Accounts receivable reconciliation is a vital course of inside accounting and financial administration practices undertaken typically by a enterprise. As transactions with prospects and purchasers occur, corporations generate accounts receivable, which symbolize portions owed to them for objects and suppliers provided or rendered.

Reconciling accounts receivable contains evaluating the balances inside the accounts receivable ledger with supporting documentation, similar to invoices, receipts, and purchaser funds. This course of helps set up discrepancies, resolve wonderful balances, and protect a clear understanding of the company’s financial place.

On this text, we’ll get into the intricacies of accounts receivable reconciliation, exploring its operate, key steps inside the reconciliation course of, and the operate of automation in streamlining this essential financial exercise. Whether or not or not you’re a seasoned accounting expert or new to the sphere, understanding recommendations on find out how to efficiently reconcile accounts receivable is critical for guaranteeing appropriate financial reporting and optimising enterprise operations.

What’s Accounts Receivable Reconciliation?

Accounts receivable reconciliation is a elementary accounting course of that features evaluating and verifying the balances inside the accounts receivable ledger in opposition to supporting documentation and exterior knowledge. This reconciliation targets to ensure the accuracy and completeness of accounts receivable transactions recorded inside the agency’s financial knowledge.

The tactic of accounts receivable reconciliation is, at its core, about confirming the amount of money owed to the company by its prospects or purchasers, and matching with the figures recorded inside the accounting system. This contains cross-referencing diversified sources of knowledge, similar to invoices, product sales receipts, purchaser funds, and ageing opinions.

All through accounts receivable reconciliation, accounting professionals meticulously analysis each transaction to determine discrepancies, errors, or inconsistencies between the ledger balances and the supporting documentation. Any discrepancies found are investigated and resolved to maintain up the integrity of the financial knowledge.

Accounts receivable reconciliation is essential for numerous causes:

- Guaranteeing the accuracy of financial statements: By reconciling accounts receivable, corporations can affirm the reliability of their financial opinions, along with the stability sheet and income assertion.

- Determining and addressing discrepancies: Reconciliation helps uncover discrepancies between the portions recorded inside the ledger and the exact transactions, allowing corporations to rectify errors and forestall financial misstatements.

- Bettering cash motion administration: Right accounts receivable balances enable corporations to raised deal with their cash motion by guaranteeing nicely timed assortment of fantastic funds from prospects.

- Facilitating decision-making: Reliable accounts receivable information provides useful insights into purchaser price tendencies, creditworthiness, and assortment efforts, empowering corporations to make educated alternatives about credit score rating insurance coverage insurance policies, product sales strategies, and debt administration.

In summary, accounts receivable reconciliation is a essential course of that ensures the accuracy, integrity, and reliability of a company’s financial knowledge related to purchaser transactions. By systematically reviewing and verifying accounts receivable balances, corporations can protect financial transparency, mitigate risks, and optimise their financial effectivity.

Step-by-Step Data to Accounts Receivable Reconciliation

The tactic of reconciling accounts receivable contains numerous steps to ensure the accuracy and completeness of the accounts receivable ledger. What follows is an in depth data to performing accounts receivable reconciliation:

- Acquire Documentation: Start by gathering all associated documentation related to accounts receivable transactions. This will likely more and more embody product sales invoices, credit score rating memos, purchaser funds, monetary establishment statements, and ageing opinions.

- Overview Product sales Transactions: Look at the product sales transactions recorded inside the accounts receivable ledger with the corresponding product sales invoices or product sales orders. Verify that each transaction is exactly recorded, along with the amount, date, purchaser title, and invoice amount.

- Verify Purchaser Funds: Cross-reference the consumer funds recorded inside the accounts receivable ledger with the monetary establishment statements or price receipts. Make certain that each price is appropriately utilized to the corresponding purchaser account and invoice.

- Reconcile Ageing Research: Overview ageing opinions to determine overdue invoices and wonderful balances. Look at the ageing report totals with the accounts receivable ledger balances to confirm accuracy.

- Look at Discrepancies: If any discrepancies or inconsistencies are acknowledged in the midst of the reconciliation course of, look at the premise set off. Frequent discrepancies may embody unapplied funds, duplicate entries, or incorrect purchaser balances.

- Modify Ledger Balances: Make essential modifications to the accounts receivable ledger to acceptable any errors or discrepancies. This will likely more and more include reversing incorrect entries, reclassifying transactions, or updating purchaser account balances.

- Doc Reconciliation: Protect detailed knowledge of the reconciliation course of, along with any modifications made and the reasons for these modifications. Documentation is essential for audit capabilities and guaranteeing transparency in financial reporting.

- Finalise Reconciliation: As quickly as all discrepancies have been resolved and modifications have been made, finalise the reconciliation course of. Make certain that the accounts receivable ledger balances match the supporting documentation and exterior knowledge.

- Perform Periodic Opinions: Usually analysis and reconcile accounts receivable balances to ensure ongoing accuracy and completeness. Month-to-month or quarterly reconciliations are useful to stay up-to-date with purchaser transactions and scale back discrepancies.

By following these steps, corporations can efficiently reconcile their accounts receivable balances, set up and sort out discrepancies, and protect appropriate financial knowledge. This course of helps ensure that the integrity of the accounts receivable ledger and permits corporations to make educated alternatives primarily based totally on reliable financial data.

Accounts Receivable Reconciliation

-

Acquire Documentation: Collect all associated paperwork (invoices, credit score rating memos, funds).

-

Overview Product sales: Verify product sales transactions inside the ledger with product sales invoices/orders.

-

Verify Funds: Cross-reference funds with monetary establishment statements/receipts.

-

Reconcile Ageing Research: Confirm overdue invoices and look at totals with the ledger.

-

Look at Discrepancies: Set up and resolve unapplied funds, duplicates, or errors.

-

Modify Ledger: Applicable errors by updating entries and balances.

-

Doc Course of: Maintain detailed knowledge of all reconciliations and modifications.

-

Finalise: Assure ledger balances match documentation and exterior knowledge.

-

Periodic Opinions: Conduct month-to-month/quarterly reconciliations for accuracy.

When to Perform Accounts Receivable Reconciliation

Performing accounts receivable reconciliation on the right time is important to sustaining appropriate financial knowledge and guaranteeing the nicely timed assortment of fantastic funds. There are some key milestones and intervals at which accounts receivable reconciliation must ideally be carried out:

Month-to-month Reconciliation: Conducting month-to-month accounts receivable reconciliation is essential for staying on excessive of purchaser transactions and determining any discrepancies or overdue invoices. By reconciling accounts receivable balances on the end of each month, corporations can promptly sort out factors and protect up-to-date financial knowledge.

Quarterly Opinions: Together with month-to-month reconciliations, performing quarterly evaluations of accounts receivable balances provides an opportunity to judge complete effectivity and set up tendencies or patterns in purchaser funds. Quarterly reconciliation helps corporations observe their progress within the path of revenue targets and sort out any underlying factors affecting cash motion.

Yr-End Reconciliation: Yr-end accounts receivable reconciliation is particularly essential for preparing financial statements and assessing the financial nicely being of the enterprise. By reconciling accounts receivable balances on the end of the fiscal 12 months, corporations can assure compliance with regulatory requirements and exactly report their financial place to stakeholders.

Sooner than Financial Reporting: Accounts receivable reconciliation additionally must be carried out sooner than producing financial opinions or statements, similar to income statements or steadiness sheets. Verifying the accuracy of accounts receivable balances ensures that financial opinions replicate the true financial standing of the enterprise and provide stakeholders with reliable data for decision-making.

Following Important Events: Accounts receivable reconciliation must be carried out following essential events that can impression purchaser transactions, similar to mergers, acquisitions, or changes in enterprise operations. Reconciling accounts receivable balances after such events helps corporations assess the impression on their financial place and set up any modifications wished.

By performing accounts receivable reconciliation at these key intervals and milestones, corporations can protect appropriate financial knowledge, improve cash motion administration, and efficiently monitor purchaser funds. Frequent reconciliation helps set up discrepancies early, sort out factors promptly, and ensure the integrity of financial reporting.

Examples of Accounts Receivable Reconciliation

Accounts receivable reconciliation contains evaluating the info of fantastic purchaser balances with the corresponding entries inside the primary ledger. Listed beneath are some examples of widespread accounts receivable reconciliation conditions:

- Matching Invoices with Funds: One widespread reconciliation exercise is matching purchaser funds with the corresponding invoices. Firms get hold of funds from prospects for objects or suppliers rendered, and these funds should be exactly recorded and matched with the invoices they relate to. Accounts receivable reconciliation ensures that each price is accurately allotted to the right invoice, stopping discrepancies in purchaser account balances.

- Determining Overdue Invoices: Accounts receivable reconciliation moreover contains determining overdue invoices that have not been paid by prospects inside the required credit score rating phrases. By evaluating the ageing report of accounts receivable with the ultimate ledger, corporations can set up wonderful invoices that require follow-up or assortment efforts. Reconciliation helps corporations prioritise assortment efforts and cut back the hazard of unhealthy cash owed.

- Resolving Discrepancies: Accounts receivable reconciliation may uncover discrepancies between the portions recorded inside the primary ledger and the exact purchaser balances. These discrepancies could come up as a consequence of errors in recording transactions, posting errors, or purchaser disputes. Reconciliation contains investigating and resolving such discrepancies to ensure the accuracy of financial knowledge and purchaser account balances.

- Adjusting for Returns or Allowances: Firms could have to manage accounts receivable balances to account for returns, allowances, or reductions granted to prospects. Reconciliation contains determining such modifications and guaranteeing that they are accurately recorded inside the primary ledger. Modifications for returns or allowances help corporations exactly replicate the online amount owed by prospects and protect the integrity of financial reporting.

- Reviewing Harmful Debt Provisions: Accounts receivable reconciliation may also include reviewing provisions for unhealthy cash owed or uncollectible accounts. Firms should assess the possibility of non-payment by certain prospects and make provisions for potential losses. Reconciliation helps corporations analysis and modify unhealthy debt provisions primarily based totally on the ageing of accounts receivable and historic assortment patterns.

Whole, accounts receivable reconciliation ensures the accuracy and completeness of purchaser account balances, facilitates environment friendly cash motion administration, and helps educated decision-making regarding credit score rating and assortment insurance coverage insurance policies. By reconciling accounts receivables typically, corporations can protect financial stability and mitigate risks associated to wonderful purchaser balances.

Right here is an occasion of accounts receivable reconciliation using a simplified desk format:

On this occasion, to reconcile accounts receivable, we start with your entire invoice amount and deduct the funds obtained to calculate the remaining steadiness. Right here is how the reconciliation course of is completed for each invoice:

- INV-001: $500 – $0 = $500

- INV-002: $750 – $500 = $250

- INV-003: $1,000 – $1,000 = $0

- INV-004: $600 – $400 = $200

- INV-005: $900 – $0 = $900

After reconciling all invoices, we calculate your entire portions:

- Complete Invoice Amount: $3,750

- Complete Charge Acquired: $1,900

- Complete Remaining Steadiness: $1,850

This reconciliation course of ensures that your entire invoice amount matches the sum of funds obtained plus the remaining steadiness, thereby verifying the accuracy of accounts receivable knowledge. Any discrepancies could also be acknowledged and investigated further to maintain up appropriate financial knowledge.

How Automation Improves Accounts Receivable Reconciliation

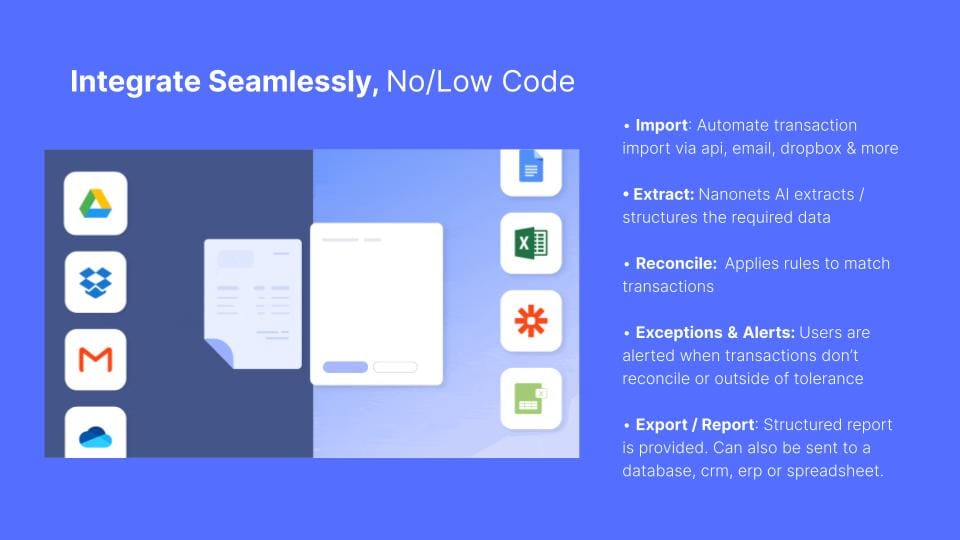

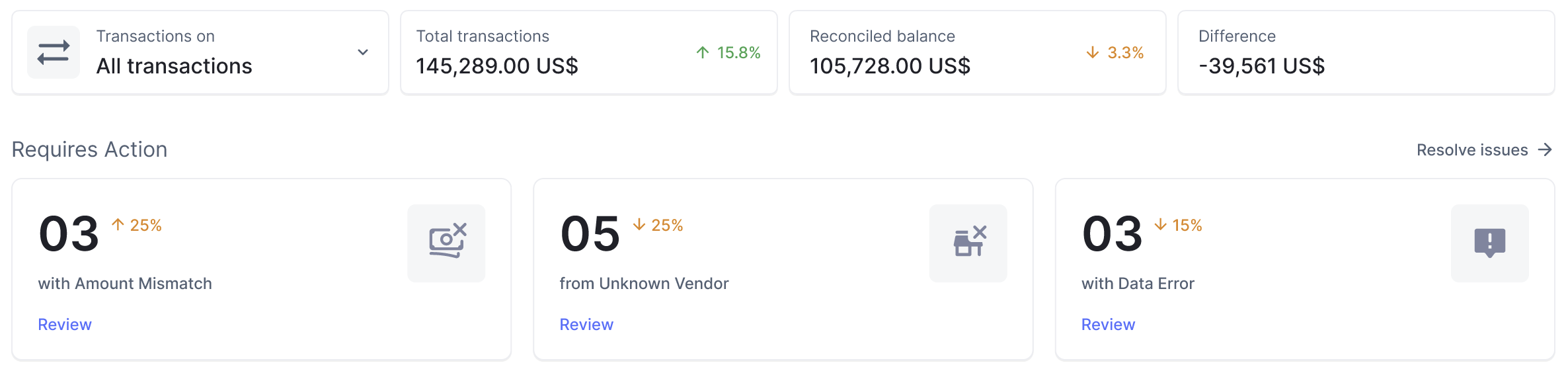

Automation devices like AI/ML-enabled Nanonets can significantly streamline the accounts receivable reconciliation course of by automating repetitive duties and decreasing information errors. Right here is how:

- Automated Information Extraction: Nanonets can extract information from invoices, receipts, and value paperwork with extreme accuracy AI/ML-enabled OCR (Optical Character Recognition) know-how. This eliminates the need for information information entry, saving time and decreasing errors.

- Matching and Reconciliation: Nanonets can robotically match funds obtained with corresponding invoices using superior algorithms. This ensures that all transactions are exactly reconciled with out the need for information intervention.

- Exception Coping with: Nanonets can flag and prioritise exceptions, similar to discrepancies between invoices and funds or missing paperwork, for analysis by finance teams. This allows teams to focus their consideration on resolving essential factors whereas decreasing the hazard of overlooking important discrepancies.

- Integration with Accounting Methods: Nanonets seamlessly integrates with accounting packages and ERP (Enterprise Helpful useful resource Planning) software program program, allowing for real-time updates and synchronisation of reconciled information. This ensures that financial knowledge are on a regular basis up-to-date and proper.

- Reporting and Analytics: Nanonets provides full reporting and analytics capabilities, allowing finance teams to realize insights into accounts receivable effectivity, set up tendencies, and make data-driven alternatives. This helps improve complete financial administration and forecasting.

By leveraging automation devices like Nanonets, corporations can streamline the accounts receivable reconciliation course of, cut back information effort, and assure increased accuracy and effectivity in financial operations.

Conclusion

Accounts receivable reconciliation is a essential course of for corporations to ensure the accuracy and integrity of their financial knowledge. By reconciling invoices and funds typically, corporations can set up discrepancies, observe wonderful balances, and protect healthful cash motion.

On this text, we’ve got explored the thought of accounts receivable reconciliation, its significance, and the steps involved inside the reconciliation course of. We’ve moreover talked about how automation devices like Nanonets can streamline the reconciliation course of, saving time and decreasing errors.

By adopting best practices and leveraging automation know-how, corporations can optimise their accounts receivable reconciliation course of, improve financial effectivity, and make further educated enterprise alternatives.