Petty Cash Reconciliation: What’s It, Most interesting Practices, and Automation

Petty cash, moreover often known as a small cash fund, is a set amount of money reserved for minor payments in a enterprise. These payments generally embody small purchases like office offers, journey payments, or miscellaneous objects which will be too insignificant to warrant writing a confirm or initiating an digital charge.

No matter its small denomination, petty cash performs a serious operate in day-to-day operations, offering flexibility and luxury in coping with minor payments with out the need for formal approval processes. Petty cash reconciliation is the tactic of verifying and documenting petty cash transactions to be sure that the amount of cash available matches the recorded stability throughout the petty cash account. It serves as a administration mechanism to maintain up appropriate financial data and forestall misuse or misappropriation of funds.

On this text, we’ll dive into petty cash reconciliation — how best to go about it, widespread challenges, and the best way superior automation choices like Nanonets would possibly assist.

Searching for a Reconciliation Software program program?

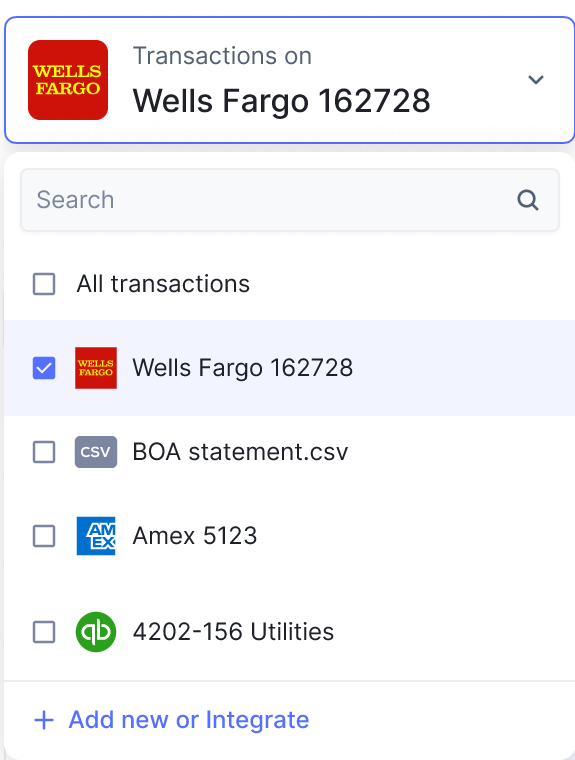

Check out Nanonets Reconciliation the place you can merely mix Nanonets collectively together with your present devices to instantly match your books and decide discrepancies.

What’s Petty Cash Reconciliation?

Petty cash reconciliation refers again to the systematic technique of evaluating the exact cash available with the recorded stability throughout the petty cash account. It entails reviewing and validating petty cash transactions to verify accuracy and completeness in financial data.

The primary purpose of petty cash reconciliation is to find out any discrepancies between the bodily cash rely and the recorded balance, thereby sustaining the integrity of agency financials and guaranteeing compliance with interior controls and accounting necessities.

Corporations generally arrange petty cash funds to facilitate the nicely timed payment of small payments that do not warrant formal procurement processes. Nonetheless, with out appropriate oversight and reconciliation procedures, petty cash will likely be susceptible to misuse, errors, or theft. Petty cash reconciliation serves as a safeguard in opposition to such risks by providing a structured framework for monitoring and controlling cash disbursements.

What are the Steps Involved in Petty Cash Reconciliation?

By the petty cash reconciliation course of, the subsequent steps are generally carried out:

- Recording Transactions: All petty cash transactions, along with withdrawals and expenditures, are documented with supporting receipts or vouchers.

- Bodily Rely of Cash: The exact amount of cash remaining throughout the petty cash fund is counted and verified in opposition to the recorded stability.

- Comparability and Analysis: The recorded transactions are in distinction with the bodily cash rely to find out any discrepancies or irregularities.

- Modifications and Corrections: Any discrepancies found all through the reconciliation course of are investigated, and modifications are made to reconcile the petty cash account stability.

- Documentation and Reporting: The reconciliation outcomes are documented in a reconciliation report, detailing the findings, modifications made, and any corrective actions taken. This report serves as a correct report of the reconciliation course of and provides transparency and accountability.

Normal, petty cash reconciliation performs a big operate in sustaining financial accuracy, transparency, and administration inside an organisation. It helps make sure that petty cash funds are used appropriately, payments are accurately accounted for, and financial data are saved up to date and proper.

Challenges of Petty Cash Reconciliation

Petty cash reconciliation, whereas essential and seemingly easy, can actually pose various challenges for firms. Some widespread ones embody:

- Lack of Documentation: Inadequate documentation of petty cash transactions, akin to missing receipts or incomplete data, can hinder the reconciliation course of and make it troublesome to verify expenditures exactly.

- Handbook Processes: Relying on handbook processes for petty cash reconciliation will likely be time-consuming and susceptible to errors. Handbook data entry and calculation enhance the hazard of inaccuracies and discrepancies in financial data.

- Cash Discrepancies: Discrepancies between the recorded stability and the exact cash rely would possibly occur because of theft, mismanagement, or human error. Determining and resolving these discrepancies requires thorough investigation and reconciliation efforts.

- Compliance Risks: Failure to stay to interior controls and compliance requirements can result in regulatory violations and financial losses. Corporations ought to make sure that petty cash reconciliation procedures align with established insurance coverage insurance policies and regulatory necessities.

- Lack of Accountability: With out clear accountability and oversight, petty cash funds is also weak to misuse or unauthorised expenditures. Implementing sturdy controls and monitoring mechanisms is essential to mitigate the hazard of fraud or misappropriation.

No matter these challenges, firms can overcome them by implementing environment friendly petty cash administration practices and leveraging experience choices to streamline the reconciliation course of.

Most interesting Practices for Petty Cash Reconciliation

To beat the challenges associated to petty cash reconciliation, firms can undertake the subsequent best practices:

- Arrange Clear Insurance coverage insurance policies and Procedures: Develop full insurance coverage insurance policies and procedures governing utilizing petty cash, along with ideas for recording transactions, approving expenditures, and conducting reconciliations.

- Protect Enough Documentation: Require employees to supply detailed receipts or vouchers for all petty cash transactions. Protect appropriate data of expenditures, withdrawals, and replenishments to facilitate the reconciliation course of.

- Widespread Reconciliation: Conduct frequent reconciliations of petty cash funds to be sure that the recorded stability aligns with the exact cash rely. Schedule reconciliation actions on a weekly or month-to-month basis to promptly decide and deal with any discrepancies.

- Segregation of Duties: Implement segregation of duties to forestall fraud and errors. Assign distinct roles and duties for managing petty cash, recording transactions, and conducting reconciliations to verify accountability and oversight.

- Leverage Experience Choices: Put cash into accounting software program program or petty cash administration strategies that automate and streamline the reconciliation course of. These devices would possibly assist cut back handbook effort, improve accuracy, and enhance visibility into petty cash transactions.

By implementing these best practices, firms can enhance the effectivity, accuracy, and administration of their petty cash reconciliation processes, guaranteeing compliance with regulatory requirements and sustaining financial integrity.

Automating Petty Cash Reconciliation

With developments in experience, firms can leverage automation to streamline petty cash reconciliation processes. Superior Optical Character Recognition (OCR) choices like Nanonets can automate petty cash reconciliation to keep away from losing your company time, money, and improve the effectivity and accuracy of petty cash reconciliation:

- Digital Receipt Administration: Implement digital receipt management choices that allow employees so as to add receipts immediately into the system using cell devices. This eliminates the need for handbook receipt assortment and ensures that every one transactions are documented electronically

- OCR Experience: Superior Optical Character Recognition (OCR) utilized sciences like Nanonets can extract data from receipts and robotically populate transaction particulars throughout the reconciliation system. OCR can exactly seize data akin to this point, vendor establish, and amount, reducing handbook data entry errors.

- Integration with Accounting Software program program: Mix petty cash reconciliation software program program with accounting strategies akin to QuickBooks or Xero to synchronise transaction data in real-time. This ensures seamless communication between financial strategies and eliminates the need for handbook data change.

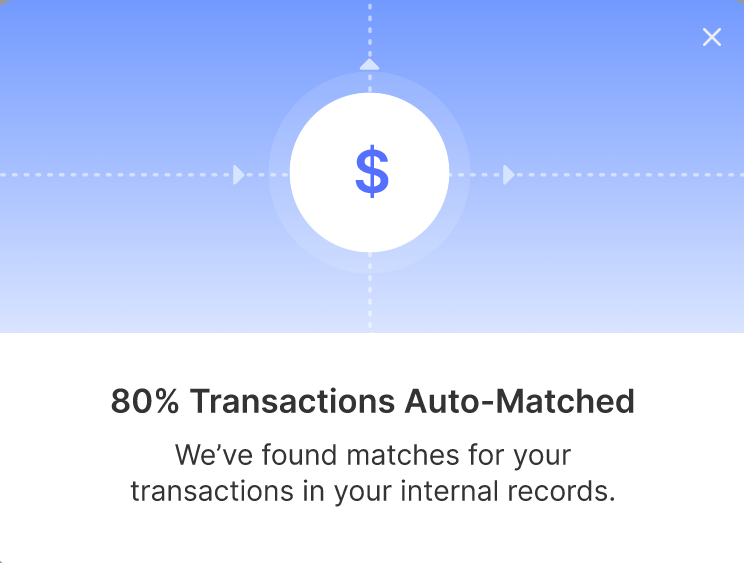

- Automated Matching Algorithms: Deploy automated matching algorithms that consider transaction particulars from receipts with recorded expenditures throughout the reconciliation system. These algorithms can decide discrepancies and flag potential errors for added investigation.

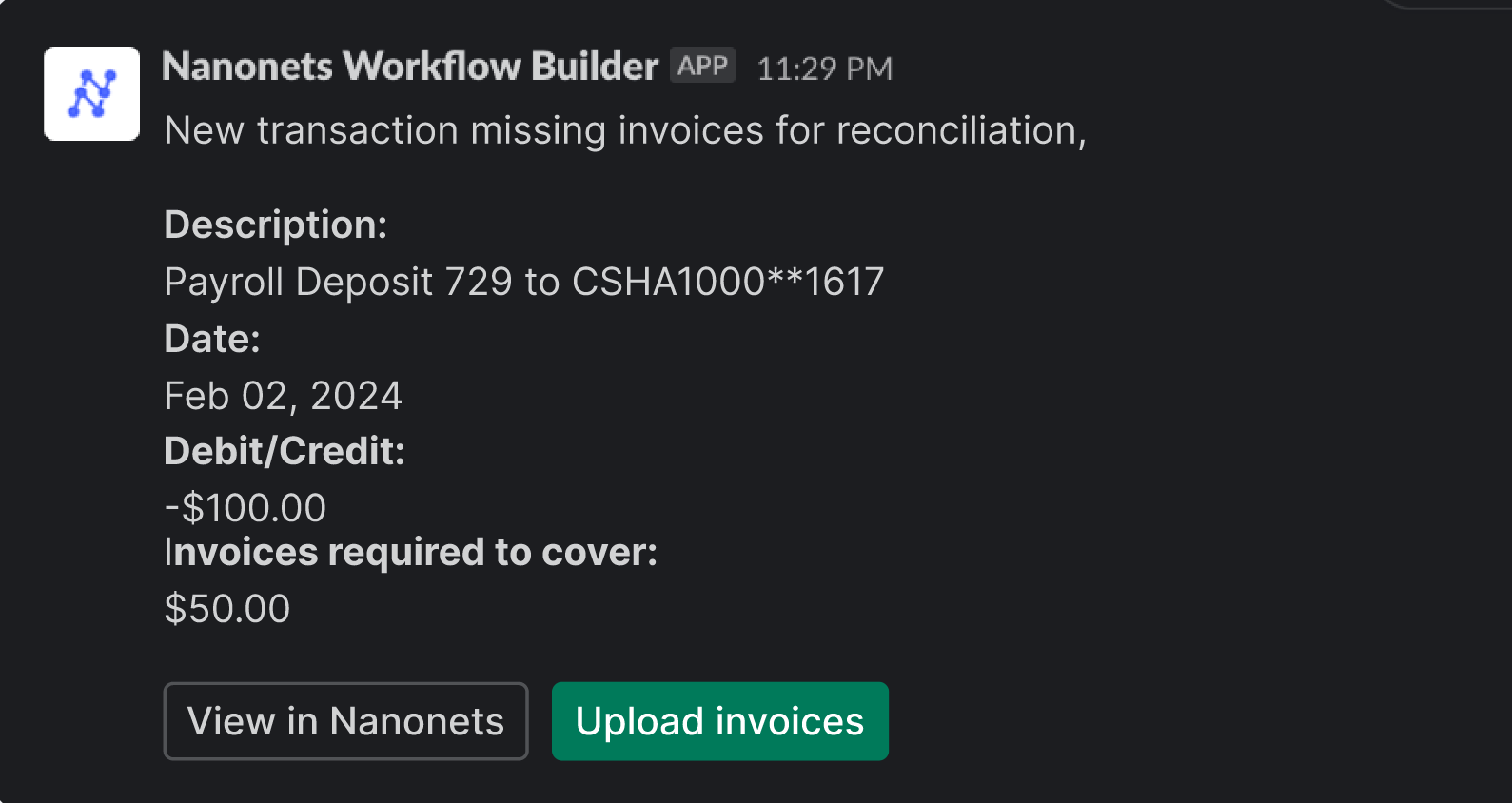

- Workflow Automation: Implement workflow automation devices to streamline the approval course of for petty cash expenditures. Define approval hierarchies and organize automated notifications to tell associated stakeholders when movement is required, reducing delays and bettering accountability.

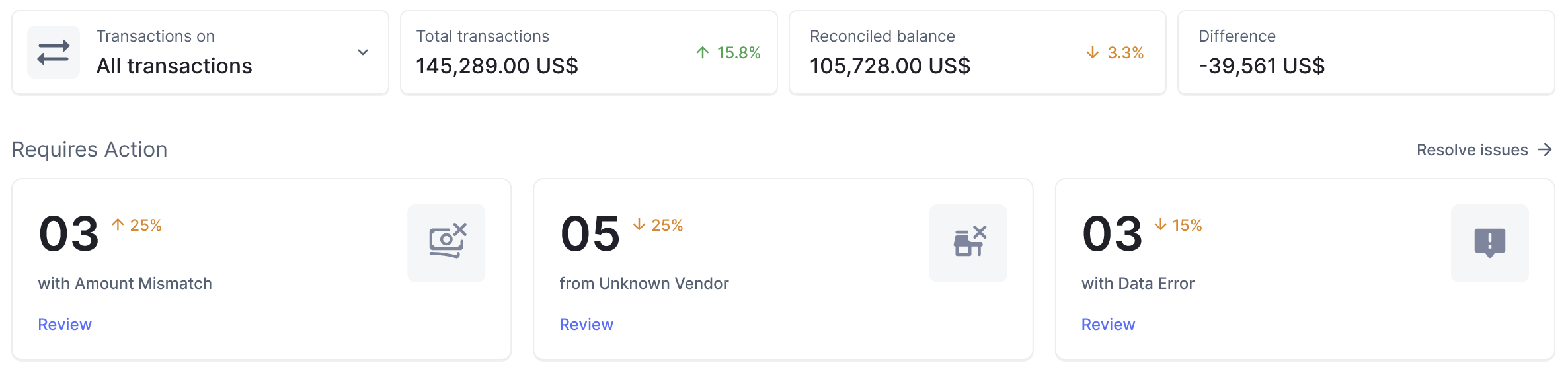

- Precise-Time Reporting and Dashboards: Utilise real-time reporting capabilities to generate customizable experiences and dashboards that current insights into petty cash transactions, balances, and tendencies. This permits stakeholders to look at petty cash train and decide areas for enchancment proactively

By embracing automation utilized sciences, firms can rework their petty cash reconciliation processes, reducing handbook effort, minimising errors, and enhancing common effectivity.

Conclusion

Petty cash reconciliation performs a big operate in sustaining appropriate financial data and guaranteeing compliance with interior insurance coverage insurance policies and regulatory requirements. By understanding the challenges associated to petty cash reconciliation and adopting best practices, firms can optimise their reconciliation processes and mitigate risks efficiently.

Furthermore, leveraging automation utilized sciences akin to digital receipt administration, OCR experience, integration with accounting software program program, automated matching algorithms, workflow automation, and real-time reporting can streamline petty cash reconciliation and improve accuracy and effectivity.

As firms proceed to evolve and embrace digital transformation, investing in automation choices for petty cash reconciliation can yield essential benefits, along with time monetary financial savings, value low cost, enhanced administration, and improved decision-making. By prioritizing automation, firms can optimize their petty cash administration processes and provides consideration to driving improvement and innovation.