Introduction

Accuracy and effectivity are non-negotiable within the processing of funds in any firm, be they funds acquired by the corporate for merchandise/companies rendered, or made to distributors for merchandise/companies acquired. Payment reconciliation is the method of verifying all cost transactions. It includes evaluating transaction information from numerous sources, equivalent to invoices, bank statements, and cost receipts, to determine discrepancies and errors. As enterprises develop and transaction volumes escalate, the guide execution of cost reconciliation turns into more and more laborious and prone to errors. Herein lies the transformative potential of cost reconciliation software program. Not surprisingly, Fortune Enterprise Insights reports that the worldwide reconciliation software program market is projected to develop from $1.28 billion in 2023 to $3.40 billion by 2030, at a CAGR of 14.9% through the forecast interval.

What’s Fee Reconciliation Software program?

Fee reconciliation software program instruments are designed to automate and streamline the method of matching and reconciling financial transactions inside a enterprise. Its major operate is to check numerous transaction information, equivalent to invoices, financial institution statements, and cost receipts, to make sure accuracy and consistency in monetary knowledge. By leveraging superior algorithms and knowledge analytics, cost reconciliation software program identifies discrepancies and errors, facilitating exact reconciliation. Whereas the precise steps concerned in Fee Reconciliation might differ throughout companies, the overall course of is as follows:

- Knowledge Assortment: All related monetary paperwork and information are collected, together with financial institution statements, invoices, receipts, and accounting system information, to confirm cost accuracy.

- Transaction Matching: Financial institution assertion information are in contrast with entries within the accounting system, guaranteeing consistency in transaction dates, quantities, and descriptions.

- Discrepancy Identification: Inconsistencies or discrepancies are recognized. These might come up from timing variations, errors, or fraudulent actions.

- Discrepancy Decision: Discrepancies are analyzed to find out their causes, probably involving communication with issuing banks or reviewing unique transaction paperwork. Appropriate or regulate accounting information accordingly.

- Adjustment Recording: Changes within the accounting system are made to reconcile accounts, equivalent to accounting for financial institution charges, curiosity earned, or rectifying errors.

- Stability Verification: The adjusted stability within the accounting information is matched with the ending stability mirrored within the financial institution assertion.

- Documentation: Complete documentation of the reconciliation course of have to be maintained, together with particulars of discrepancies and changes, for audit path functions, guaranteeing accountability and transparency.

- Evaluate and Approval: Relying on the scale and construction of the enterprise, a supervisor or supervisor might assessment and approve the reconciliation course of to make sure its accuracy and completeness.

Fee reconciliation is carried out at common intervals, equivalent to month-to-month or quarterly. The cost reconciliation software program automates many of those steps thereby saving money and time.

Advantages of Utilizing Fee Reconciliation Software program:

Utilizing cost reconciliation software program presents a spread of advantages for companies:

- Elevated Effectivity: Automation of repetitive reconciliation duties saves time and reduces guide effort, permitting workers to concentrate on extra strategic actions.

- Accuracy and Precision: The software program employs superior algorithms to systematically examine and match transaction information, minimizing the danger of errors or discrepancies in monetary knowledge.

- Value Financial savings: By streamlining reconciliation processes and decreasing guide labor, companies can obtain price financial savings related to labor hours and potential errors.

- Improved Compliance: Fee reconciliation software program helps guarantee adherence to regulatory requirements and monetary compliance by sustaining correct and clear monetary information.

- Enhanced Visibility: Actual-time insights and analytics offered by the software program provide larger visibility into monetary transactions, empowering knowledgeable decision-making and strategic planning.

- Quicker Determination-Making: With well timed entry to correct monetary data, companies could make quicker choices relating to money circulation administration, budgeting, and forecasting.

- Scalability: The software program is designed to accommodate rising transaction volumes and increasing enterprise wants, offering scalability with out compromising efficiency.

- Diminished Fraud Danger: By promptly figuring out discrepancies and irregularities in monetary transactions, cost reconciliation software program helps mitigate the danger of fraud and unauthorized actions.

- Buyer Satisfaction: Correct and well timed reconciliation ensures that prospects are billed accurately and funds are processed effectively, contributing to improved buyer satisfaction and loyalty.

- Strategic Insights: By analyzing reconciliation knowledge, companies can acquire helpful insights into cost tendencies, buyer conduct, and operational effectivity, enabling them to optimize processes and drive enterprise progress.

Key Options to Search for:

listed below are some widespread options present in cost reconciliation software program:

- Knowledge Integration: Seamless connectivity with numerous knowledge sources equivalent to ERP programs, banking platforms, and cost gateways.

- Matching Algorithms: Superior algorithms for evaluating and matching transaction information based mostly on customizable standards.

- Reconciliation Guidelines: Customizable guidelines and parameters for automating the reconciliation course of in keeping with particular enterprise necessities.

- Dashboard and Reporting: Intuitive dashboards and reporting instruments for real-time insights into monetary transactions and reconciliation standing.

- Scalability: Capability to deal with giant transaction volumes and accommodate enterprise progress.

- Flexibility: Adaptability to evolving enterprise wants and modifications in reconciliation processes.

- Safety Options: Encryption protocols, entry controls, and knowledge safety measures to safeguard delicate monetary data.

- Audit Trails: Complete audit trails to trace modifications and keep a clear reconciliation course of.

- Exception Dealing with: Mechanisms for figuring out and resolving discrepancies or errors in reconciliation.

- Integration with Accounting Methods: Integration capabilities with accounting software program to make sure seamless knowledge circulation between reconciliation and accounting processes..

Finest Fee Reconciliation Software program

With the growing demand for reconciliation software program, the market presents a plethora of choices for firms to select from. Choosing the right answer includes cautious consideration of the corporate’s particular wants and necessities. Corporations ought to assess the options and functionalities supplied by completely different reconciliation software program, contemplating features equivalent to automation capabilities, scalability, integration with current programs, and safety measures. Moreover, evaluating vendor status, buyer evaluations, and help companies can present helpful insights into the reliability and effectiveness of the software program. The next desk presents the most effective options of some in style Fee Reconciliation Automation Instruments

The very best cost reconciliation software program – Nanonets

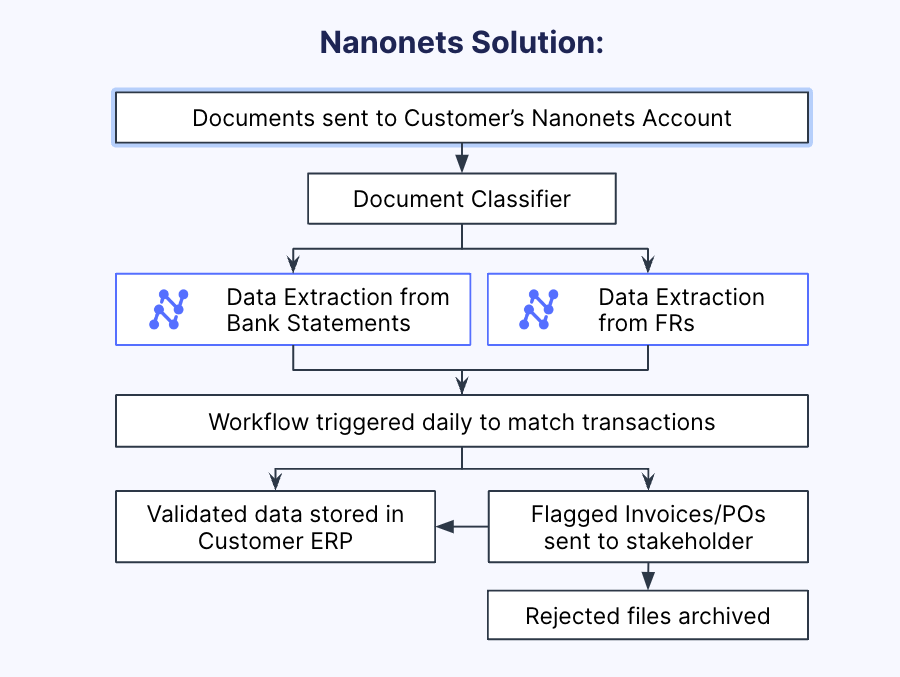

AI-powered Nanonets may help you automate payment reconciliation. It will possibly automate the retrieval of monetary transactions from numerous sources in real-time, eliminating the necessity for guide knowledge entry and decreasing the danger of human error. Using OCR know-how and machine studying, our software program extracts cost transaction knowledge and validates it towards ledger entries, highlighting any discrepancies for additional investigation and correction. This automation not solely saves companies important effort and time but in addition ensures speedy consideration to any discrepancies recognized through the course of.

Try Nanonets Reconciliation the place you’ll be able to simply combine Nanonets together with your current instruments to immediately match your books and determine discrepancies.

Nanonets’ customizable method permits tailoring of the software program to match the distinctive workflows, knowledge codecs, and reporting wants of every enterprise. Our group of consultants collaborates carefully with shoppers to know their particular reconciliation processes and develop custom-made options that streamline operations and improve accuracy.

Nanonets facilitates provider cost reconciliation, guaranteeing that funds made to suppliers align with bill particulars. It additionally allows the reconciliation of each inter and intra-company payments, additional enhancing monetary integrity and transparency.

With seamless compatibility with a whole lot of instruments, together with Gmail, Quickbooks, Xero, and Stripe, Nanonets streamlines operations and boosts effectivity effortlessly.

By implementing Nanonets’ cost reconciliation software program, companies can considerably scale back fraudulent transactions by as much as 60%, improve monetary integrity by about 80%, and obtain 90% compliance with regulatory requirements. This not solely ensures safer monetary operations but in addition mitigates potential authorized points and fines.

Take Away

With digitalization surging throughout sectors, reconciliation software program demand peaks, notably within the retail sector. The fast progress of E-commerce’s, pushed by urbanization and favorable insurance policies, has resulted in giant enterprises and SMEs turning to reconciliation software. This adoption presents promising options, offering swift insights and enhancing market presence. Nanonets and related corporations pioneer this shift, integrating AI and machine studying into their software program fashions. In navigating monetary complexities, reconciliation instruments equivalent to Nanonets have turn into important to mitigate threat, drive market progress and promote sustainable monetary operations throughout the enterprise.