Companies more and more lean on exterior contractor assist for a lot of operational features as payroll prices balloon and world expertise swimming pools turn into more and more accessible. For corporations utilizing QuickBooks, a spread of self-service contractor fee choices can be found that, moreover, may be optimized utilizing third-party integrations. We’ll take a fast have a look at paying contractors via QuickBooks, however, in actuality, the method couldn’t be extra easy for even the least tech-literate enterprise proprietor.

Can I Pay Contractors with QuickBooks On-line?

After all! QuickBooks presents a spread of contractor fee choices, however the base QuickBooks On-line platform lets customers rapidly pay contractors through direct deposit and examine. Make certain to first construct a vendor profile for the contractor if one doesn’t exist already.

Vendor Profile in QuickBooks

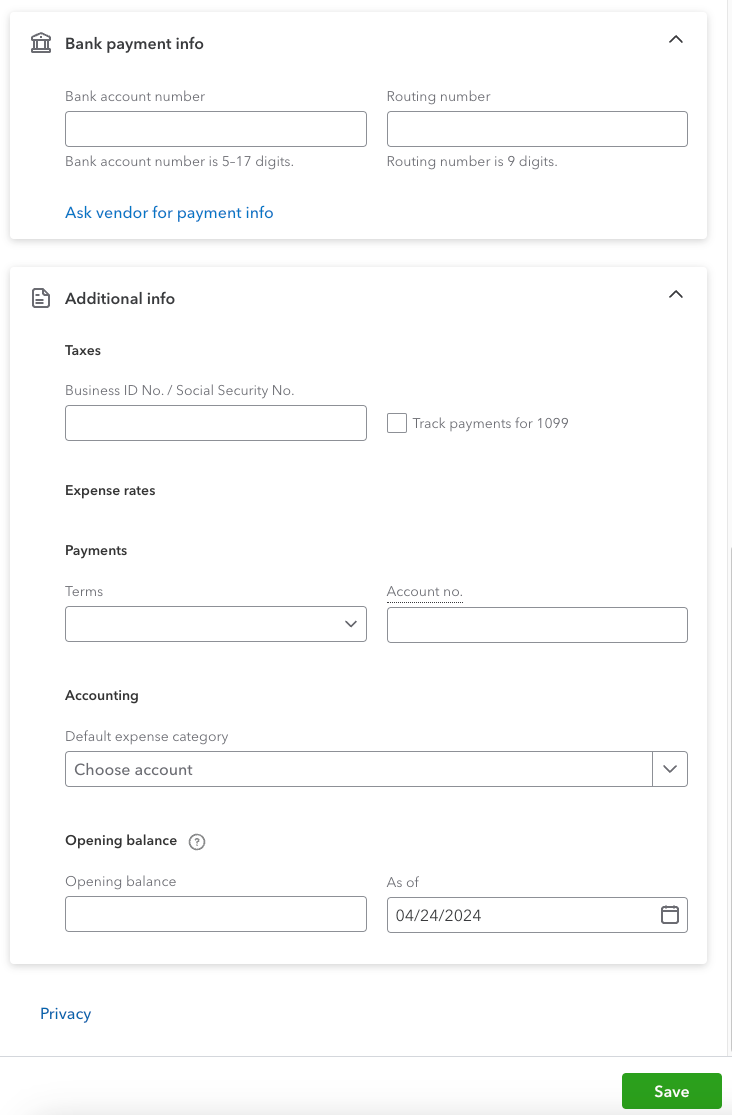

The seller profile will embody fundamental administrative data, like identify and deal with, banking data, and extra feeder information to assist generate paperwork like 1099s and make sure the contractor is paid promptly, precisely, and inside compliance with related legal guidelines and laws.

To take action in QuickBooks On-line,

- Navigate to Bills and click on Distributors.

- Inside the dashboard, click on New Vendor and populate the dropdown menu.

- After filling within the fundamental particulars in regards to the vendor, proceed to fill within the monetary and tax data of the seller for seamless transaction and compliance.

- After filling in all particulars, hit ‘Save’

Paying Contractors through Examine

In case your contractor is native or prefers paper checks, doing so is simple in QuickBooks On-line.

- To take action, you’ll have to set your printing preferences so you may print in your examine paper of alternative.

- As soon as prepared, navigate to your Contractor dashboard and click on the dropdown menu subsequent to the contractor’s identify – you’ll see Write Examine as an choice.

- From there, merely fill out related banking data and the examine quantity, then print or reserve it for later.

Paying Contractors via Direct Deposit

Paying contractors via direct deposit with QuickBooks On-line is simply as easy.

- Choose the contractor in query from the Contractor dashboard and click on Pay Contractor – Direct Deposit

- Validate that the data stays correct.

- Fill out fee data earlier than reviewing the direct deposit, then merely submit.

Paying Contractors with QuickBooks Payroll: The Fundamentals

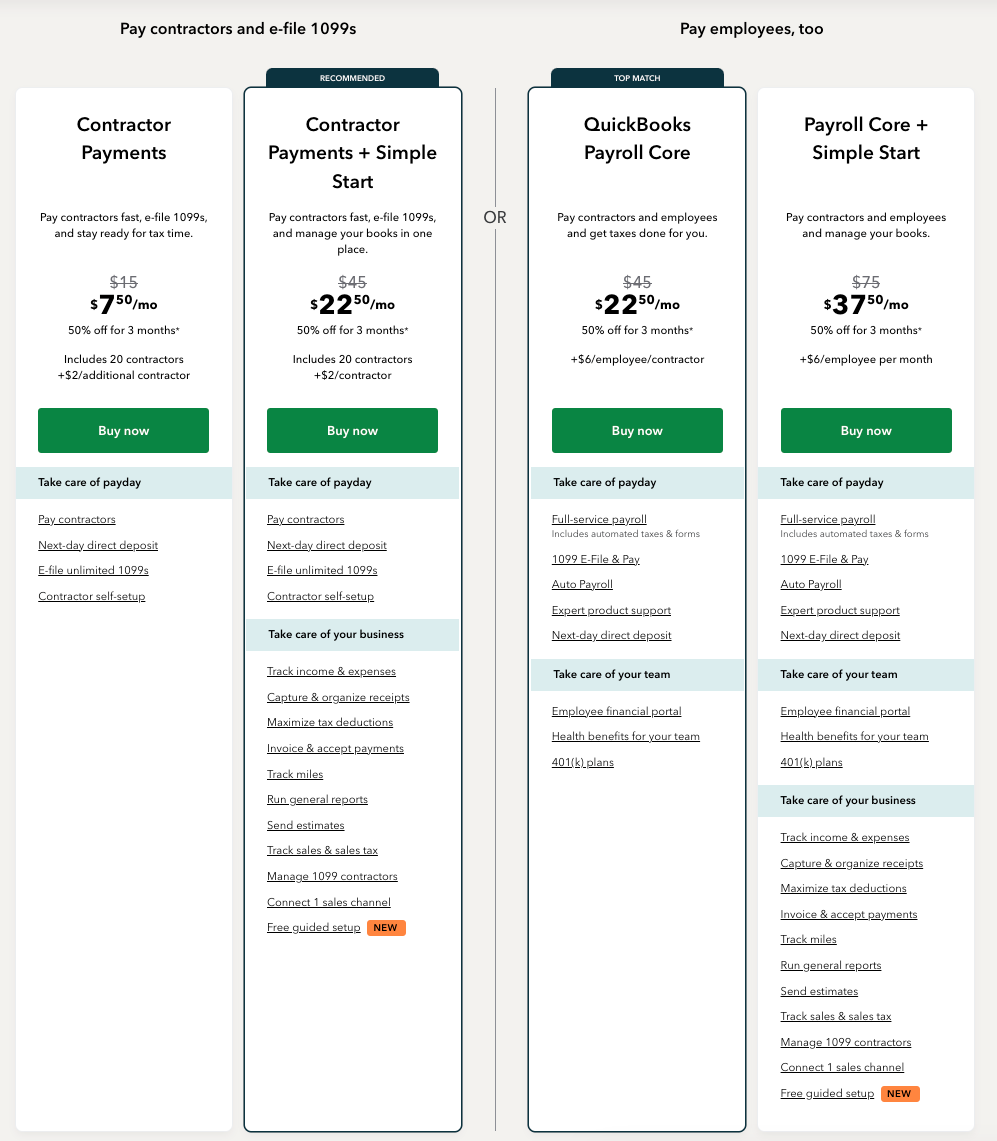

QuickBooks presents QuickBooks Payroll as an add-on to your present QuickBooks On-line account or as a standalone characteristic. QuickBooks Payroll presents two broad classes, contractor and worker funds, with completely different tiers in every.

The contractor fee plan begins at $7.50 month-to-month for as much as 20 contractors ($2 after that) and is the baseline plan that doesn’t require an energetic QuickBooks plan.

The subsequent tier consists of Easy Begin for $22.50/month, and fundamental QuickBooks On-line options like earnings and expense monitoring, receipt administration, and invoicing.

Utilizing QuickBooks Payroll to pay contractors is so simple as following the identical steps detailed above. Nonetheless, it comes with further advantages like producing 1099s to remain compliant and self-guided contractor companies to assist your contractors receives a commission effectively, rapidly, and precisely.

Paying Contractors with QuickBooks Payroll: Direct Deposit

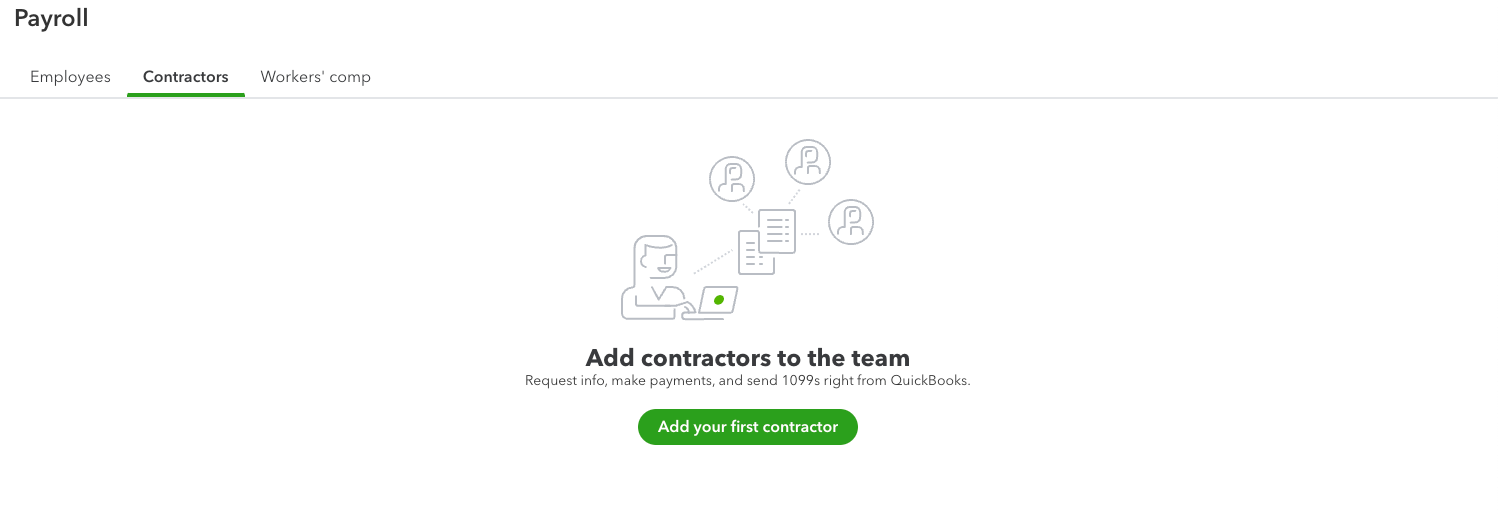

To pay your contractors through direct deposit in QuickBooks Payroll, we’ll first navigate to the Contractors display from the primary Payroll dashboard.

Bear in mind, when you haven’t but added your contractor and their related data to your QuickBooks account, you’ll want to take action first.

- As soon as prepared, choose Pay Contractors and validate the checking account you propose to pay with – don’t skip this step!

- You’ll then decide the fee date, methodology, and which expense class you need to pay the contractor towards in your books.

- If in case you have an present, open invoice with the contractor, QuickBooks Payroll may even immediate you to ask whether or not you need to enter a brand new expense or pay towards the present, unpaid steadiness.

- Lastly, enter and validate all fee and administrative information

- Navigate to the Preview contractor pay button for a ultimate once-over after which click on Submit.

Paying Contractors with QuickBooks Payroll: Examine

As with direct deposit in QuickBooks Payroll, utilizing a examine to pay contractors within the system is straightforward – a lot less complicated, actually, than having to steadiness the precise checkbook!

- Once more, we’ll begin within the Contractors display from our fundamental Payroll dashboard.

- Likewise, enter the contractor’s data if that is the primary time paying them;

- In any other case, click on the dropdown subsequent to the contractor’s identify and click on Write examine.

- When you navigate to the examine writing dashboard, decide the proper checking account from which funds are withdrawn.

- Full all required fields and place the ready-to-print examine in your printing queue or choose Print later when you’re merely making ready a examine for future funds.

- If that’s the case, simply Save and shut the window – the examine will populate throughout the contractor’s profile out of your account when you’re able to return to that individual fee.

Paying Contractors in QuickBooks with Nanonets Integrations

After all, third-party integrations step in to assist clean out a few of QuickBooks’ tough edges and make a extra streamlined expertise for enterprise house owners and contractors alike. By leveraging Nanonets’ accounts payable instruments, you may simply and rapidly manage contractor payments in QuickBooks. As the one 100% automated fee service, you’ll be capable of:

Conclusion

In the end, QuickBooks presents a spread of choices to pay contractors throughout the native platform, whether or not through the use of baseline QuickBooks On-line or integrating QuickBooks Payroll to pay contractors. Likewise, integrating superior third-party add-ons like Nanonets’ accounts payable tools can go a great distance towards streamlining and optimizing your contractor fee technique and planning.

In case you are concerned with speaking to our AI professional on easy methods to energy your QuickBooks.