Introduction to Monetary establishment Reconciliation Journal Entries

Bank reconciliation is a crucial course of in accounting that ensures the accuracy and integrity of a corporation’s financial knowledge. It entails the comparability between the company’s inside financial knowledge and other people of the monetary establishment. On the coronary coronary heart of this reconciliation lies the creation of journal entries, which serve to align discrepancies between the company’s books and the bank statement. Understanding the intricacies of bank reconciliation journal entries is essential for finance professionals and enterprise homeowners alike, as a result of it empowers them to determine, deal with, and forestall errors or discrepancies in financial reporting. On this essay, we’re going to take a look on the significance of monetary establishment reconciliation journal entries, uncover widespread sorts of entries, and see how Nanonets will help make sure accuracy and effectivity throughout the reconciliation course of.

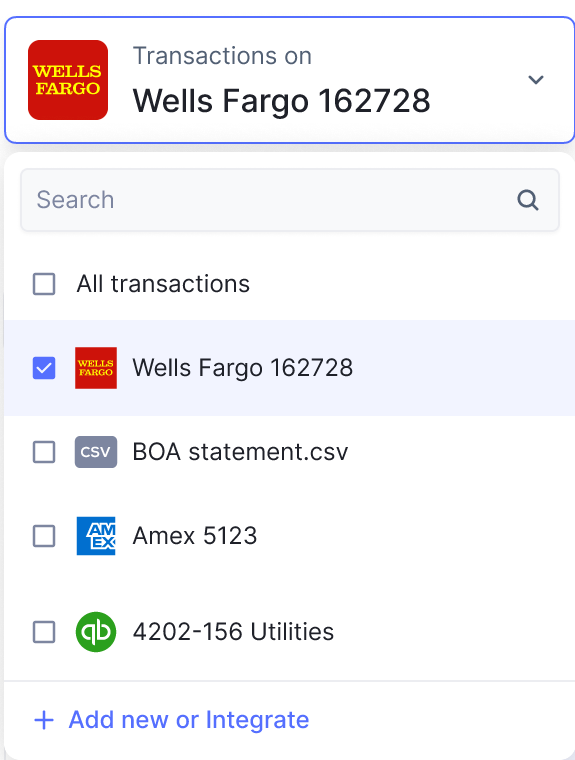

Trying to find a Reconciliation Software program program?

Check out Nanonets Reconciliation the place you’ll merely mix Nanonets alongside along with your present devices to instantly match your books and set up discrepancies.

What’s Journal Entry in accounting?

A journal entry is a report of a financial transaction that impacts the financial statements of a enterprise. It’s the first step throughout the accounting cycle and entails recording the transaction throughout the general ledger.

Listed beneath are the vital factor components of a journal entry:

- Date: The date on which the transaction occurred.

- Accounts: The accounts affected by the transaction. Each journal entry entails as a minimum two accounts: one account to be debited and one different account to be credited. Debits and credit score are used to report will improve and reduces particularly accounts based mostly on the rules of double-entry accounting.

- Debit and Credit score rating Portions: The portions to be debited and credited to each account. Debits are recorded on the left facet of the journal entry, whereas credit score are recorded on the exact facet.

- Description/Narration: A brief description or rationalization of the transaction, indicating the character of the transaction and providing context for the entry.

As an example, take into consideration a enterprise that receives $1,000 in cash for suppliers equipped. The journal entry to report this transaction would often seem to be this:

On this journal entry:

- The “Cash” account is debited because of the enterprise receives cash, resulting in an increase in cash (an asset account).

- The “Service Revenue” account is credited because of the enterprise earns revenue from providing suppliers, resulting in an increase in revenue (an equity account).

The essential principle behind journal entries is the double-entry system, which ensures that the accounting equation (Property = Liabilities + Equity) stays balanced. Every debit should be accompanied by an equal and reverse credit score rating, thereby sustaining the equilibrium of the accounting equation.

Journal Entries in Monetary establishment Reconciliation

Throughout the technique of bank reconciliation, quite a few transactions require journal entries to verify right alignment between a corporation’s financial knowledge and its monetary establishment assertion. Listed beneath are examples of such transactions and the corresponding journal entries:

- Monetary establishment Service Prices: When the monetary establishment imposes service charges, often confirmed on the ultimate day of the monetary establishment assertion, nevertheless not however mirrored throughout the agency’s books, a journal entry is vital. This entails crediting the Cash account and debiting an expense account harking back to Monetary establishment Prices or Miscellaneous Expense.

- Returned Purchaser Checks (NSF): If checks deposited by prospects bounce on account of insufficient funds, resulting in reversal of funds throughout the agency’s account, a journal entry is required to control the Cash account and reverse the revenue initially recorded

- Monetary establishment Costs for Returned Checks: If the monetary establishment charges costs for returned checks, a journal entry is made to acknowledge this expense and cut back the Cash account.

- Collections of Notes Receivable by the Monetary establishment: If the monetary establishment collects on the company’s behalf for notes receivable, a journal entry is vital to acknowledge the rise in cash.

- Curiosity Earned on Monetary establishment Accounts: When the monetary establishment pays curiosity on the company’s account, a journal entry is made to acknowledge this earnings.

One other devices that go into the journal are confirm printing charges, purchaser checks that had been initially deposited nevertheless are subsequently returned on account of insufficient funds (NSF), monetary establishment corrections addressing agency errors, mortgage funds, and digital deposits and withdrawals.

These journal entries help be sure that the company’s financial knowledge exactly replicate the transactions reported by the monetary establishment, facilitating precise financial reporting and powerful inside controls.

Goal of Journal Entries in Monetary establishment Reconciliation

The primary aim of journal entries in bank reconciliation is to align a corporation’s inside financial knowledge with the transactions reported by the monetary establishment. Monetary establishment reconciliation ensures the accuracy and integrity of financial info by determining and addressing discrepancies between the company’s knowledge and the monetary establishment assertion. Journal entries facilitate modifications to the company’s books to duplicate transactions which had been recorded by the monetary establishment nevertheless not however by the company, or vice versa.

Listed beneath are some key capabilities of journal entries in bank reconciliation:

- Correcting Discrepancies: Journal entries help proper any variations between the company’s knowledge and the monetary establishment assertion. These variations may come up on account of fantastic checks, deposits in transit, monetary establishment costs, curiosity earned, or completely different transactions that have not been exactly recorded or mirrored in every items of information.

- Guaranteeing Accuracy: By making essential modifications by way of journal entries, monetary establishment reconciliation ensures that the company’s financial knowledge exactly replicate its true financial place. This accuracy is vital for making educated enterprise selections and meeting regulatory requirements.

- Strengthening Inside Controls: Monetary establishment reconciliation, supported by journal entries, serves as an important inside administration mechanism. It helps detect errors, discrepancies, or potential fraud throughout the agency’s financial transactions by evaluating knowledge independently maintained by the monetary establishment and the company.

- Facilitating Decision-Making: Appropriate and up-to-date financial knowledge, achieved by way of environment friendly monetary establishment reconciliation and journal entries, current administration with reliable data for decision-making. Clear and reconciled financial info enable administration to judge the company’s effectivity, deal with cash circulation efficiently, and plan for the long term.

- Enhancing Financial Reporting: Accurately reconciled financial knowledge, aided by journal entries, contribute to the preparation of right financial statements. These statements are vital for stakeholders, along with patrons, collectors, and regulators, to evaluate the company’s financial properly being, effectivity, and compliance with accounting necessities.

Learn to Make Journal Entries in Monetary establishment Reconciliation?

Making journal entries in monetary establishment reconciliation entails a scientific technique to verify accuracy and alignment between a corporation’s knowledge and the monetary establishment assertion. It is a step-by-step info on one of the simplest ways to make journal entries in monetary establishment reconciliation:

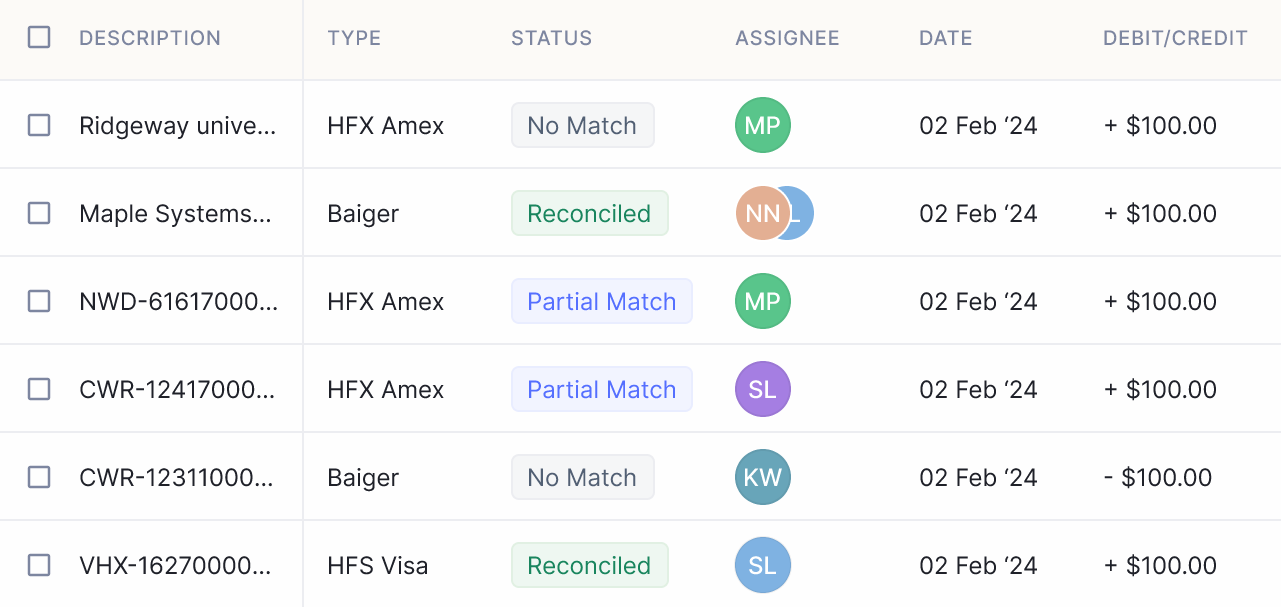

- Decide Discrepancies: Begin by reviewing the monetary establishment assertion and evaluating it with the company’s inside knowledge such as a result of the Regular Ledger to determine any variations or discrepancies. Frequent discrepancies embrace wonderful checks, deposits in transit, monetary establishment costs, curiosity earned, or errors in recording transactions.

- Analyze Transactions: Analyze each acknowledged discrepancy to search out out the appropriate adjustment wished throughout the agency’s books. Assess whether or not or not each merchandise requires a journal entry and whether or not or not it should be debited or credited based totally on its nature.

- Choose Accounts: Select the accounts to be debited and credited for each journal entry. Debit accounts symbolize will improve in property or payments, whereas credit score rating accounts symbolize will improve in liabilities, equity, or earnings. Assure accuracy by choosing the proper accounts for each transaction.

- Resolve Portions: Calculate the portions to be debited and credited for each journal entry. Affirm that the general debits equal the general credit score to maintain up the steadiness of the accounting equation. Take care to exactly determine the portions to duplicate the true impression of each transaction.

- Put collectively Journal Entries: Report the journal entries throughout the agency’s primary ledger or accounting software program program. Embrace the date of the entry, the accounts debited and credited, and a brief description of the transaction to supply readability and context. Double-check the accuracy of each entry sooner than persevering with.

- Put up Entries: Put up the journal entries to the appropriate accounts throughout the primary ledger. Guarantee that each entry is posted exactly to duplicate the modifications made throughout the agency’s knowledge. Consider the posting to substantiate that the balances are updated precisely.

- Reconcile Balances: After ending all journal entries, reconcile the adjusted balances with the monetary establishment assertion to verify consistency between the company’s knowledge and the monetary establishment’s knowledge. Study the reconciled balances to determine any remaining discrepancies which would require extra investigation or adjustment.

- Consider and Confirm: Consider the completed monetary establishment reconciliation and journal entries to substantiate accuracy and completeness. Confirm that all discrepancies have been addressed and resolved appropriately. Preserve thorough documentation of the reconciliation course of for future reference and auditing capabilities.

Streamlining Monetary establishment Reconciliation with Nanonets Automation

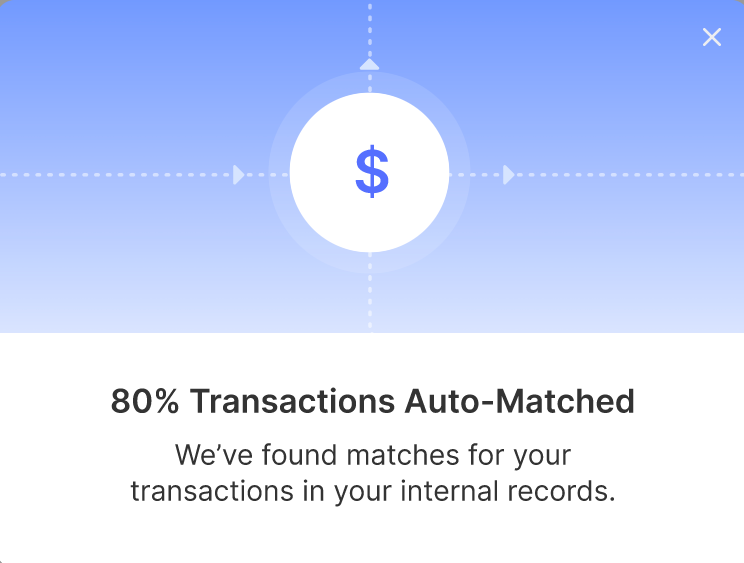

Nanonets can enhance the effectivity and accuracy of the bank reconciliation course of by automating the creation of journal entries. That is how Nanonets will assist.

- Information Extraction: Nanonets makes use of superior optical character recognition (OCR) know-how to extract associated data from monetary establishment statements, along with transaction particulars harking back to dates, portions, and transaction varieties.

- Integration with Accounting Software program program: Nanonets seamlessly integrates with trendy accounting software program program strategies, harking back to QuickBooks or Xero. This integration permits extracted info to be routinely transferred into the accounting software program program, eliminating the need for handbook info entry.

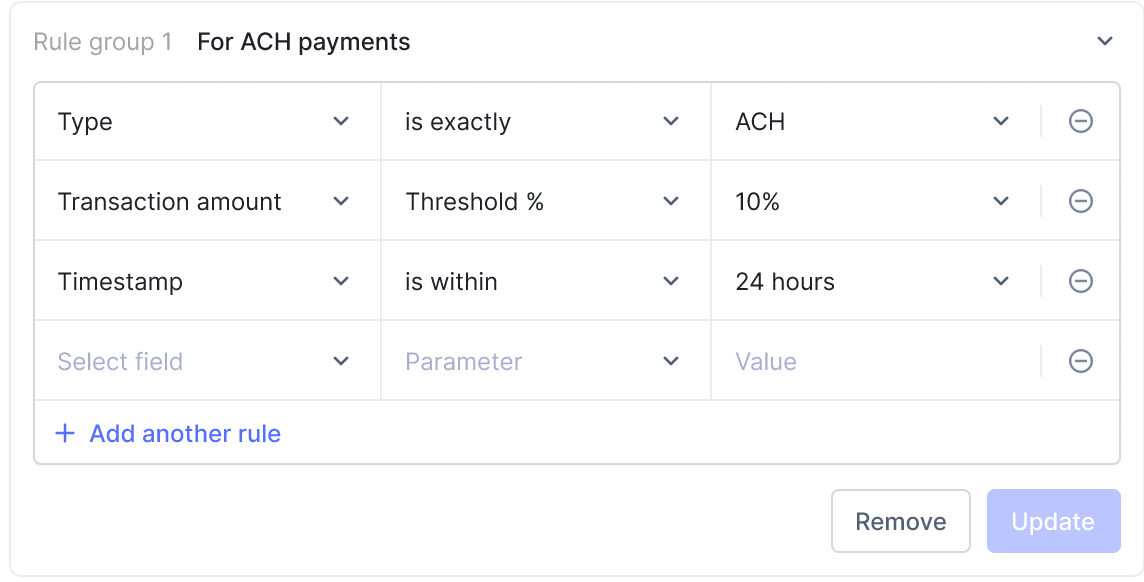

- Rule-based Classification: Nanonets employs machine finding out algorithms to classify transactions based totally on predefined pointers. As an example, it’d in all probability distinguish between deposits, withdrawals, monetary establishment costs, and curiosity earned, guaranteeing right categorization of transactions.

- Automated Journal Entry Know-how: As quickly as transactions are categorised, Nanonets routinely generates journal entries based totally on predetermined pointers and mappings. It debits and credit score the appropriate accounts, streamlining the journal entry creation course of.

- Customization and Flexibility: Nanonets presents customization selections to tailor the automation course of to the actual needs of the enterprise. Clients can define pointers, mappings, and approval workflows based mostly on their accounting practices and preferences.

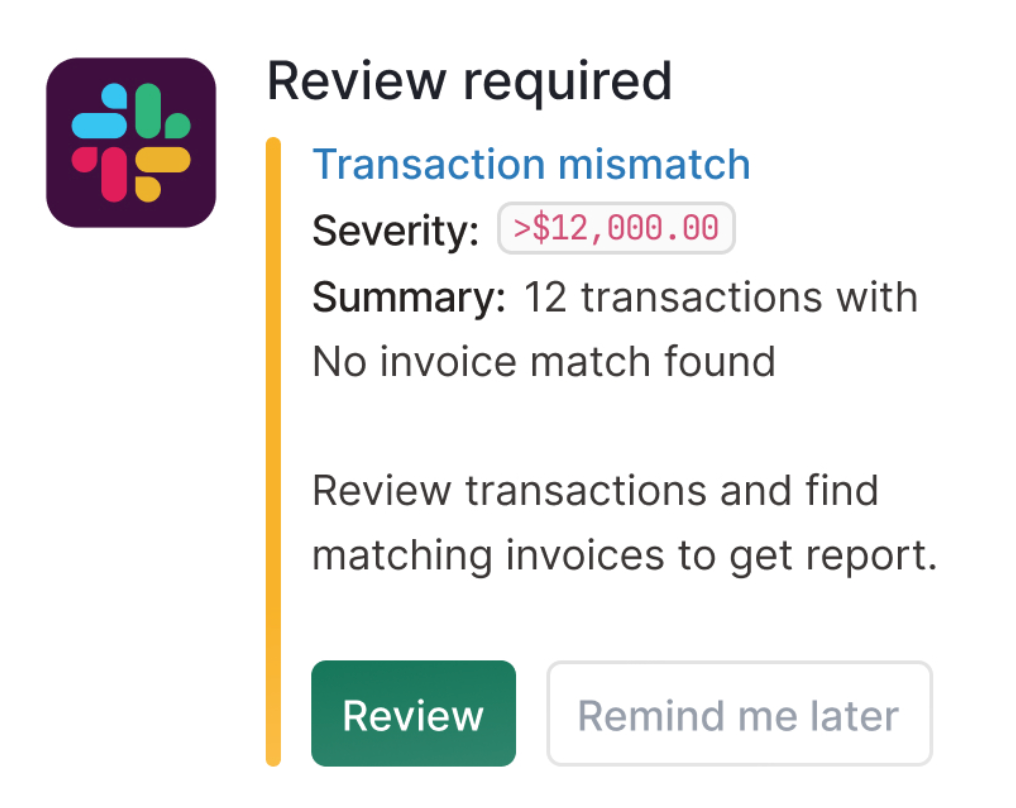

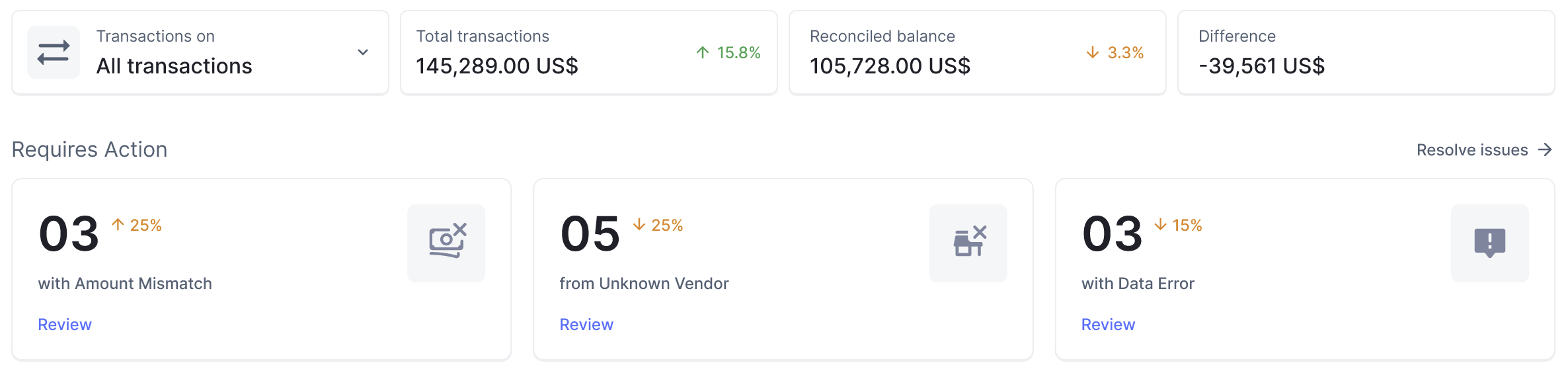

- Precise-time Updates and Alerts: Nanonets offers real-time updates and alerts on reconciled transactions, discrepancies, or exceptions. This enables properly timed resolution of factors and ensures that the reconciliation course of stays setting pleasant and up-to-date.

- Audit Path and Compliance: Nanonets maintains an entire audit path of all automated journal entries, providing transparency and accountability. This helps corporations modify to regulatory requirements and facilitates audit processes.

- Regular Enchancment: Nanonets leverages machine finding out capabilities to always research from client strategies and data patterns, enhancing accuracy and effectivity over time. This iterative technique ensures that the automation course of evolves to fulfill altering enterprise needs.

Take Away

The monetary establishment reconciliation journal helps in sustaining financial integrity. By efficiently reconciling agency knowledge with monetary establishment statements and utilizing devices like Nanonets for automation, corporations can streamline operations, cut back handbook effort, and reduce errors. With right and up-to-date financial knowledge, companies may make educated selections, modify to regulatory requirements, and drive sustainable progress.