Constructing on the insights from Half 1, this text delves deeper into the transformative potential of superior AI-driven programs in fostering financial stability and guaranteeing sturdy shopper safety. By leveraging refined machine studying (ML) and synthetic intelligence (AI) strategies, this technique not solely enhances monetary safety but additionally meticulously assesses mortgage eligibility based mostly on employment standing, mortgage goal, and monetary standing. Future enhancements promise to harness massive knowledge and cloud computing to supply superior suggestions, additional empowering people to reinforce their monetary capability and entry greater loans.

Following our exploration of fraud detection and monetary safety in Half 1, we now flip our consideration to how superior AI and ML applied sciences can additional contribute to financial stability and sturdy shopper safety. This method leverages detailed knowledge on employment standing, mortgage goal, and monetary standing to supply correct and customized assessments of mortgage eligibility, making monetary providers extra environment friendly, dependable, and equitable.

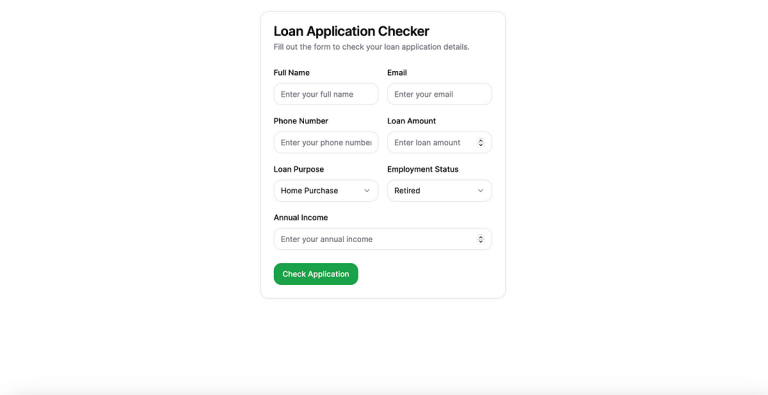

Under is the entire code driving this transformative AI system, showcasing its full performance and demonstrating the way it assesses mortgage purposes and offers suggestions:

schema: loanApplicationResponseSchema,

});

for await (const partialObject of partialObjectStream) {

stream.replace(partialObject);

}]

stream.completed();

})();

return { object: stream.worth };

}

Financial Stability

As a Fullstack developer dedicated to leveraging know-how for financial resilience, I designed this technique to assist financial stability by analyzing varied knowledge factors, together with employment standing and monetary standing. This evaluation offers a complete evaluation of mortgage eligibility, guaranteeing that solely certified candidates obtain loans, thereby sustaining the monetary well being of each lenders and debtors.

Shopper Safety

A cornerstone of this AI system is its concentrate on shopper safety. By offering customized suggestions on mortgage purposes, the system helps candidates perceive their eligibility standing and affords insights into bettering their monetary standing. This transparency fosters belief and ensures customers are well-informed of their monetary selections.

The way forward for this AI system lies within the integration of massive knowledge and cloud computing. By leveraging intensive datasets and highly effective cloud engines, the system will supply much more customized monetary suggestions. For example, it may counsel job alternatives to enhance employment standing or present tailor-made recommendation on monetary administration to reinforce mortgage eligibility. These superior options will empower customers to take management of their monetary futures, entry greater loans for varied functions, and contribute to total financial stability.

By combining superior AI and ML strategies with complete knowledge evaluation, this technique represents a major development in monetary providers. It not solely addresses the urgent points of economic insecurity, financial instability, and shopper safety but additionally paves the best way for a future the place people are empowered to make knowledgeable monetary selections and enhance their monetary standing. That is just the start; the mixing of massive knowledge and cloud computing will additional improve the system’s capabilities, providing much more profound insights and suggestions. Keep tuned for extra updates as we proceed to refine and broaden this transformative AI-driven answer.