Managing hundreds of worker bills and reimbursement claims each day will not be straightforward for corporations.

Expense studies hyperlink workers and finance departments by permitting workers to request reimbursements and finance groups to trace bills and guarantee swift disbursements.

Let’s perceive expense reporting and the steps to create and use expense studies.

What’s an expense report?

Broadly, an expense report is an in depth listing of enterprise bills incurred by an worker on behalf of the corporate. The studies might be both bodily sheets with listed bills or digital paperwork.

Staff use these expense report kinds to assert reimbursement for enterprise bills they incurred out of their very own pockets. The workers connect receipts, invoices, and some other related paperwork of proof for the bills, and the whole quantity is often reimbursed.

Staff must file such expense studies periodically, and so they assist corporations hold monitor of worker and firm spending.

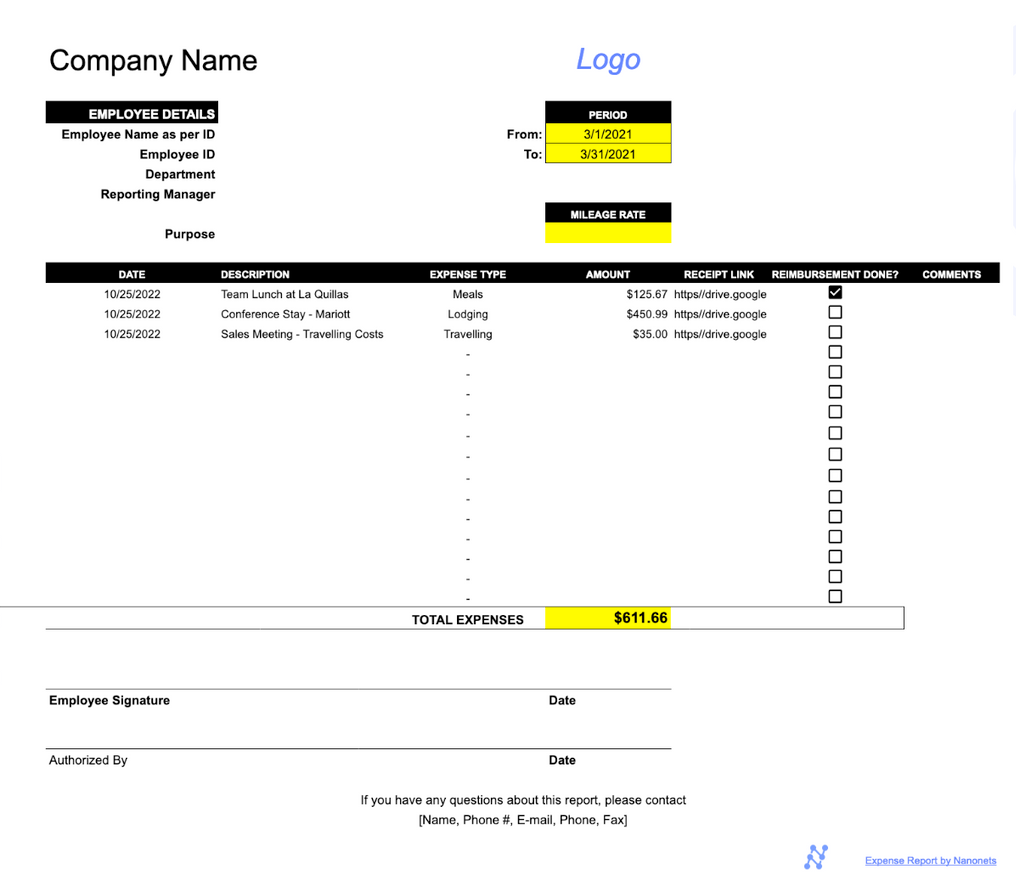

Free Expense Report Template | Nanonets

Use the free expense report template to create professional expense reports for your company.

Forms of expense studies

Staff use several types of expense studies relying on the corporate’s dimension and the frequency of enterprise bills.

One-time expense report

Because the title suggests, a one-time expense report is used for a uncommon one-time fee state of affairs. It’s mostly utilized by workers who not often incur bills.

Recurring expense report

Recurring expense studies normally look at the corporate’s month-to-month expenditures, similar to lease, wage, and utilities.

Mileage monitoring report

Staff use mileage monitoring studies to assert reimbursements after they use their private automobiles to commute to their office or for enterprise rides. These studies normally comprise a mileage log ebook and journey info, similar to the whole distance traveled, objective, locations, and so on.

Journey expense report

Generally often known as a T&E report, a journey expense report features a breakdown of all of the expenditures made by an worker for a sure enterprise journey.

Lengthy-term expense report

Firms monitor their spending by producing quarterly or annual expense studies. These periodic expense studies are broadly categorized as long-term expense studies that monitor month-to-month general spending.

These studies assist corporations visualize their spending on a selected mission, division, or value middle. In addition they assist enterprise homeowners monitor their general spending and find tax deductions for inclusion of their annual tax returns.

What ought to an expense report embody?

Worker info

The distinctive worker info is on the high of the expense report. Sometimes, that features the worker’s full title, division, and worker ID quantity.

For each expense that goes within the report, the road merchandise ought to embody the next:

Date

The date of every expense ought to match the receipt or bill hooked up to the report hooked up for proof.

Service provider or Vendor

The service provider or vendor particulars ought to be talked about for every expense.

Class and outline

The aim of the expense (e.g., airfare, meal receipt) ought to be added clearly to the expense class, together with any required description.

Whole quantity

That is the whole expense, together with the taxes. The quantity of every expense ought to completely match the receipt/bill quantity.

Instance of an expense report type

Find out how to make an expense report on Excel?

Employers can use the next steps to ascertain a swift expense reporting course of.

Select an expense report template

A easy Google search will carry tons of of expense report templates to you. You need to use our free Excel expense report template to get began.

Customise the columns

The usual ones which are a must-go in your expense studies are:

- Date

- Vendor

- Class

- Description

- Quantity

These columns ought to find widespread bills in your enterprise. You may customise these and embody extra columns to incorporate completely different expense classes.

It will allow you to itemize bills by tax class. According to the IRS, companies can declare some bills as deductions below particular classes.

Report every expense

All bills ought to be reported as particular person line objects, ideally in chronological order, with the most recent expense added on the finish.

All of the obligatory particulars ought to be stuffed in accurately, or the studies threat being flagged or rejected by the finance division.

Calculate the whole quantity

All bills ought to embody the quantity inclusive of taxes. As there are a number of expense classes, calculate subtotals for particular person expense classes as properly. It will assist enhance general spend visibility for various expense categories.

Connect proof of expenditure

Expense studies are required for many reimbursement claims. You have to connect a digital receipt/ bill wherever potential as proof of expenditure for the expense reimbursement declare.

Print/Submit the expense report

The ultimate step for an worker within the expense reporting course of is to print or submit the expense report for approval. Hold monitor of the standing of your expense report.

What’s expense reporting?

I hope you have got a good concept of learn how to create and use expense studies. However that’s only one step of the expense reporting course of.

Expense reporting can look completely different for various organizations. For small corporations with only some workers, documenting occasional bills adopted by reimbursement claims the place required is a straightforward course of.

Nonetheless, expense reporting can look very completely different for giant corporations and enterprises. With hundreds of each day bills, the finance division is swarmed with a excessive quantity of expense studies.

All the technique of recording, classifying, and documenting workers’ expenditures and the corporate’s spending is named expense reporting.

Expense reporting course of

The expense reporting course of is essential for finance groups in tax submitting, auditing, bookkeeping, budgeting, and forecasting.

Whereas many small corporations desire to stay to guide paper or Excel-based expense reporting, some automate the method partially or absolutely utilizing expense reporting software program.

Let’s perceive these completely different strategies:

Guide expense reporting

Staff submit paper-based expense studies with bodily payments and receipts in guide expense reporting

Most corporations have moved from paper-based processes to Excel-based reporting, the place the finance or accounts division manually paperwork, verifies, and initiates reimbursements for the submitted expense studies.

Small to mid-sized corporations desire such low-cost expense reporting processes.

Automated expense reporting

With many superior expense reporting instruments in the marketplace, completely different steps like expense report creation, verification, and reimbursement initiating may be simply automated.

Staff can submit expense studies and declare reimbursements with out time-consuming log sheets, and finance groups can use an OCR-enabled receipt verification tool to confirm and approve the studies.

Expense reporting software program

Expense reporting software program, generally often known as expense administration software program, is probably the most most well-liked selection of medium—to large-sized corporations for managing worker bills.

Excel-based guide expense reporting may be tedious and time-consuming. As an organization expands, it is higher to maneuver to built-in expense reporting software program.

This software program automates all steps of the reporting course of into one platform and may be simply built-in with different finance instruments, similar to accounting and HRMS software program.

15 Best Spend Management Software Solutions in 2024

Looking to optimize expenditure, improve budget control, and enhance transparency? Do your pain points include overspending, lack of visibility into expenses, and inefficient procurement processes? Transform your spend management workflows with Nanonets.

Allow us to do your expense reporting for you

With Nanonets, employers can simply automate any workflow of the expense reporting course of.

Staff can simply create and submit expense studies on the go, whereas managers and admins can rapidly approve them with a click on.

Right here’s how every workflow automation appears like:

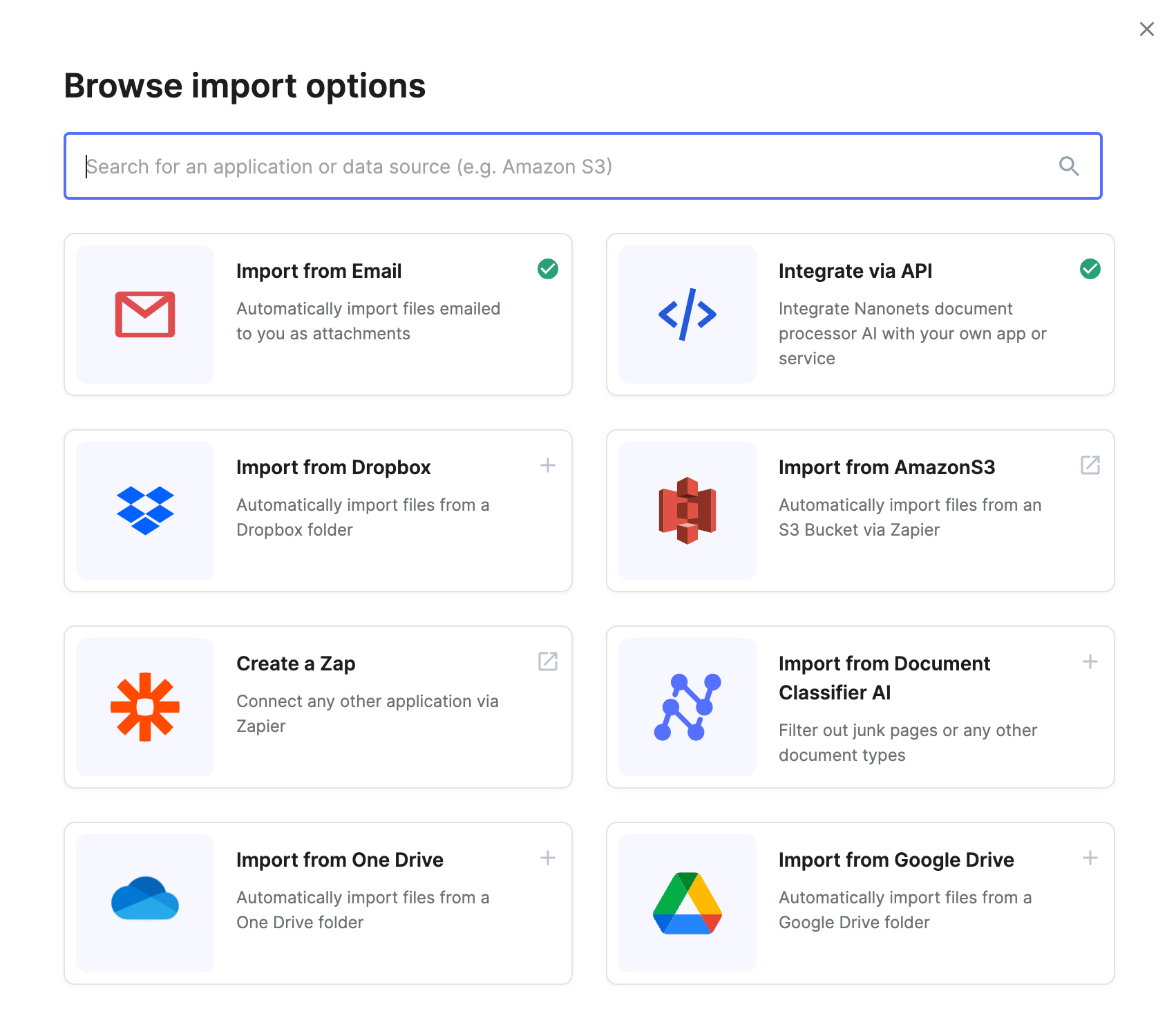

- Expense seize: Staff can seize bills and receipts from 10+ completely different sources, which employers can customise in response to their widespread expense sources.

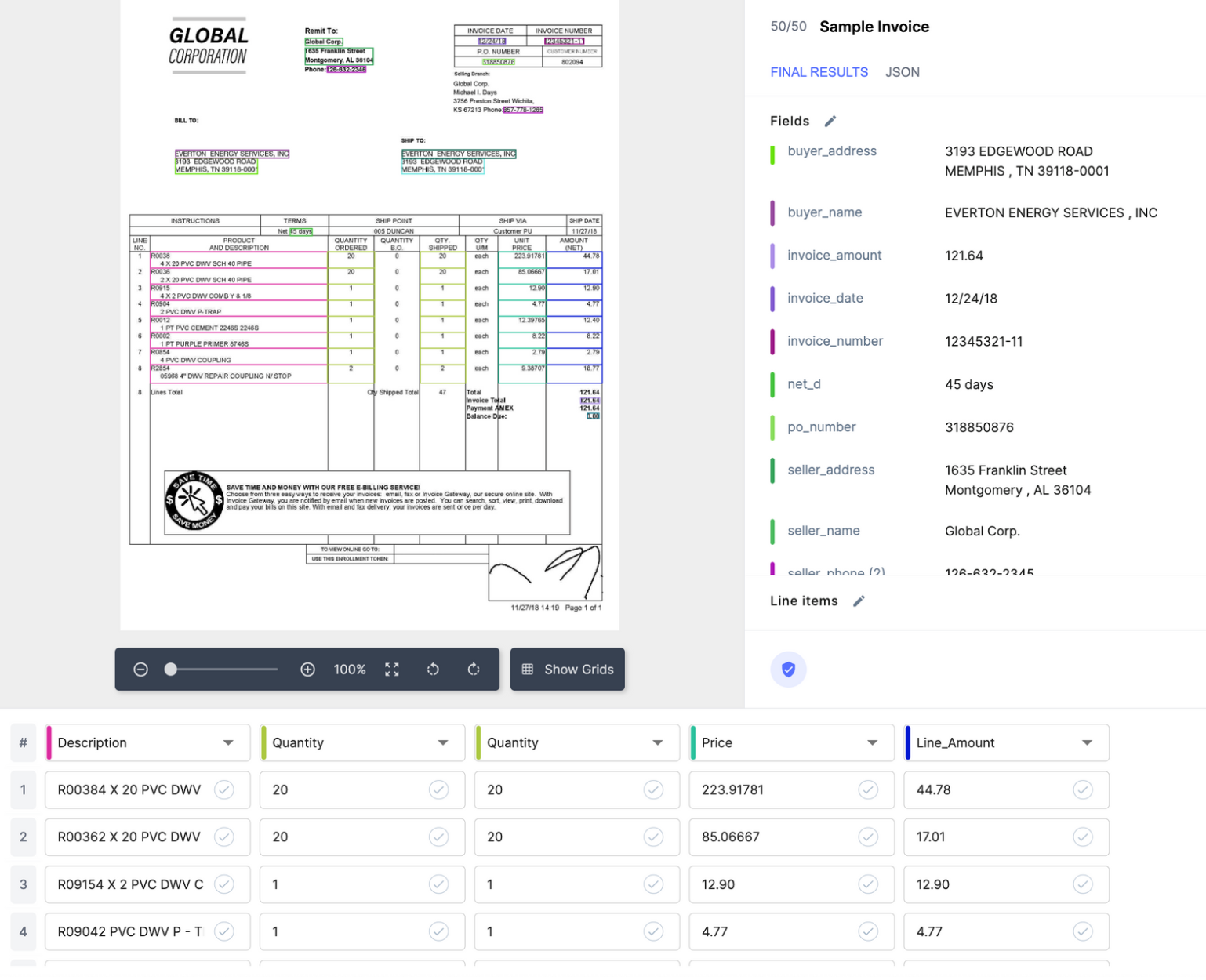

- Expense recording: With superior OCR expertise, all bills, be they paper receipts, invoices, or screenshots, may be simply learn and captured into your worker expense studies.

Nanonets routinely inputs the receipt’s date, vendor title, quantity, and foreign money for you—no guide entry is required. You may even prepare the device to find and seize extra particulars.

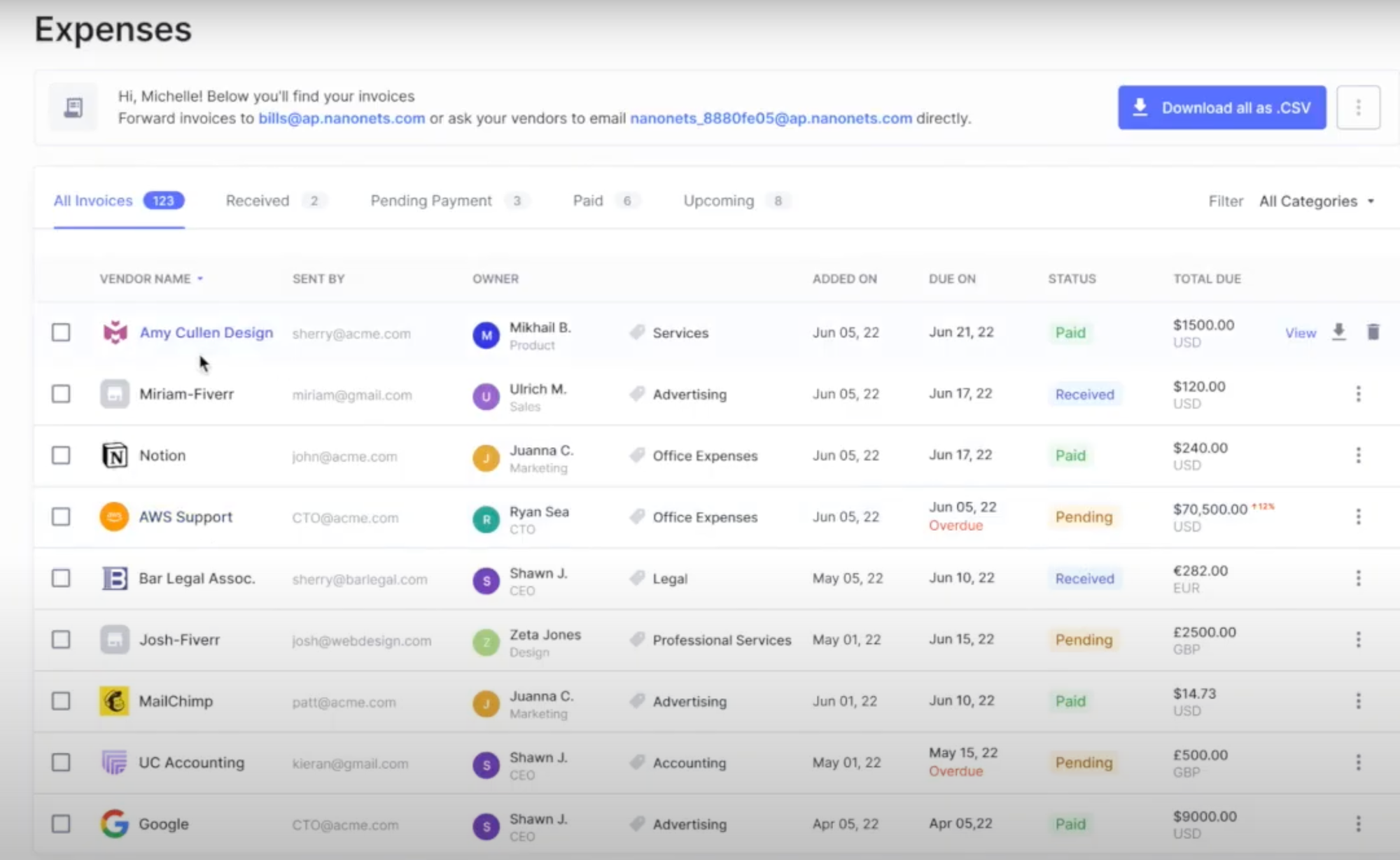

- Create expense studies: With real-time reporting, workers can simply create studies on the go and filter them into completely different expense classes.

- Approvals: Arrange and customise approval workflows and guarantee validation checks by admins and the finance division at every step.

- Coverage compliance: By flagging mismatches and non-compliant bills, Nanonets helps finance groups settle for solely professional reimbursement claims. This ensures coverage compliance and prevents expense fraud.

- Reimbursements: Reimburse your workers simply and monitor the standing of reimbursement requests for all workers in a single place.

- Integrations: Nanonets’ device may be simply built-in together with your preexisting accounting software program and different instruments to make sure seamless sync.

Closing phrases

Companies should embody expense report kinds of their documentation for clean expense reporting and reimbursement.

These studies enable corporations to visualise worker spending absolutely and are essential for an environment friendly spending administration course of.

Ceaselessly Requested Questions (FAQs)

Q. What’s a month-to-month expense report?

A. Staff use a month-to-month expense report back to submit their bills and request reimbursement. Firms additionally use this report back to hold monitor of workers’ month-to-month expenditures.

For small enterprise homeowners, such month-to-month studies might help finances, forecast, and cut back prices.

Q. Find out how to create an expense report in Excel?

A. An expense report may be simply created in Excel utilizing the next 4 columns: Date, Service provider, Quantity, and Class.

You need to use Nanonets’ free Excel expense report template to customise your expense report type.

Q. How can I categorize bills in an expense report?

A. The most typical expense classes as per the enterprise objective are

- Working bills (lease, utilities, workplace provides, and so on.)

- Personnel prices (salaries, payroll taxes, and so on)

- Expertise and software program

- Advertising and promoting

- Journey and leisure (transportation, airfare, meals, mileage, and so on.)

- Skilled charges

- Insurance coverage

- Taxes and licenses (revenue tax, gross sales tax, and so on.)

- Analysis and improvement

How to Categorize Business Expenses?

Learn about business expense categories, how to categorize them for clarity & tax benefits, and automation tools for expense categorization.

Q. Can I take advantage of software program to automate expense reporting?

A. Staff typically use their very own cash for business-related bills and request reimbursement later. Software program that automates the expense reporting course of from begin to finish can save your workers treasured time and guarantee a clean reimbursement course of.

Nonetheless, not all instruments are created equal. If you’re a small enterprise proprietor, you don’t want expensive expense administration software program. Find the largest ache level in your expense reporting course of and automate that workflow utilizing a device.

Try Nanonets free tool to automate your expense reporting course of.