Account Reconciliation

The strategy of Account Reconciliation consists of numerous key steps to verify accuracy and completeness:

- Accumulate Paperwork: Accumulate financial knowledge like monetary establishment statements, invoices, and ledger entries.

- Set up Accounts: Resolve accounts needing reconciliation, along with monetary establishment, payables, receivables, inventory, payroll, and belongings.

- Look at Data: Match inside knowledge with exterior sources like monetary establishment statements and invoices.

- Look at Discrepancies: Analyze variations, trace transactions and rectify errors.

- Make Adjustments: Report missing transactions and correct errors for proper balances.

- Doc Course of: Preserve detailed knowledge of steps, findings, and modifications.

- Consider and Approve: Validate reconciled accounts for accuracy, seeking approval from stakeholders.

- Implement Controls: Introduce measures to forestall future discrepancies and assure accuracy.

Frequent Challenges and Discrepancies inside the Account Reconciliation Course of

The Account Reconciliation course of comes with its private set of challenges and potential discrepancies. Listed below are some widespread ones:

- Information Entry Errors: Human errors all through info entry may end up in discrepancies between inside knowledge and exterior sources. Transposing numbers, omitting transactions, or recording incorrect portions can distort the accuracy of reconciled accounts.

- Timing Variations: Variations in timing between when transactions are recorded internally and as soon as they appear in exterior statements, paying homage to monetary establishment statements, can create challenges in reconciliation. As an illustration, checks is also issued nonetheless not however cashed, leading to timing discrepancies.

- Monetary establishment Errors: Banks might make errors in processing transactions, paying homage to posting incorrect portions or duplicating entries. Determining and rectifying these errors may be time-consuming and require coordination with the monetary establishment.

- Unrecorded Transactions: Failure to file all transactions, paying homage to glorious checks or pending deposits, may end up in discrepancies in reconciled accounts. You will need to ensure that all transactions are exactly recorded and accounted for.

- Fraudulent Actions: Fraudulent actions, paying homage to unauthorized transactions or embezzlement, can go undetected in the middle of the reconciliation course of, leading to essential financial losses for the company.

- Sophisticated Transactions: Sophisticated transactions, paying homage to abroad international cash exchanges or mergers and acquisitions, can pose challenges in reconciliation attributable to their intricate nature and numerous accounting implications.

- System Errors: Errors or glitches in accounting software program program or methods can result in discrepancies in reconciled accounts. Widespread maintenance and updates are important to mitigate the hazard of system-related errors.

- Lack of Documentation: Insufficient documentation or missing supporting paperwork for transactions can hinder the reconciliation course of, making it robust to substantiate the accuracy of recorded transactions.

- Incomplete Data: Incomplete or outdated knowledge can complicate the reconciliation course of, because it could possibly be troublesome to trace transactions or verify balances with out full data.

- Staff Turnover: Extreme employees turnover or inadequate teaching of accounting personnel can impression the usual and consistency of the reconciliation course of, rising the possibility of errors and discrepancies.

Best Practices in Account Reconciliation

Listed below are some biggest practices in account reconciliation that help in sustaining right financial knowledge and guaranteeing the integrity of the financial reporting course of:

- Widespread Reconciliation Schedule: Arrange an on a regular basis schedule for conducting account reconciliations, paying homage to month-to-month or quarterly. Fixed reconciliation helps set up discrepancies promptly and prevents the buildup of errors over time. As an illustration, a company would possibly reconcile its monetary establishment accounts on the end of each month to verify accuracy in cash balances.

- Segregation of Duties: Implement segregation of duties to forestall errors and fraud. Assign completely totally different individuals to hold out reconciliations, approve transactions, and file accounting entries. This separation of duties helps assure checks and balances inside the reconciliation course of. For example, one particular person would possibly reconcile monetary establishment statements whereas one different evaluations and approves the reconciled balances.

- Documentation and Report-Defending: Preserve thorough documentation of the reconciliation course of, along with supporting paperwork, audit trails, and explanations for any modifications made. Right documentation presents a clear audit path and facilitates transparency and accountability. As an illustration, maintain copies of monetary establishment statements, invoices, and receipts as proof of reconciled transactions.

- Use of Reconciliation Devices: Benefit from accounting software program program and reconciliation devices to streamline the reconciliation course of and reduce handbook errors. Automated reconciliation software program program can match transactions, set up discrepancies, and generate research successfully. For example, reconciliation software program program can mechanically look at monetary establishment transactions with accounting knowledge and highlight any discrepancies for added investigation.

- Consider and Approval Procedures: Arrange consider and approval procedures for reconciled accounts to verify accuracy and completeness. Assign obligation to designated personnel for reviewing reconciled balances and approving modifications sooner than finalizing the reconciliation. As an illustration, a financial supervisor would possibly consider and approve monetary establishment reconciliations sooner than they’re submitted for audit.

- Regular Monitoring and Analysis: Always monitor account balances and developments to determine anomalies or irregularities which would require extra investigation. Widespread analysis of reconciled accounts helps detect errors, fraud, or inefficiencies early on, allowing for effectively timed corrective movement. For example, perform improvement analysis on accounts receivable balances to determine overdue funds or potential unhealthy cash owed.

- Teaching and Education: Current ongoing teaching and coaching to accounting employees on reconciliation biggest practices, accounting necessities, and regulatory requirements. Make it possible for employees are equipped with the necessary experience and knowledge to hold out right and environment friendly reconciliations. As an illustration, conduct widespread teaching courses on reconciliation procedures, software program program utilization, and fraud detection strategies.

By implementing these biggest practices, firms can enhance the accuracy, reliability, and effectivity of the account reconciliation course of, lastly enhancing financial reporting and decision-making capabilities.

Automate the Reconciliation Course of with Nanonets

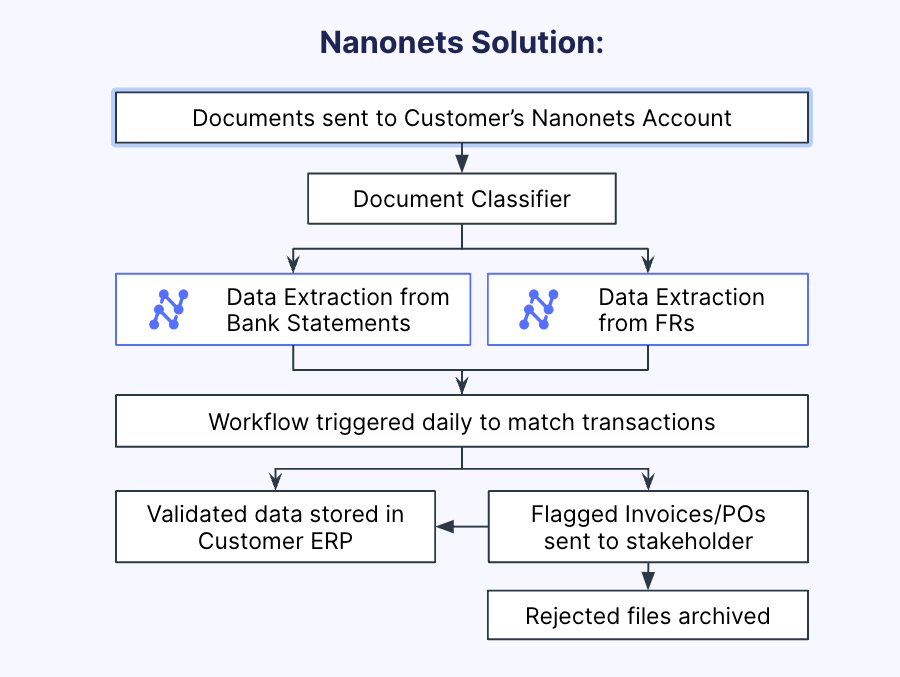

When it comes to automating reconciliation duties, Nanonets stands out as certainly one of many premier software solutions within the market. Nanonets offers numerous choices that make it well-suited for automating account reconciliation processes:

- Customizable Models: Nanonets presents devices to create personalized OCRmodels tailored to specific reconciliation needs. This customization permits organizations to educate fashions based on their distinctive info items and reconciliation requirements, guaranteeing optimum effectivity and accuracy.

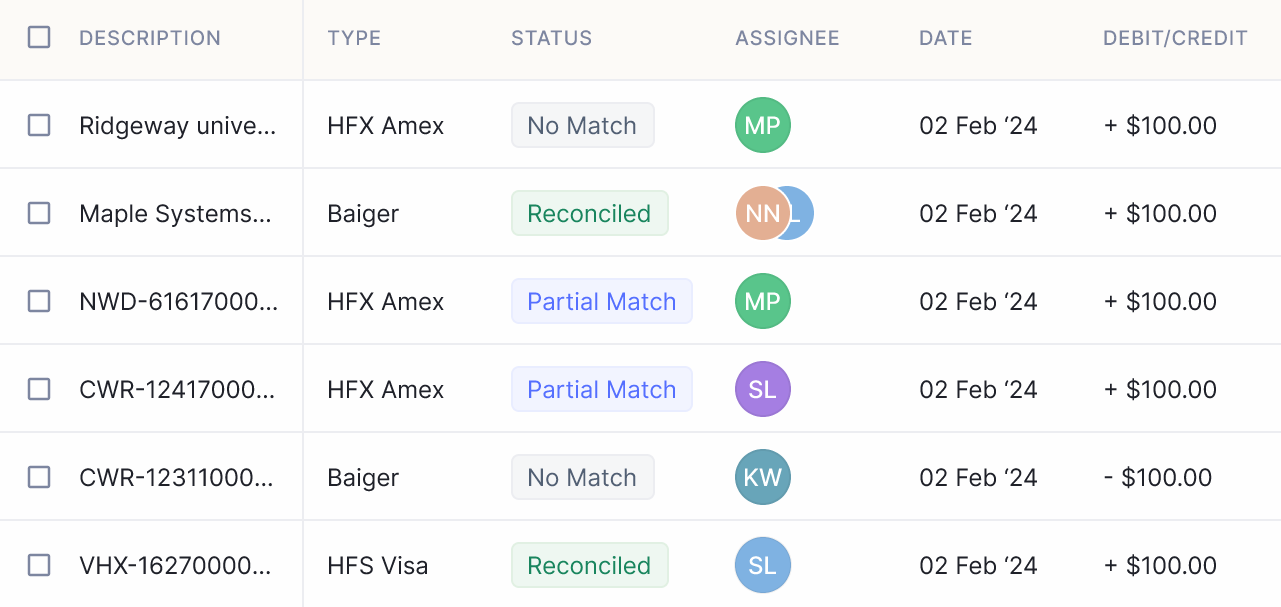

- Data Extraction Capabilities: Nanonets consists of choices for extracting info from quite a few sources, along with scanned paperwork, PDFs, pictures, and structured info codecs like CSV or Excel. This flexibility in info extraction permits organizations to reconcile transactions from varied sources, paying homage to invoices, receipts, monetary establishment statements, and purchase orders.

- API Integration and Workflow Automation: Nanonets offers APIs and integration capabilities that let seamless integration with present methods and workflows. Organizations can incorporate Nanonets’ reconciliation efficiency into their present accounting or ERP methods, streamlining the reconciliation course of and eliminating handbook info entry duties.

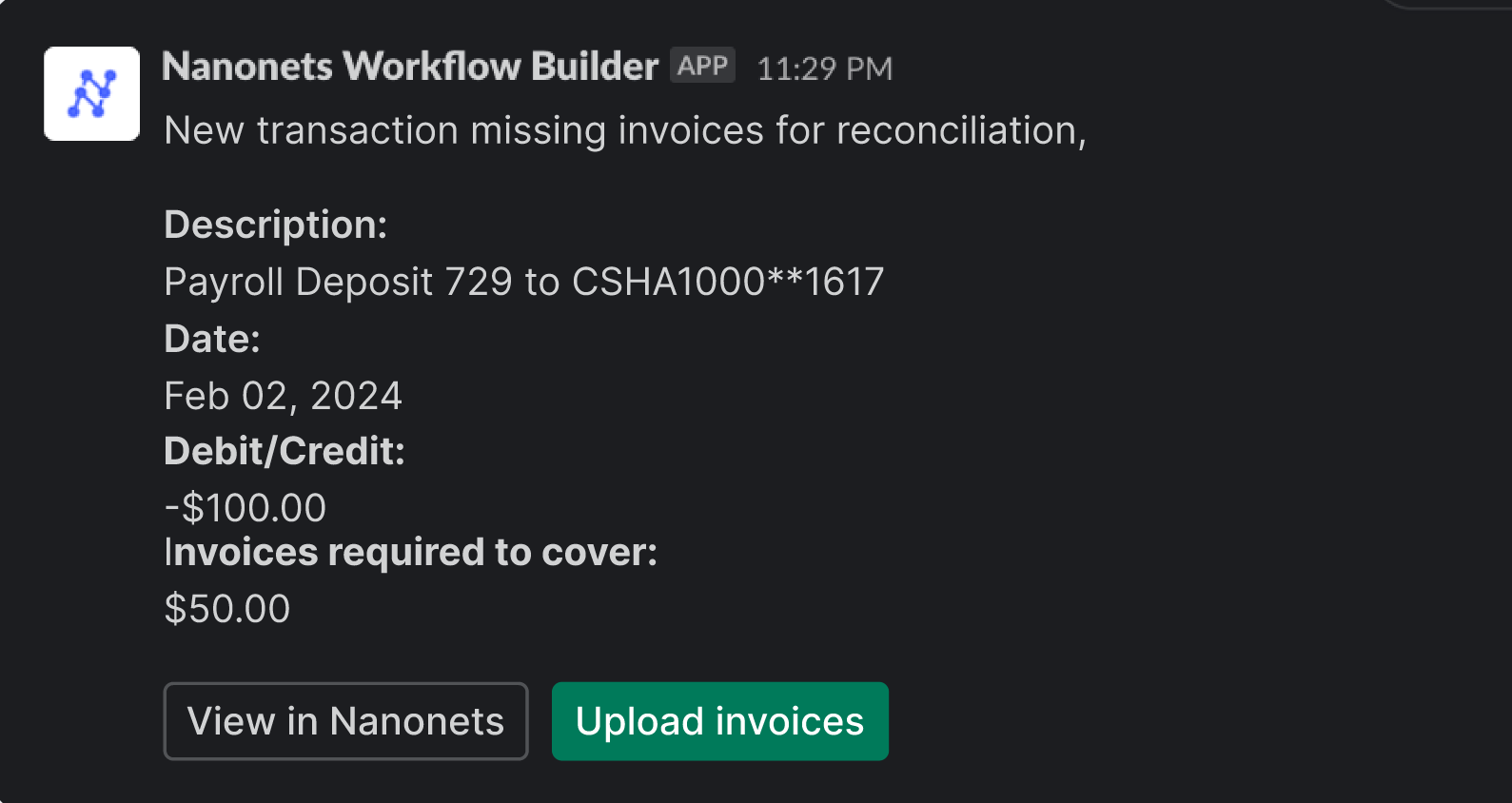

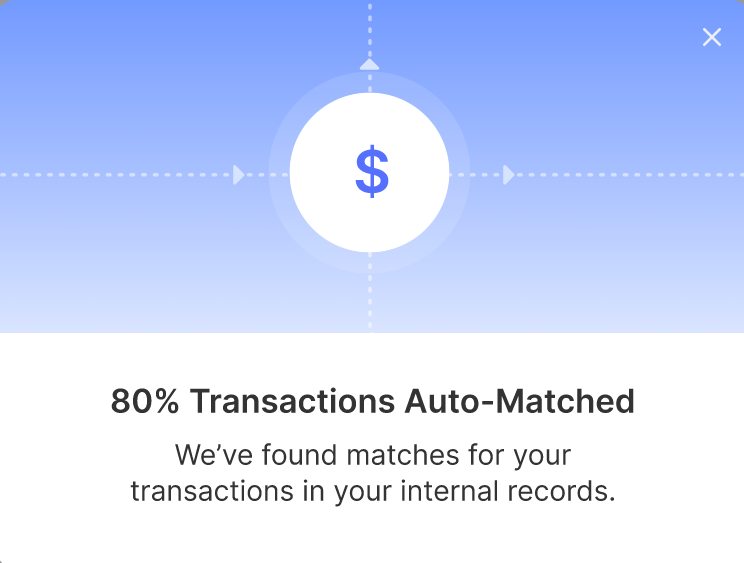

- Real-time Reconciliation: With Nanonets, organizations can perform real-time reconciliation, allowing for fast detection and spine of discrepancies as transactions occur. This real-time performance enhances financial visibility and administration, enabling organizations to make educated decisions based on up-to-date financial info.

- Accuracy and Confidence Scoring: Nanonets presents confidence scoring mechanisms that assess the accuracy of reconciliation outcomes and provide insights into the reliability of match outcomes. This attribute permits clients to prioritize and consider reconciliation outcomes based on confidence ranges, guaranteeing high-quality outcomes and minimizing the hazard of errors.

Take Away

Environment friendly account reconciliation is important for financial accuracy and integrity. Implementing biggest practices like widespread evaluations and segregation of duties mitigates errors and ensures compliance. However, handbook processes are time-consuming and error-prone. Software program program choices like Nanonets use superior algorithms to automate the account reconciliation course of, thereby empowering finance teams to cope with strategic initiatives, enhancing effectivity and transparency.