Have you learnt that processing an expense report for an in a single day resort hold can take as a lot as 20 minutes and worth a median of $58?

According to a GBTA report, out-of-pocket costs an employee has paid expense tales includes errors or missing data, costing an additional $52 and 18 minutes to applicable each.

Now take into consideration all the a number of of payments and tales staff file, and film the helpful useful resource drain it might very nicely be costing you.

Sooner than we uncover the world of payments and reimbursements, it’s necessary to understand expense claims.

What’s an expense declare?

An expense declare is a correct request by an employee to be reimbursed for enterprise payments incurred by staff on behalf of the company.

These might very nicely be journey payments, meals, office offers, or one other out-of-pocket costs an employee has paid for enterprise features.

The employee initiates the reimbursement request using an expense declare form or an expense report.

What qualifies as a declare?

Whether or not or not the enterprise expense shall be claimed or reimbursed relies upon the following parts:

Compliance with IRS suggestions

The IRS has a simple rule about what counts as a legit enterprise expense.

It should be extraordinary and important.

Unusual means it's frequent and accepted in your self-discipline of labor, whereas important means it's helpful, relevant, or applicable to your company. This enterprise expense does not ought to be required to be thought-about important.

Adherence to the company’s expense protection

An expense reimbursement protection is a rulebook for enterprise spending. Solely payments that adhere to this protection are thought-about reimbursable.

Expense class

Each agency has a set of predefined expenditure courses that staff need to grasp sooner than submitting their expense claims for reimbursement.

These claims can depend on permitted expense courses, comparable to journey payments, office offers, meals and leisure payments, and lots of others.

Take into accout to note the exclusions, corresponding to personal leisure (e.g., alcohol), penalties, and lots of others.

Proof of expense

Every expense declare must be substantiated with proof of expense inside the kind of a receipt, invoice, or one other associated doc.

This proof ought to consider all the associated particulars, such as a result of the expense date, amount of expense, vendor/service supplier particulars, and lots of others.

Types of payments that could be claimed

The frequent expense courses that could be claimed are:

Journey payments

Employees on enterprise journeys ought to spend on airfare, resorts, rental automobiles, toll charges, gas, and lots of others. These all fall beneath journey payments.

Meals and leisure payments

These embrace payments like meals with potential purchasers or on-site staff and tickets to a networking event.

Office payments

Operational payments, like daily office offers, stationery, net funds, and lots of others, fall beneath this class.

Miscellaneous payments

Whereas the most common courses of payments are journey, meals and leisure, and office-related operational payments, totally different costs are included beneath miscellaneous payments.

These embrace sudden costs like emergency repairs or licensed prices, which are not part of the widespread operations nonetheless are important for the enterprise.

Proper right here is an exhaustive itemizing of expense courses employers can use to classify employee payments for enterprise features.

Strategies to generate an expense declare

Companies can allow staff to claim reimbursements for business-related payments using fully totally different modes:

Receipts

In most likely essentially the most typical expense declare course of, staff who make out-of-pocket payments save expense receipts from business-related purchases and submit these as proof. The claimant is lastly credited with an equal amount of their expense account.

Financial institution card statements

If the company affords a enterprise financial institution card, payments shall be tracked instantly from the cardboard assertion. Such firm financial institution playing cards present useful and are generally given to solely certain staff, comparable to product sales representatives and staff in administration positions.

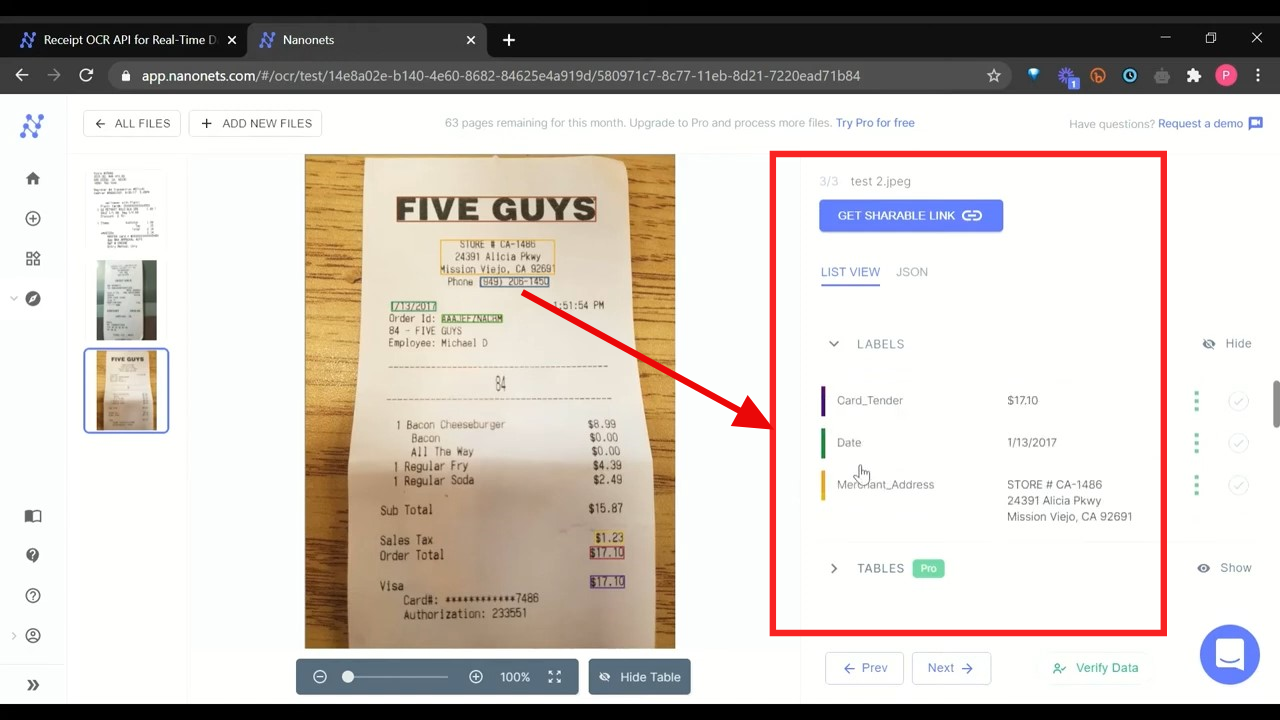

OCR-enabled cell apps

Many firms now use OCR-enabled expense administration apps that allow staff to snap a picture of their receipt and submit it instantly.

Per diem allowances

In some circumstances, firms might current a per diem daily allowance for staff to cowl their meals and commuting payments. Any spending previous this allowance would ought to be claimed individually.

The entire above methods have execs and cons, and your only option normally relies upon the size and needs of your company.

Expense declare course of

The expense declare course of can look fully totally different for numerous corporations. Typically, it consists of the following steps:

Expense incurrence

An employee incurs an expense. It might very nicely be an out-of-pocket expense for which the employee needs to avoid wasting a number of the invoice or proof of purchase.

Producing an expense declare

Smaller corporations typically ask staff to utilize an employee expense declare form for reimbursement.

Enterprises generally use an expense administration system that allows staff to generate periodic expense tales and submit them for approval.

Getting approval

As quickly because the expense declare form/expense report is submitted, the supervisor approves or denies the declare, counting on its legitimacy. Solely the reimbursable payments are despatched to the finance division for extra processing.

Finance verification

As quickly because the supervisor approves the employee expense declare, it is extra despatched to the finance group for verification.

Reimbursement

As quickly because the expense declare is verified and permitted by all important stakeholders, the finance division initiates the reimbursement counting on the mode of charge as per the company’s expense reimbursement protection.

Bookkeeping and documentation

The finance group moreover ensures the knowledge entry of all such payments and retains observe of all such expense tales. All such tales, along with proofs, are recorded.

Challenges inside the expense declare course of

Time-consuming information info entry

The tedious and extended info entry course of is a huge drawback for corporations that observe the traditional expense declare course of.

Employees waste treasured time discovering and manually stepping into particulars of each purchase, which regularly leads to many inaccuracies.

Monitoring proofs of purchase

All through enterprise journey, staff are pressured to avoid wasting a number of paper receipts. Many misplaced receipts can hinder bookkeeping. With out such proof, staff can’t declare reimbursements, which ends up in a poor employee experience.

Typically, staff intentionally inflate costs by submitting defective or duplicate receipts. With out right checks in place, expense monitoring can grow to be expensive for corporations.

No real-time spend analytics

Standard information expense declare processes do not exactly give real-time visibility of employee spend. In consequence, finance teams can’t monitor spending patterns and optimize costs on the correct time.

Lack of workflow automation

A simple expense declare course of requires quick approvals. With out delegation and workflow automation, staff and managers get caught in infinite loops of e mail trails and follow-ups, leading to prolonged reimbursement cycles.

Protection non-compliance

Adherence to expense protection is important for environment friendly spend management. With out compliance checks, instances of expense and charge fraud enhance.

Ensuring such protection compliance is troublesome and often leads to auditory challenges when corporations observe information, paper-based expense declare processes.

10 steps to simplify the expense declare course of

Leaky expense declare processes typically is a sluggish, silent killer to your agency funds. Listed beneath are some strategies you presumably can streamline your declare course of.

Assemble a corporation expense protection

A corporation expense protection is the rulebook of expense reimbursements and is a ought to for a simple declare course of.

Arrange clear suggestions and level out the eligibility for reimbursement requests inside the protection. Assure this protection is periodically revisited and updated to align with tax guidelines and your staff’ needs.

Discuss this protection efficiently to your staff via emails, employee onboarding processes, teaching intervals, and bulletins. This will lower potential and future disputes and save everyone time.

Categorize your employee payments

Categorize all of your company payments clearly in your group expense protection and suggestions.

Earlier, we seen the 4 broad courses of payments: journey, meals and leisure, office payments, and miscellaneous payments.

Study further about how to categorize business expenses.

Digitize and arrange receipts

Employees ought to arrange and observe receipts and proofs of payments for a hassle-free expense declare.

Digitization of this course of using receipt scanner apps or expense administration devices with OCR-based functionalities can reduce staff' workload. This moreover ensures right documentation and minimizes the possibility of shedding receipts.

Go for paperless expense reporting

Employees submit paper-based expense declare varieties with bodily funds and receipts inside the typical expense declare course of.

Switch away from paper-based processes to digital-based reporting or superior expense reporting devices and streamline your expense reporting course of.

Analyze employee spending patterns

Repeatedly analyze your staff’ spending patterns. Many cost-optimization alternate options lie hidden and often go unnoticed as corporations ignore employee expenditures.

By reviewing expense info using analytical devices, CFOs can improve budgeting and obtain a fowl' s-eye view of missed monetary financial savings. Analyzing this info is essential to setting the becoming benchmarks and aims.

Have sturdy authorization and approval workflows

Set strict deadlines for expense approvals counting on the authorization required. These assure a seamless and nicely timed reimbursement course of for staff.

Properly-defined approval workflows moreover assure no fraudulent claims go via the cracks. Cowl all grounds by considering all approvers based not solely on teams, grades, and portions however as well as on deviations and exceptions.

This can be merely prepare using workflow automation devices that give real-time updates and reminders.

Implement quick reimbursements

Assure quick and nicely timed reimbursements to your staff by allowing fully totally different modes of funds and reimbursements.

Whereas some employers current up-front per diem allowances for journey meals, others choose to reimburse staff at a later date. Regardless of the mode of charge, nicely timed reimbursements are necessary for a simple declare course of.

Tax compliance

Maintain updated with IRS suggestions and totally different regional tax guidelines and licensed requirements. Companies normally face penalties for failing to regulate to guidelines related to employee expense claims.

Go for expense administration devices

Leveraging modern expense administration devices typically is a recreation changer to your group. They may improve your company effectivity and accuracy and your bottom line.

Suppose sooner reimbursements, right financial info, 100% tax, and protection compliance!

These devices can automate fully totally different processes, comparable to data capture, expense reporting, approval workflows, reimbursements, and lots of others.

When and automate your expense declare course of

Each enterprise has distinctive needs and requirements. A small enterprise might solely need an OCR instrument to grab receipt info. The rest might very nicely be managed using a spreadsheet.

A mid-sized agency might desire a further full decision. One which handles all of the issues from info seize to approval workflows to integration with accounting software program program.

Ensure you understand your requirements clearly sooner than you take into account automation.

Proper right here’s a quick rundown of the steps you presumably can observe to automate your expense declare course of:

1. Decide your needs

Resolve what it’s good to get hold of with automation — sooner processing events, diminished errors, increased compliance, or all three.

Moreover, take into consideration parts comparable to:

- The size of your group

- Your expense protection

- The quantity of expense claims you cope with

- The technical capabilities of your group

- Your worth vary

- Hurdles inside the present workflow

2. Think about obtainable choices

Evaluation {the marketplace} for obtainable expense administration choices. Seek for choices that align collectively together with your needs:

- OCR for info seize and processing

- Rule-based approvals for sooner processing

- AI-powered anomaly flagging

- Self-learning algorithms for categorizing payments

- Integration collectively together with your accounting software program program

- On-the-go expense submission

- Customizable approval workflows

- Compliance checks and alerts

- Detailed reporting and analytics

3. Choose an expense administration decision and implement it

When choosing a solution, take into consideration user-friendliness, teaching required, scalability, security measures, worth, and purchaser help.

Slender down your selections. Request a demo or a trial interval. This affords you hands-on experience with the software program program and help you determine whether or not or not it matches your company.

Once you've found the becoming decision, you presumably can implement the reply in your group. This may occasionally sometimes include:

- Follow your staff

- Defining the eligible payments, approvers, approval limits, and workflows

- Establishing the roles and system to adapt collectively together with your expense protection and guidelines

- Integrating it collectively together with your present applications (accounting, payroll, HR, and lots of others.)

4. Monitor and optimize the effectivity

Confirm the accuracy of information seize, approval events, and reimbursement events.

Study the way in which normally information intervention is required and whether or not or not the system appropriately flags anomalies. Exchange the roles and tips as important.

Moreover, maintain a observe of client solutions.

Are your staff discovering the system easy to utilize? Are they able to submit their payments and get reimbursed quickly? It’s best to make the most of their solutions to make enhancements.

Moreover, monitor the system's impression in your bottom line. Are you saving time and cash? Is the instrument serving to you administration costs and reduce fraud?

How Nanonets might assist automate your expense declare course of

Expense declare processing will get fairly a bit easier with Nanonets. You can automate the expense declare course of, from receipt seize to expense approvals and charge processing.

Here is a quick overview of how Nanonets might assist:

1. Automate info seize

Employees can add their receipts in bulk, and all the info is mechanically extracted and categorized. There is no need to fret about formatting or information info entry errors.

2. Centralize expense administration

All expense claims are saved in a single place, making monitoring, managing, paying, and auditing easy. You can merely export the parsed info as CSV or Excel info for extra analysis or reporting.

3. Work with an intelligent model

Our expense declare processing model learns out of your actions over time. This helps improve the accuracy of data extraction and categorization, making the tactic further setting pleasant over time.

4. Customise the workflows

You can prepare approval workflows that align collectively together with your agency's insurance coverage insurance policies, guaranteeing that every one expense claims endure the required checks and balances sooner than approval.

5. Robotically flag anomalies

Decide unusual expense claims based on historic info and flag them for evaluation. This helps cease fraud and protect compliance with agency insurance coverage insurance policies.

6. Mix with present applications

Seamlessly mix with finance, accounting, and totally different devices like Google Drive, Zapier, Xero, Sage, Gmail, QuickBooks, and additional. Neglect about infinite info migration and luxuriate in a simple transition.

7. Entry real-time analytics

Get insights into your spending patterns, set up traits, and make data-driven selections. Monitor your expense claims in real-time and take rapid movement when important.

8. Assure compliance

With built-in compliance checks and alerts, you presumably can make certain that all expense claims adhere to your group's insurance coverage insurance policies and guidelines. Sustaining an audit trail turns into simple, and it’s possible you’ll stay away from any potential licensed factors.

Final concepts

Managing expense claims is important to any enterprise. However, it is easy to lose observe of payments, significantly whilst you’re chasing growth and progress.

The good news is that automating the expense declare course of helps. It not solely saves you time and money however as well as retains your operations working simply.

It reduces information errors, ensures compliance, improves budgeting accuracy, and affords a clear view of your group's spending. This isn't almost worth administration — it's about making intelligent, educated enterprise selections.

Nanonets can help you on this journey by providing an intelligent, reliable, secure, and setting pleasant decision for expense declare processing. Our platform is designed to adapt to your company needs, making the shift to automated expense administration simple and painless.

Schedule a demo with Nanonets proper this second and permit us to help you streamline your expense administration.

Incessantly Requested Questions (FAQs)

Q. What are expense claims examples?

A. Journey payments (airfare, meals, in a single day resorts, cabs, and lots of others), office payments, gas and mileage, networking payments, meals, and leisure payments are a variety of the expense declare examples.

Q. What would you like for an expense declare?

A. Typically, you need an expense declare form to generate an expense declare. This type captures the small print of all payments, such as a result of the date of expense, amount, vendor/service supplier particulars, and the purpose of the expense. It’s best to moreover join all important paperwork, like receipts and invoices, as proof of costs.

In some corporations, you need to make the most of expense tales as an alternative choice to generate a reimbursement request.

Q. What’s expense declare administration?

A. Expense declare administration is the end-to-end technique of expense seize, expense declare period, approval, verification, and reimbursing the employees for these payments.

Q. Can I deduct unreimbursed employee payments?

A. In accordance with the IRS guidelines, solely a select personnel can deduct unreimbursed employee payments. This group comprises Armed Forces reservists, licensed performing artists, educators, fee-basis state or native authorities officers, or staff with impairment-related work payments.

They should use Form 2106 to calculate and report such deductible unreimbursed payments.