Sage Intacct, a world-renowned ERP resolution, is among the high selections for companies globally. Finance groups and plenty of others use it to facilitate their operations.

In at present’s fast-paced enterprise atmosphere, it is important to streamline operations and maximize effectivity. That is very true for the accounts payable (AP) division, which manages an organization’s monetary obligations to suppliers.

Enhancing the effectivity of the Accounts Payable (AP) course of is a strategic initiative for companies, because the complicated and resource-intensive work is unsustainable, difficult to scale, and liable to error.

Automation in accounts payable refers to utilizing software program to digitize, streamline, and optimize the end-to-end strategy of managing payables. It addresses the challenges of conventional processes by decreasing handbook

intervention, dashing up processing occasions, and enhancing visibility. On this weblog, we’ll talk about Sage Intacct, particularly for finance groups, and the way Account Payable Automation (APA) is the subsequent step to enhancing the method.

Sage Intacct: The cloud-based ERP

Sage Intacct, a world-renowned ERP resolution, ranks among the many high selections for companies globally. Sage Intacct serves clients throughout industries and geographies, primarily in North America. Whereas appropriate for enterprises, Sage Intaccts’ distinction and power lie within the Small-Medium Enterprise (SMB) market.

Sage Intacct is an AICPA-endorsed, HIPAA-compliant cloud accounting system. Its capability to rapidly ‘tag’ your transactions and operational knowledge with dimensional values is a singular distinction of Sage Intacct.

This is how Sage Intacct can energy your monetary groups :

- Account Payable / Receivable: eliminates inefficiencies and will get you paid quicker.

- Multi-Entity Insights: Intacct empowers rising multi-entity companies with precious insights for readability and enhanced effectivity

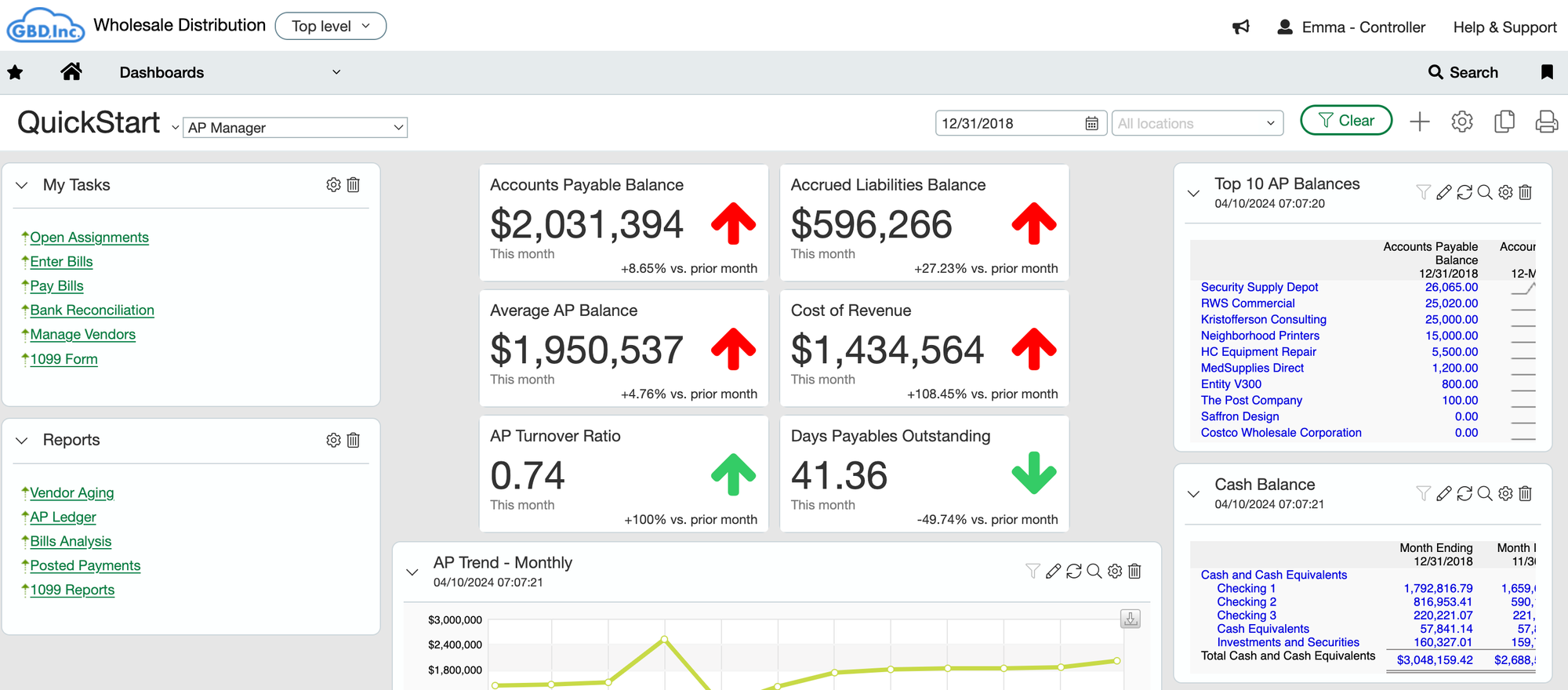

- Dashboard & Insights: Flip knowledge into insights and attain peak efficiency with wealthy, versatile, real-time monetary reviews and customizable dashboards.

Understanding Accounts Payable (AP)

Accounts payable, or AP is the sum of money a enterprise owes to its distributors for items or providers which have been delivered however haven’t been paid. The AP division is liable for preserving a detailed file of invoices, guaranteeing that funds are processed precisely and on time, and sustaining detailed monetary data.

Sage Intacct powers the Accounts Payable staff with insights. It additionally allows payments, reconciliation, and different related duties.

Historically, AP workflows contain a considerable quantity of handbook effort. This is a breakdown of a typical handbook AP course of:

- Bill Reception: Invoices arrive from distributors by way of varied channels, together with electronic mail, mail, and fax.

- Information Entry: Guide knowledge entry includes keying bill particulars like vendor identify, bill date, bill quantity, and due date into the accounting software program. This repetitive process is liable to errors.

- Approval Workflow: Invoices are routed to designated personnel for approval based mostly on pre-defined standards, typically involving bodily paperwork and handbook routing.

- Fee Processing: As soon as permitted, funds are manually initiated by checks or ACH transfers.

- Recordkeeping: Invoices and fee data are meticulously filed for future reference and audit functions.

The handbook AP course of may very well be extra lively, weak to human error, and labor-intensive. Account Payable Automation or APA turns into essential to digitize, streamline, and optimize

Account Payable Automation with Sage Intacct

Sage Intacct provides two principal methods to automate your accounts payable (AP) course of:

- Sage Intacct AI: Sage has a built-in AP automation characteristic with AI capabilities. This is what it may well accomplish

- Add an bill, and Sage can seize knowledge from the bill

- It additionally flags any duplicate invoices

- Third-party AP Automation Integrations: Sage Intacct boasts of a variety of integration and expertise companions, some of their Market. They provide options with a wider vary of functionalities, together with:

- Correct capturing of Bill knowledge from varied sources

- Two/Three method matching for Buy Orders

- Approval guidelines and workflows

- Fee Integrations

Nanonets: Your AP Automation Champion

Nanonets is a strong AP automation resolution that leverages the magic of Synthetic Intelligence (AI) to streamline bill processing.

Trusted by over 10,000+ manufacturers, Nanonets is a Sage Intacct Market Companion with best-in-class bill recognition and AI software program for correct recognition and processing of AP

This is a glimpse into how Nanonets automates the AP workflow:

- Automated Bill Receipts: Importing invoices into Nanonets from a number of sources is one of the best at school

- Automated Information Entry: Nanonets extracts structured knowledge out of your invoices, regardless of the bill format and whether or not the bill is scanned or digital.

- Automated Verification: Two-way matching and past. Match bill data in opposition to open Buy Orders, Supply Notes, and different AP paperwork.

- Multi-stage Approval routing: Send automated notifications to the suitable individual within the group to overview invoices earlier than approval.

- Actual-time syncing: Import your Sage chart of accounts and create guidelines to code paperwork out of your Distributors.

By automating these crucial duties, Nanonets considerably reduces handbook effort, minimizes errors, and expedites the AP course of, permitting your staff to deal with extra strategic endeavors.

Unleashing the Energy of Integration

Integrating Nanonets with Sage Intacct unlocks many advantages for companies of all sizes. Listed below are a few of the most compelling benefits:

- Lowered Effort: Nanonets automates bill processing, liberating up your AP staff.

- Enhanced Accuracy: Integration reduces errors and ensures knowledge integrity.

- Quicker Processing: Automate duties for faster approvals and funds.

- Elevated Visibility: Achieve insights with real-time dashboards.

- Improved Compliance: Ensures a streamlined and auditable AP course of.

Integrating Nanonets with Sage Intacct can automate and optimize accounts payable operations. This mix can streamline the AP course of, cut back prices, and empower the staff to deal with extra strategic initiatives.

Taking the First Step In direction of AP Automation

Nanonets automate accounts payable, driving effectivity, accuracy, and a strong monetary course of. Leverage AI and machine studying to steer in monetary administration. Remove errors, automate duties, and seamlessly combine AP. See how Nanonets tailors options with a free demo. Step into the way forward for finance with Nanonets.