Within the ever-evolving actual property market, precisely figuring out property values is a posh problem. Conventional valuation strategies usually fall brief in capturing the nuanced and dynamic nature of actual property. That is the place superior machine studying methods, like Self-Organizing Maps (SOM), come into play. SOMs present a complicated method to visualizing and analyzing advanced knowledge, making them significantly appropriate for actual property valuation.

What are Self-Organizing Maps?

Self-Organizing Maps, launched by Teuvo Kohonen, are a kind of synthetic neural community skilled utilizing unsupervised studying to supply a low-dimensional, discretized illustration of the enter area (Kohonen, 2001). They’re extensively used for clustering, visualization, and abstraction of high-dimensional knowledge.

“Self-Organizing Maps (SOM) are a kind of synthetic neural community which are skilled utilizing unsupervised studying to supply a low-dimensional illustration of the enter area.” (Kohonen, 2001)

Software of SOM in Actual Property

In actual property, SOMs can deal with giant, spatially distributed datasets, uncover hidden patterns, and supply priceless insights for property valuation (Hagenauer & Helbich, 2022). As an illustration, SOMs can cluster properties primarily based on traits equivalent to location, measurement, and age, serving to to establish tendencies and outliers out there.

“Self-Organizing Maps are significantly helpful in actual property valuation for his or her capability to deal with giant, spatially distributed datasets and reveal underlying patterns.” — Hagenauer, J., and Helbich, M. (2022).

Introducing SOMantic: Revolutionizing Actual Property Valuation in Germany

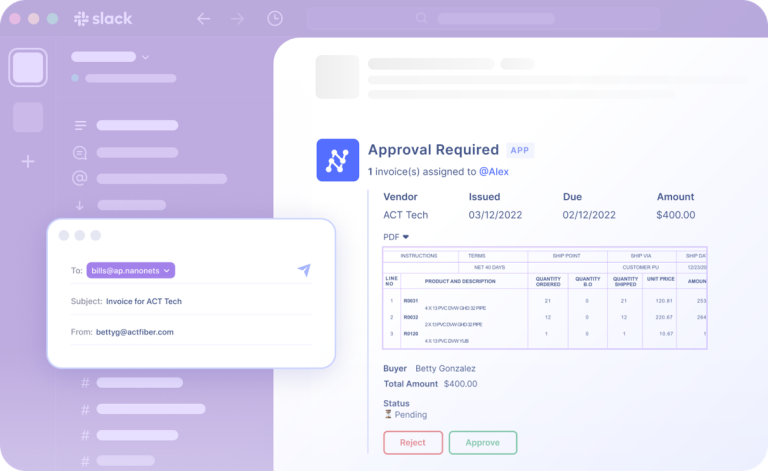

To leverage the facility of SOMs, we (Kretronik GmbH) developed SOMantic, an actual property crawler and aggregator designed to streamline property search and valuation in Germany. Somantic aggregates listings from all main actual property platforms, offering customers with a single, complete platform to search out properties. Customers can save their filters and obtain real-time notifications by way of Telegram and/or e-mail when new properties matching their standards are listed, giving them a aggressive edge in contacting sellers first.

How Somantic makes use of SOM for Property Valuation

Somantic employs SOMs to calculate the Return on Funding (ROI) and money movement of properties by modeling their worth and hire. The method entails the next steps:

- Knowledge Aggregation: Somantic crawls and aggregates knowledge from varied actual property platforms in Germany.

- Function Extraction: Key options equivalent to latitude, longitude, sq. meters, room depend, and age of the property are extracted.

- SOM Coaching: These options are used to coach the SOM, which clusters comparable properties collectively.

- Worth and Lease Modeling: For a given property, Somantic identifies the very best matching unit (BMU) throughout the SOM. The typical worth and hire of properties on this BMU are calculated to estimate the market worth.

“The Self-Organizing Map (SOM) algorithm provides a novel method to visualizing high-dimensional knowledge by its topology-preserving mapping.” (Kohonen, 2013)

Through the use of comparable properties in a node for valuation, Somantic ensures that the estimated worth and hire are reflective of the present market situations.

Property Valuation in Munich use case

Within the screenshot beneath we will analyze the market worth and the ROI for a 96.19m² property in Munich. We can also see comparable hire and promote properties on a map which might help us in our choice making.

For buyers a very powerful metrics are money movement and the ROI of the property. The ROI is calculated by dividing the estimated yearly hire by the worth of the property. On this case we assume our hire earnings per 12 months is 22.331,28 € (= 1.860,94€ * 12 which is estimated by the SOM) and divide it by the precise worth of 1.299.000 € in order that we get 1,72% (22.331,28 €/1.299.000 €). To be worthwhile the rule of thumb is to have a minimum of 5% which on this case makes the property a nasty funding and thus can shortly be filtered out.

What in regards to the money movement?

To calculate the money movement we’re making three assumption which may be modified by the consumer:

- Fairness: How a lot of the worth can I pay myself plus the closing prices? In Germany when making use of for a mortgage with a financial institution it’s common to pay the closing prices out of your personal pocket. Right here we assume we paid the closing prices + 20% of the worth (259.800 €). Meaning we have to borrow “solely” 1.039.200 € from the financial institution.

- Curiosity Charge: The present rates of interest in Germany are nonetheless rising however right here we assume 3% for long run contracts.

- Compensation Charge: For the compensation fee we assume the traditional 2% fee.

Meaning if we borrow 1.039.200 € we have to pay the financial institution 51.960 € (=1.039.200 € * 5%) per 12 months or 4.330 € / month. There’s additionally the price of the upkeep worth of which 40% the proprietor pays and 60% the renter which for a 96.19m² condo could be round 173,14 € (=96.19m²*4,5€*40%) monthly. The upkeep price for an condo is all the time one thing in between 3€ — 4,5€ per sq. meter. That leads us to a money movement of -2642,20€ (=1860,94€-4.330€-173,14€) which is unfavorable. We should always solely purchase properties with constructive money movement meaning we should always modify our parameters (enhance our fairness proportion), negotiate a smaller worth or seek for one other worthwhile condo.

Benefits of Utilizing SOMantic

- Complete Aggregation: Entry all actual property listings in Germany on one platform.

- Actual-Time Notifications: Keep forward with instantaneous updates on new listings.

- Correct Valuation: Profit from superior SOM-based fashions for exact property valuation.

- Funding Insights: Calculate ROI and money movement to make knowledgeable funding selections.

Conclusion

The mixing of Self-Organizing Maps by SOMantic in actual property valuation ought to add transparency to the business and simplify quick choice making. By leveraging SOMs, Somantic not solely aggregates listings but in addition provides exact valuation and funding evaluation, making it a useful gizmo for patrons and sellers.

For extra data, go to Somantic and discover the way it can remodel your actual property expertise. Check out the worth and hire estimation your self:

References:

- Kohonen, T. (2001). Self-Organizing Maps.

- Nguyen, T. V., & Cripps, A. (2001). Predicting Housing Worth: A Comparability of A number of Regression Evaluation and Synthetic Neural Networks. Journal of Actual Property Analysis, 22(3), 313–336.

- Kohonen, T. (2013). Necessities of the Self-Organizing Map. Neural Networks, 37, 52–65.

- Hagenauer, J., & Helbich, M. (2022). A Comparative Examine of Machine Studying Classifiers for Modeling Spatial Knowledge. ISPRS Worldwide Journal of Geo-Info, 11(1), 1–26.

- Bação, F., Lobo, V., & Painho, M. (2005). The Self-Organizing Map, the Geo-SOM, and related variants for geosciences. Computer systems & Geosciences, 31(2), 155–163.

- Kohonen, T. (1995). Self-Organizing Maps and their Functions. Neural Networks, 8(3), 477–493.

- Hamnett, C. (1991). The Blind Males and the Elephant: The Clarification of Gentrification. Transactions of the Institute of British Geographers, 16(2), 173–189.