The monetary sector generates and shops huge volumes of knowledge, each structured and unstructured. The info is derived from a number of sources, equivalent to monetary statements, regulatory compliance paperwork revealed on the corporate web site or by regulators, and transaction information generated from day by day monetary exercise. As well as, supplementary sources equivalent to monetary information, market updates, and social media additionally improve the prevailing monetary information pool.

This information has the capability to help monetary analysts in making well-informed funding selections (Hasan, Popp, and Oláh 2020). Nonetheless, it additionally poses challenges in extracting, processing, and analysing this abundance of knowledge to offer worthwhile and credible info. To handle these challenges, machine studying presents itself as an answer.

Machine studying demonstrates excellent skills for processing, classifying, and forecasting complicated and large-scale information. The benefits of this methodology in comparison with commonplace information evaluation strategies are its capability to deal with substantial quantities of structured and unstructured information and its means to boost decision-making or forecasting (Ghoddusi, Creamer, and Rafizadeh 2019). This essay will concentrate on the functions of machine studying by monetary information platforms in processing huge information and study the implications inside the monetary system.

Large Knowledge in Finance

The time period “huge information” incorporates the three key facets often called the three Vs: selection, quantity, and velocity. Large information refers to info that incorporates higher selection, arrives in rising volumes, and has a velocity that exceeds the capability of conventional information administration instruments (Oracle 2022). Throughout the context of finance, the thought of huge information is outlined as follows:

a. Selection

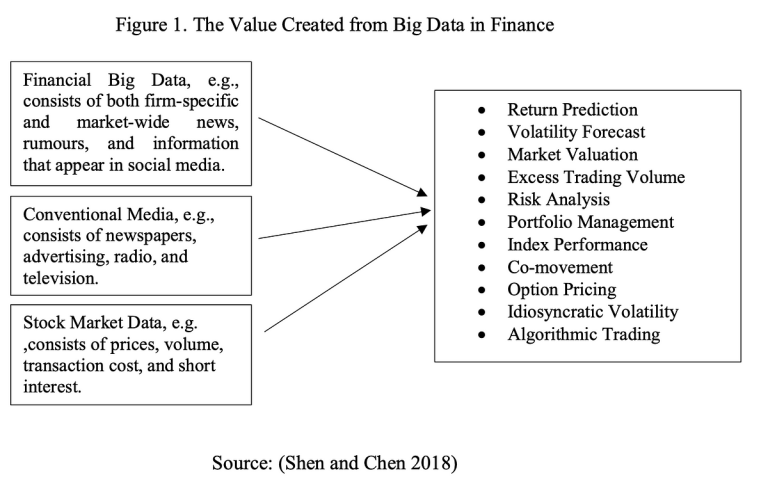

This refers back to the various kinds of information out there. Within the monetary sector, a variety of knowledge sources affect the decision-making course of. Shen and Chen (2018) categorised information in monetary markets into monetary huge information, standard media, and inventory market, as detailed in Determine 1.

b. Quantity

Large information is notable for its great amount. For instance, in 2018, the Nasdaq Inventory Trade processed monetary market information from hundreds of sources nightly, dealing with between 30 billion and 55 billion information, amounting to over 4 terabytes. In February 2020, throughout the early phases of the COVID-19 pandemic, Nasdaq’s information ingestion elevated to 70 billion information day by day, peaking at 113 billion (Amazon Internet Companies 2020), demonstrating the substantial quantity of knowledge within the monetary market.

c. Velocity

The velocity at which information is generated and processed. A notable instance is Bloomberg, which processes and publishes over 200 billion items of economic info in real-time day by day (Tech At Bloomberg 2022).

The Utility of Machine Studying

The utilisation of huge information within the discipline of finance has the potential to generate worth, as demonstrated in Determine 1. Machine studying works as an strategy for analysing massive quantities of knowledge to generate worthwhile perception.

A machine studying system can have three main features: descriptive, predictive, and prescriptive. Within the descriptive operate, the system makes use of information to offer a proof of previous occasions. Within the predictive operate, the system makes use of information to forecast future occasions. Lastly, within the prescriptive operate, the system makes use of information to supply suggestions on the suitable motion (Brown 2021). Monetary information platforms like Bloomberg and Refinitiv exhibit the appliance of machine studying within the finance trade.

Bloomberg and Refinitiv are corporations that function in a real-time surroundings, managing huge volumes of knowledge and recognising the rising significance of machine studying. As an example, Bloomberg obtained an in depth quantity of knowledge, most of that information in unstructured format and is embedded in tens of millions of firm experiences, press releases, information articles, and even social media. Bloomberg processes 1.5 million paperwork day by day in roughly 30 various languages, sourced from 125,000 completely different sources. Moreover, they extract info from 100,000 numerous web sites, together with third-party suppliers, governmental our bodies, and different authorised entities. Bloomberg utilises machine studying to analyse information, detect patterns, and make predictions. This permits computer systems to amass information and transmit it by their community, which powers the Bloomberg Terminal (Bloomberg 2016). Bloomberg additionally provides machine studying solutions2 to its clients in keeping with their focus, e.g., units of options which can be labeled into purchase aspect, promote aspect, company, and highlight on. This answer may help clients with sentiment evaluation, threat and compliance administration, and addressing macro-economic pressures and market volatility.

The Implications of Machine Studying

Along with its functions in processing huge information in finance to generate worth, the utilisation of machine studying could carry sure implications for the monetary system.

a. Market focus

A restricted variety of superior third-party distributors specialising in machine studying might result in an elevated focus of sure operations inside the monetary system (Monetary Stability Board 2017).

The consolidation of knowledge assortment and administration could result in a threat of dependency. Such dependence would possibly create points for aggressive dynamics and doubtlessly end in oligopolistic market constructions in these providers (OECD 2021).

b. Systemic significance of establishments

The flexibility to acquire huge information could change into critically important as entities inside the monetary system would possibly change into closely reliant on these companies for information entry. Consequently, operational points or disruptions in these companies might have broad, systemic penalties (Monetary Stability Board 2017).

Moreover, this dependency could end in dangers of convergence each on the particular person agency stage and throughout the system, significantly if the third-party fashions out there available in the market are uniform (OECD 2021).

c. Networks and interconnectedness

The monetary system could be very linked. If a big group of economic establishments depend on the identical information sources and algorithmic methods, then an issue with these information sources might affect the entire group as if it have been a single entity (Monetary Stability Board 2017). This situation might unfold no matter whether or not the phase includes tens, a whole bunch, and even hundreds of legally unbiased monetary entities.

Bloomberg has 350.000 clients from a various vary of economic establishments, together with asset administration, banks, funding advisors, insurance coverage, pensions, and even authorities. Because of this, the collective adoption of machine studying instruments could introduce new dangers.

Conclusion and Suggestions

In abstract, machine studying performs an important position in processing the huge portions of economic information prevalent in at present’s period, reworking them into worthwhile insights that drive better-informed selections in monetary markets. It facilitates a variety of analytical features, equivalent to return prediction, volatility forecasting, market valuation, sentiment evaluation, and threat administration.

Nonetheless, the dominance of some machine studying suppliers, significantly monetary information platforms that utilise machine studying to each generate information and create analytical options, results in market focus. This focus has the potential to ascertain systemic significance, the place your complete monetary market might change into depending on these suppliers, thereby posing a threat of systemic disruption.

To mitigate these dangers and make sure the stability of the monetary system, a number of measures must be applied and monitored by the related authorities or the platform’s person:

a. Knowledge accuracy and reliability

The accuracy and reliability of the information are essential to stopping the unfold of deceptive info. Within the realm of huge information, there’s an rising concentrate on the facet of veracity, which underlines the importance of knowledge accuracy. This extra ‘V’ of huge information underscores the significance of verifying the truthfulness of knowledge to make sure knowledgeable decision-making.

b. Machine studying mannequin and governance

In relation to information accuracy, monetary establishments should be sure that fashions are constructed utilizing acceptable datasets and supply explanations for the outputs generated (OECD 2021).

c. Platform robustness

Making certain the robustness of machine studying platforms is important. It requires programs which can be resilient to technical failures, able to dealing with massive information streams with out interruption, and safe in opposition to potential cyber threats.

Addressing these concerns is essential to sustaining a dependable and steady monetary information surroundings, which advantages all market contributors. The involvement of related authorities and the purchasers of those platforms is important to upholding information accuracy and the integrity of fashions. Such collaboration serves as a elementary check-and-balance mechanism, guaranteeing the continuing robustness of the platforms and thereby stopping points that might negatively affect the decision-making course of inside the monetary system.

References

Amazon Internet Companies. 2020. “Nasdaq Makes use of AWS to Pioneer Inventory Trade Knowledge Storage within the Cloud.” Amazon Internet Companies. 2020. https://aws.amazon.com/solutions/case-studies/nasdaq-case-study/.

Bloomberg. 2016. “Bloomberg and ‘The Magic’ of Machine Studying.” Bloomberg. Might 25, 2016. https://www.bloomberg.com/company/press/bloomberg-magic-machine-learning/.

Brown, Sara. 2021. “Machine Studying, Defined.” MIT Administration Sloan College. April 21, 2021. https://mitsloan.mit.edu/ideas-made-to-matter/machine-learning-explained.

Monetary Stability Board. 2017. “Synthetic Intelligence and Machine Studying in Monetary Companies Market Developments and Monetary Stability Implications.”

Ghoddusi, Hamed, Germán G. Creamer, and Nima Rafizadeh. 2019. “Machine Studying in Power Economics and Finance: A Evaluation.” Power Economics 81 (June): 709–27. https://doi.org/10.1016/j.eneco.2019.05.006.

Hasan, Md Morshadul, József Popp, and Judit Oláh. 2020. “Present Panorama and Affect of Large Knowledge on Finance.” Journal of Large Knowledge 7 (1). https://doi.org/10.1186/s40537-020-00291-z.

OECD. 2021. “OECD Enterprise and Finance Outlook 2020 : Sustainable and Resilient Finance.”

Oracle. 2022. “The Evolution of Large Knowledge and the Way forward for the Knowledge Platform.”

Shen, Dehua, and Shu-Heng Chen. 2018. “Large Knowledge Finance and Monetary Markets.” In Computational Social Science, 235–48. http://www.springer.com/series/11784.

Tech At Bloomberg. 2022. “How Bloomberg Handles a Huge Wave of Actual-Time Market

Knowledge in Microseconds.” Bloomberg. March 4, 2022. https://www.bloomberg.com/company/stories/how-bloomberg-handles-a-massive-wave-of-real-time-market-data-in-microseconds/.