Audit Financial institution Reconciliation Information

Each inner and exterior accounting audits are important components of monetary administration in addition to organizational danger administration. A bank reconciliation audit is one such course of that helps in figuring out monetary gaps or discrepancies. Along with firms performing financial institution reconciliations internally at the very least as soon as a month, it’s endorsed that exterior auditors conduct a radical financial institution reconciliation course of biannually or yearly to confirm the interior reconcliaition carried out by the inhouse groups.

This text discusses the importance of financial institution reconciliation audits and the function of automation in streamlining the method.

Looking for a Reconciliation Software program?

Take a look at Nanonets Reconciliation the place you possibly can simply combine Nanonets along with your present instruments to immediately match your books and determine discrepancies.

What’s Financial institution Reconciliation?

Checking account reconciliation compares the monetary knowledge in an organization’s inner accounting books (e.g., the General Ledger) with the info in its financial institution assertion. When all entries and the balances match exactly, the checking account is deemed “reconciled.” By evaluating the info within the firm’s accounting system with the financial institution assertion, discrepancies akin to double funds, calculation errors, or fraudulent transactions could be recognized and rectified. This course of ensures the integrity of monetary knowledge and confirms that the reported monetary place is correct. Financial institution reconciliation sometimes includes gathering financial institution statements and transaction data, evaluating them with the corresponding entries within the firm’s accounting data, and investigating any discrepancies. By means of this meticulous course of, companies can mitigate the chance of errors, fraud, and authorized problems, thus safeguarding their monetary well being and compliance.

What’s Financial institution Reconciliation Audit and How Does it Work?

Financial institution reconciliation audit refers back to the complete examination of an organization’s financial institution reconciliation processes and data by an unbiased auditor. This audit goals to confirm the accuracy and completeness of the financial institution reconciliation procedures and be certain that they’re carried out in accordance with established accounting requirements and regulatory necessities. The auditor scrutinizes numerous points of the reconciliation course of, together with the comparability of financial institution statements with the corporate’s accounting data, the identification and determination of discrepancies, and the adherence to inner controls and procedures. Here is how Reconciliation Audits work:

- Planning Stage: The audit course of begins with thorough planning that features defining audit targets, scope, and timelines. The auditor assesses dangers, identifies key areas for assessment, and develops an audit plan tailor-made to the group’s particular wants.

- Knowledge Assortment: The auditor collects related knowledge, together with financial institution statements, transaction data, reconciliation reviews, and supporting documentation. This knowledge serves as the idea for the audit examination.

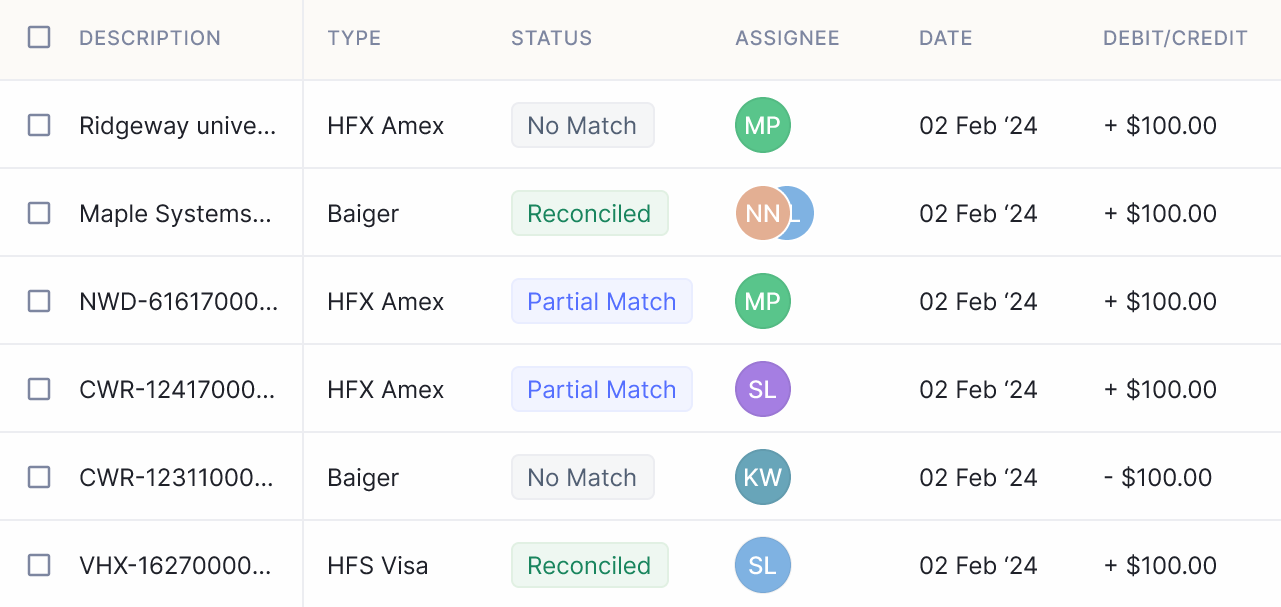

- Examination and Evaluation: The auditor scrutinizes the reconciled financial institution statements and compares them with the corresponding entries within the firm’s accounting data. They analyze transaction particulars, akin to quantities, dates, and descriptions, to determine discrepancies, errors, or irregularities.

- Testing Controls: The auditor evaluates the effectiveness of inner controls associated to financial institution reconciliation processes. This will contain testing the segregation of duties, authorization procedures, and documentation practices to make sure compliance with inner insurance policies and regulatory necessities.

- Documentation Evaluation: The auditor evaluations the documentation supporting the financial institution reconciliation course of, together with reconciliations, changes, and explanations for discrepancies. They assess the adequacy and accuracy of documentation to assist the integrity of monetary data.

- Communication and Reporting: All through the audit course of, the auditor communicates findings and observations to administration and related stakeholders. On the conclusion of the audit, they put together a complete audit report summarizing their findings, together with any recognized points, suggestions for enchancment, and general audit conclusions.

- Observe-Up and Implementation: After presenting the audit report, the auditor may go with administration to handle any recognized deficiencies or areas for enchancment. They supply steering on implementing corrective actions and monitoring progress to make sure the effectiveness of remedial measures.

- Steady Monitoring: Reconciliation audits could also be carried out periodically to observe ongoing compliance and assess the effectiveness of applied controls. This iterative course of promotes steady enchancment and ensures the integrity of the financial institution reconciliation operate over time.

The Significance of Reconciliation Audits

The auditing of the reconciliation processes, particularly financial institution reconciliation by an exterior monetary knowledgeable is essential for the next causes:

- Accuracy Assurance: Financial institution reconciliation audits make sure the accuracy of monetary data by verifying that the balances within the firm’s financial institution accounts match the corresponding entries within the accounting system.

- Error Detection: These audits assist in detecting errors akin to incorrect postings, duplicate transactions, or unauthorized withdrawals, thereby decreasing the chance of monetary misstatements.

- Fraud Prevention: By scrutinizing financial institution transactions and figuring out irregularities, financial institution reconciliation audits play a vital function in detecting and stopping fraudulent actions inside the group.

- Compliance Verification: Financial institution reconciliation audits guarantee compliance with regulatory necessities and accounting requirements, offering assurance to stakeholders and regulatory authorities concerning the accuracy and integrity of monetary reporting.

- Inside Management Analysis: These audits consider the effectiveness of inner controls associated to financial institution reconciliation processes, highlighting areas for enchancment and strengthening inner management mechanisms.

- Danger Mitigation: By figuring out discrepancies and weaknesses in financial institution reconciliation procedures, audits assist in mitigating the chance of monetary losses, reputational harm, and regulatory sanctions.

- Enhanced Resolution-Making: Correct and dependable monetary data ensuing from financial institution reconciliation audits permits administration to make knowledgeable choices and strategic planning with confidence.

- Investor Confidence: Thorough financial institution reconciliation audits instill confidence in buyers and collectors concerning the monetary well being and transparency of the group, thereby attracting funding and facilitating enterprise progress.

- Operational Effectivity: Streamlining financial institution reconciliation processes by way of audits enhances operational effectivity, decreasing handbook effort, and minimizing the time and assets spent on reconciling financial institution accounts.

- Steady Enchancment: Financial institution reconciliation audits present invaluable insights and suggestions for enhancing reconciliation processes, selling steady enchancment in monetary administration practices inside the group.

Guidelines for a Financial institution Reconciliation Audit

A guidelines for a financial institution reconciliation audit sometimes contains the next key objects:

- Financial institution Statements: Receive and assessment financial institution statements for the audit interval, making certain they cowl the whole reconciliation interval and embody all related accounts.

- Accounting Data: Examine financial institution statements with the corporate’s accounting data, together with money receipts, disbursements, and basic ledger entries.

- Transaction Particulars: Analyze transaction particulars for accuracy, together with dates, quantities, descriptions, and classifications.

- Reconciliation Stories: Evaluation reconciliation reviews ready by the corporate, making certain they reconcile financial institution balances with accounting data and supply explanations for any discrepancies.

- Supporting Documentation: Confirm the existence and accuracy of supporting documentation, akin to receipts, invoices, and financial institution correspondence, for reconciled transactions.

- Inside Controls: Consider the effectiveness of inner controls associated to financial institution reconciliation processes, together with segregation of duties, authorization procedures, and documentation practices.

- Compliance: Assess compliance with regulatory necessities and accounting requirements, making certain adherence to related legal guidelines, laws, and business greatest practices.

- Documentation High quality: Evaluation the standard and completeness of documentation supporting the financial institution reconciliation course of, together with reconciliations, changes, and explanations for discrepancies.

- Audit Path: Hint transactions from supply paperwork by way of the reconciliation course of to the ultimate accounting data, making certain a transparent and full audit path.

- Accuracy of Changes: Confirm the accuracy of any changes made in the course of the reconciliation course of, making certain they’re correctly supported, approved, and recorded.

- Timeliness: Assess the timeliness of the reconciliation course of, making certain reconciliations are accomplished promptly and inside established deadlines.

- Administration Evaluation: Verify that reconciliations are reviewed and authorized by administration or designated personnel, offering oversight and accountability for the reconciliation course of.

- Observe-Up Actions: Establish any discrepancies, errors, or deficiencies uncovered in the course of the audit and advocate acceptable follow-up actions, together with corrective measures and course of enhancements.

- Audit Documentation: Preserve complete documentation of audit procedures, findings, and conclusions, making certain transparency and accountability within the audit course of.

- Communication: Talk audit findings, observations, and suggestions to administration and related stakeholders, fostering dialogue and collaboration in addressing recognized points.

This guidelines will assist auditors successfully consider the financial institution reconciliation course of, determine areas for enchancment, and supply insights to boost monetary controls and accountability inside the group.

Discover Nanonets for automating financial institution reconciliation

Audit automation has turn out to be a cornerstone technique for modernizing the auditing course of, leveraging superior applied sciences like Nanonets to streamline workflows and improve effectivity. Based on a 2021 survey carried out by Forbes amongst finance and accounts-related executives, almost all respondents (98%) famous that their exterior audit corporations make the most of superior expertise. This utilization of expertise contributes considerably to enhancing audit high quality by offering deeper insights into areas of elevated danger, higher benchmarking, and broader knowledge protection. Moreover, 94% of executives understand that this expertise enhances the general shopper expertise.

Nanonets, is a great OCR software program that’s adept at dealing with the challenges related to managing in depth paperwork and handbook knowledge entry related to financial institution reconciliation audits. At its core, Nanonets’ Optical Character Recognition (OCR) performance expedites knowledge assortment from scanned paperwork, simplifying doc storage and granting fast entry to beforehand inaccessible particulars inside moments. This functionality is essential, as nearly all executives acknowledge the importance of expertise in enhancing audit high quality and shopper expertise.

Nanonets goes past primary OCR by leveraging machine studying (ML) algorithms to extract particular entries, akin to dates, buy order numbers, and reference IDs, from a myriad of monetary paperwork. With coaching, Nanonets achieves over 90% accuracy and might analyze 1000’s of paperwork in a fraction of the time. This accuracy and effectivity are important in addressing the calls for of contemporary audit processes, the place massive volumes of information must be processed quickly and precisely.

Not like typical template-based options, Nanonets boasts an clever doc processing algorithm able to dealing with beforehand unseen doc sorts. Its proficiency extends to managing unstructured knowledge, navigating frequent knowledge constraints, decoding multi-page paperwork, tables, and multi-line objects effortlessly.

Nanonets operates as a no-code clever automation platform, empowering customers to customise doc processing in accordance with their particular necessities. With the power to constantly retrain itself and be taught from customized datasets, Nanonets persistently delivers outputs with minimal post-processing. This adaptability ensures that audit processes stay agile and conscious of altering necessities, as highlighted by executives who understand expertise as enhancing audit high quality and shopper expertise.

Final however not least, Nanonets facilitates seamless integration with present programs, together with legacy software program, CRM, ERP, or RPA platforms. This interoperability ensures a easy implementation course of, permitting organizations to leverage Nanonets’ capabilities with out disruption to their present workflows. This ease of integration aligns with executives’ perceptions that expertise enhances the general shopper expertise.

Take Away

Audits play a vital function within the financial institution reconciliation processes by making certain its accuracy and integrity. Automation instruments like Nanonets provide invaluable assist to reconciliation audits by streamlining knowledge assortment, extraction, and evaluation. By leveraging superior OCR and machine studying algorithms, Nanonets can swiftly course of massive volumes of monetary paperwork, determine related data akin to dates, quantities, and transaction particulars, and flag potential discrepancies for additional assessment. This not solely accelerates the audit of the reconciliation course of but additionally enhances its accuracy and reliability, empowering organizations to keep up strong monetary controls and uphold the belief and confidence of stakeholders.