Why is it Necessary to Reconcile your Financial institution Account?

Reconciliation is an important accounting course of that ensures the accuracy of the financial close process. It ensures that the cash credited or debited in your checking account matches the cash being expended or made.

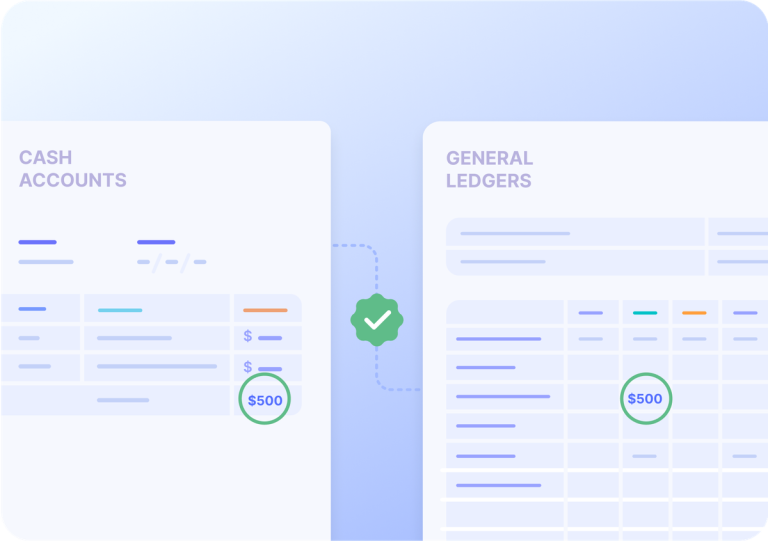

Reconciling the financial institution assertion entails evaluating the corporate”s inside monetary information or ledger to the financial institution assertion obtained through the financial institution. Bank reconciliation is crucial because it helps within the early detection of fraud, prevents monetary assertion errors throughout handbook knowledge entry, and supplies a clearer image of the corporate’s funds.

Key takeaways:

- Financial institution reconciliation is the transaction matching of your information in opposition to the financial institution assertion.

- Financial institution reconciliation is completed to identify variations between the 2 information, confirm the transaction quantities, and make the mandatory changes.

- In discrepancies, the finance controller should be concerned in additional investigation.

- Financial institution reconciliation will help guarantee the corporate’s correct monetary reporting when carried out often.

Financial institution Reconciliation Definition

Financial institution Reconciliation is the method of matching every steadiness on the accounting information to the steadiness famous on the financial institution assertion. Normally, the balances reported on each information will differ barely. There are a number of explanation why these differences occur (which we’ll focus on later), and financial institution reconciliation helps make the mandatory changes in order that the accounts align and correct monetary reporting will be achieved.

The aim of financial institution reconciliation is to:

- Determine accounting errors reminiscent of duplicate funds, misplaced checks, and different human-made errors throughout knowledge entry.

- Stop fraud by flagging unrecorded transactions and immediate investigation.

- Determine financial institution errors like unauthorized charges and incorrect transactions recorded.

- Present transparency into money flows (inflows and outflows) to enhance the general effectivity of monetary administration. Figuring out your precise monetary place means that you can make knowledgeable choices.

How Usually Ought to You Reconcile Your Financial institution Statements?

Financial institution reconciliation needs to be carried out often, with the frequency relying on transaction volumes and enterprise wants. Accounting groups ought to typically reconcile their financial institution statements a minimum of as soon as each month since addressing discrepancies, and errors can show problematic if the changes are usually not made correctly in time.

- Small companies or people have transaction volumes on the decrease finish. They will profit by reconciling their financial institution statements month-to-month.

- Giant companies have excessive transaction volumes, and reconciling the financial institution statements on the finish of the month can result in human mishaps and errors. These companies can carry out weekly or each day reconciliations to watch money flows and deal with abnormalities carefully.

After the financial institution assertion reconciliation, it’s prudent to often verify the quantities being credited and debited from the account. This can assist spot fraudulent actions and flag discrepancies, if any.

How do you reconcile your financial institution assertion?

Earlier than we take you thru the method of carry out financial institution reconciliation, there are some important phrases that you ought to be conscious of

Excellent Checks:

These are funds that the corporate has despatched out and recorded however haven’t but been cleared by the financial institution. Equally, checks obtained by the enterprise however have not but hit the account need to be adjusted accordingly.

Money-In Transit:

The money may not instantly replicate within the checking account when funds are transferred through bank card funds or wire transfers. We have to make the right changes right here as nicely.

Financial institution curiosity and repair charges:

Banks deduct costs for companies rendered (usually comparatively small), which should be adjusted accordingly for correct reconciliation. Equally, banks pay curiosity on financial institution accounts, which should be accommodated accordingly.

Financial institution reconciliation entails matching the cash within the financial institution vs the precise money mirrored within the cashbook. Right now, reconciliation is primarily automated by way of software to save lots of money and time. Nonetheless, let’s perceive the handbook financial institution reconciliation course of as soon as:

Step 1: Collect paperwork

On the financial institution aspect, you want the financial institution statements, excellent checks, deposits, and any pending transactions. On the corporate aspect, you require the corporate’s cashbook, which information each incoming and outgoing transactions.

Step 2: Match deposits

Following double-entry accounting, a debit within the financial institution assertion is recorded as a credit score within the cashbook, and vice versa. Match the deposits within the two statements.

Observe: Financial institution and cashbook balances are typically not anticipated to match as a consequence of pending transactions, reminiscent of excellent checks or deposits in transit. They need to be adjusted as proven within the following steps.

Step 3: Alter financial institution steadiness

The discrepancy within the two balances must be recognized and checked on a person transaction foundation. Financial institution statements should be adjusted by including pending deposits (deposit-in-transit) and deducting pending outgoing checks (excellent checks). The logic right here is:

Financial institution Steadiness + Deposits-in-transit – Excellent Checks = Adjusted Financial institution Steadiness

Step 4: Alter cashbooks

The cashbook steadiness wants adjustment for financial institution service charges, accrued curiosity, and rejected checks (NSF Checks). The logic right here is:

Cashbook Steadiness + Curiosity – Financial institution Charges – Rejected Checks = Adjusted Cashbook

Step 5: Examine Steadiness

After adjustment, the financial institution steadiness and cashbook ought to match. If they don’t seem to be equal, there’s an error within the reconciliation course of. Any unwarranted bills or lacking revenue needs to be investigated and accounted for in the course of the reconciliation course of.

Financial institution Reconciliation Course of

Step 1: Collect Paperwork

Financial institution Statements

Firm Cashbook

Step 2: Match Deposits

Step 3: Alter Financial institution Steadiness

Financial institution Steadiness + Deposits-in-transit – Excellent Checks = Adjusted Financial institution Steadiness

Step 4: Alter Cashbooks

Cashbook Steadiness + Curiosity – Financial institution Charges – Rejected Checks = Adjusted Cashbook

Step 5: Examine Steadiness

Implications of Failing to Reconcile Your Financial institution Assertion

A number of points might come up if the variations between your information do not match.

Inaccurate Monetary Reporting:

The accounting group can’t precisely replicate the corporate’s money place with out common reconciliations. This could result in poor monetary decision-making, incorrect monetary statements, and errors in the course of the tax submitting course of.

Poor Money-Move Administration:

Unresolved discrepancies may cause points within the firm’s money stream. With out this perception, accounting groups would possibly ignore missed funds, excellent invoices, and so on.

Elevated Danger of Fraud:

For instance you are attempting to reconcile your financial institution assertion by checking the transactions on the bank card assertion in opposition to the receipts. You would possibly ignore these transactions if there aren’t any paper receipts as a result of the transaction quantities are low. Nonetheless, in case you are diligent, you could dispute the portions with the bank card firm and be taught that the bank card info was revealed and {that a} legal is making the costs. On this case, you had been capable of detect fraud and cancel the bank card due to the reconciliation apply.

Pricey Errors:

Overstatements or understatements of income, bills, or belongings as a consequence of unreconciled accounts can result in inflated earnings, incorrect tax filings, and monetary penalties.

In abstract, neglecting to reconcile your financial institution statements often can lead to inaccurate monetary information, money stream issues, elevated fraud threat, reputational harm, and expensive accounting errors. Performing well timed reconciliations is a necessary inside management to take care of the integrity of your monetary knowledge.

Leverage Nanonets for Financial institution Assertion Reconciliation

Staying on prime of reconciling your financial institution assertion often will be difficult but crucial for accounting groups worldwide. The financial institution assertion reconciliation apply is very handbook and would not scale nicely when the quantity of transactions and the frequency of reconciliation improve.

To handle this drawback, Nanonets has developed an automatic reconciliation software program answer that helps with satisfactory and correct reconciliations and scales with the elevated quantity of transactions.

To be taught extra about our answer, you’ll be able to verify our product providing at Nanonets Automated Reconciliation or schedule a name with our reconciliation knowledgeable right now.