What’s Credit score rating Card Reconciliation?

Financial institution card reconciliation is the strategy of creating sure that the financial institution card transactions match the inside fundamental ledger. It entails verifying the payments recorded by the company”s accounting system align with the statements supplied by the financial institution card issuer.

Financial institution playing cards have made it easier for firms to course of funds. Throughout the U.S. alone, credit card balances exceeded $1 trillion all through the pandemic.

However, the rise in financial institution card utilization has led to financial nightmares all through accounting teams on the end of the month because of this suggests the transactions that must be reconciled are moreover on the rise. With disparate information sources and improper expense monitoring, the accounting employees can trace the proof of payments all through quite a few information sources, which could be very time-consuming.

Types of Credit score rating Card Reconciliation

Accounting teams come all through these two types of financial institution card reconciliation:

Assertion-based reconciliation:

This affords with the company’s financial institution card payments. It entails matching the financial institution card payments recorded by the company’s accounting devices to the financial institution card assertion acquired by the credit score rating issuer. That’s vital to verify the validity of the financial institution card costs is mirrored inside the financial books.

Service supplier service reconciliation:

That’s pertinent to the earnings side of the reconciliation, the place shoppers pay for the enterprise by means of financial institution card. The accounting employees ought to reconcile the financial institution card transactions acquired with the proofs acquired by means of the service supplier service provider or price processor, resembling Paypal.

Why Is Credit score rating Card Reconciliation Important?

Agency financial institution playing cards are a most popular alternative for managing enterprise payments. They promote consolation and ease of use for employees to take care of work-related costs.

The accounting teams wish to hint each expense charged through the financial institution card. All these entries must be present inside the fundamental ledger, which have to be matched all through monetary establishment statements, receipts, and financial institution playing cards to verify the validity of the expense declare.

When line devices of the ultimate ledger don’t match the financial institution card assertion, the transaction is escalated to the financial controller, who identifies why the discrepancy occurred inside the first place.

Financial institution card reconciliation is essential as a result of it helps firms cease fraud, protect financial integrity, optimize spending, and protect the company’s books audit-friendly all through the financial close process, typically occurring on the end of each month.

The way in which to do Credit score rating Card Reconciliation?

Financial institution card reconciliation entails matching financial institution card statements to inside financial info. Nonetheless how can we go about this?

Gathering the entire Statements and Receipts or supporting paperwork:

First, we must always accumulate the entire financial institution card statements and the associated receipts for the required interval. Receipts carry out as proof of expense. Each time the corporate financial institution card makes a price, an invoice is obtainable, which have to be recorded by the expense administration system or manually recorded in spreadsheets.

Matching the expense to the transactions:

Now, the strategy entails going through each transaction listed inside the financial institution card assertion and evaluating it to the receipts. The transactions must be verified to ensure that they’re authorised and match the purpose and amount of the expense.

Look at discrepancies:

Reconciliation is a crucial part of the financial shut course of to verify the integrity of the enterprise’s funds. In case of discrepancies, the route set off must be acknowledged, the people involved inside the funds must be notified, and in some situations, the monetary establishment authorities must be educated.

Buying Approval:

As quickly as all the data is recorded inside the fundamental ledger, subject inside the costs of the financial institution playing cards and cross-check whether or not or not the entire financial institution card payments match. After this carry inside the controllers or the designated finance managers who can consider and provide the approval for all of the course of.

Points involving Credit score rating Card Reconciliation

There are a variety of challenges associated to financial institution card reconciliation.

Shared Agency Credit score rating Enjoying playing cards:

In a lot of conditions, the similar financial institution card is shared amongst quite a few employees. This proves problematic for financial closers as they should decide which employee made the acquisition when receipts are often not adequately present and will present to be a fraud hazard.

Missing Receipts:

The issue of missing receipts raises the problem of untraceable sources of reality. This results in a spot inside the documentation and invoices are involved to fill inside the gap by matching in opposition to the financial institution card statements.

Service supplier Account Reconciliation Factors:

When funds are processed through service supplier accounts, points can come up when costs are deducted on the platform, formatting factors on reporting transactions, and completely different points that must be factored in all through the information reconciliation.

Handbook Data Entry:

Folks make many errors whereas entering data manually. Points resembling double entry and rounding errors could come up when reconciling financial institution playing cards. Nonetheless this moreover implies that when a extreme amount of transactions have to be reconciled, potentialities of missing human errors, duplicate submissions, and inaccurate data would possibly present to be a problem.

Quite a few Data Components:

A single financial institution card transaction can generate quite a few information components that must be matched—the financial institution card assertion, the receipt, and doubtlessly an invoice inside the accounting system. Preserving monitor of all these information sources and making sure they align is liable to errors, significantly and never utilizing a centralized storage system.

Paper receipts:

With out capturing or digitizing receipts and invoices, storing and recording information from paper receipts could be error-prone and simple to misplace such that each one the course of, when carried out on the month’s end, is inefficient.

Credit score rating Card Reconciliation Software program program as a Reply:

Automating the strategy of financial institution card reconciliation would possibly assist leverage accuracy and effectivity and protect the financial integrity of bookkeeping.

Financial institution card reconciliation software program program presents a diffusion of choices and benefits that will help curb the challenges listed above and let accounting teams facilitate financial closing with automation.

Key choices of financial institution card reconciliation software program program:

Automated information import:

Financial institution card reconciliation software program program can mix with banks and financial institutions to import information routinely; this eliminates the need for information information entry and scales with elevated volumes of transactions which might be in must be reconciled.

Automated Transaction Matching:

Reconciliation or Matching logic is a speciality for financial institution card reconciliations. The superior transaction matching algorithms are capable of matching the financial institution card transactions with the corresponding entries inside the accounting system.

Integration with Accounting strategies:

With disparate information sources caring in B2B transactions, financial institution card reconciliation software program program can bridge the opening, which might in another case go away accounting teams with strands full of hairs on their fingers whereas they try to accumulate the invoice handed over by the supplier, tracing the transaction once more to the accounts payable ledger and gathering the receipt.

How Nanonets Solves Credit score rating Card Reconciliation:

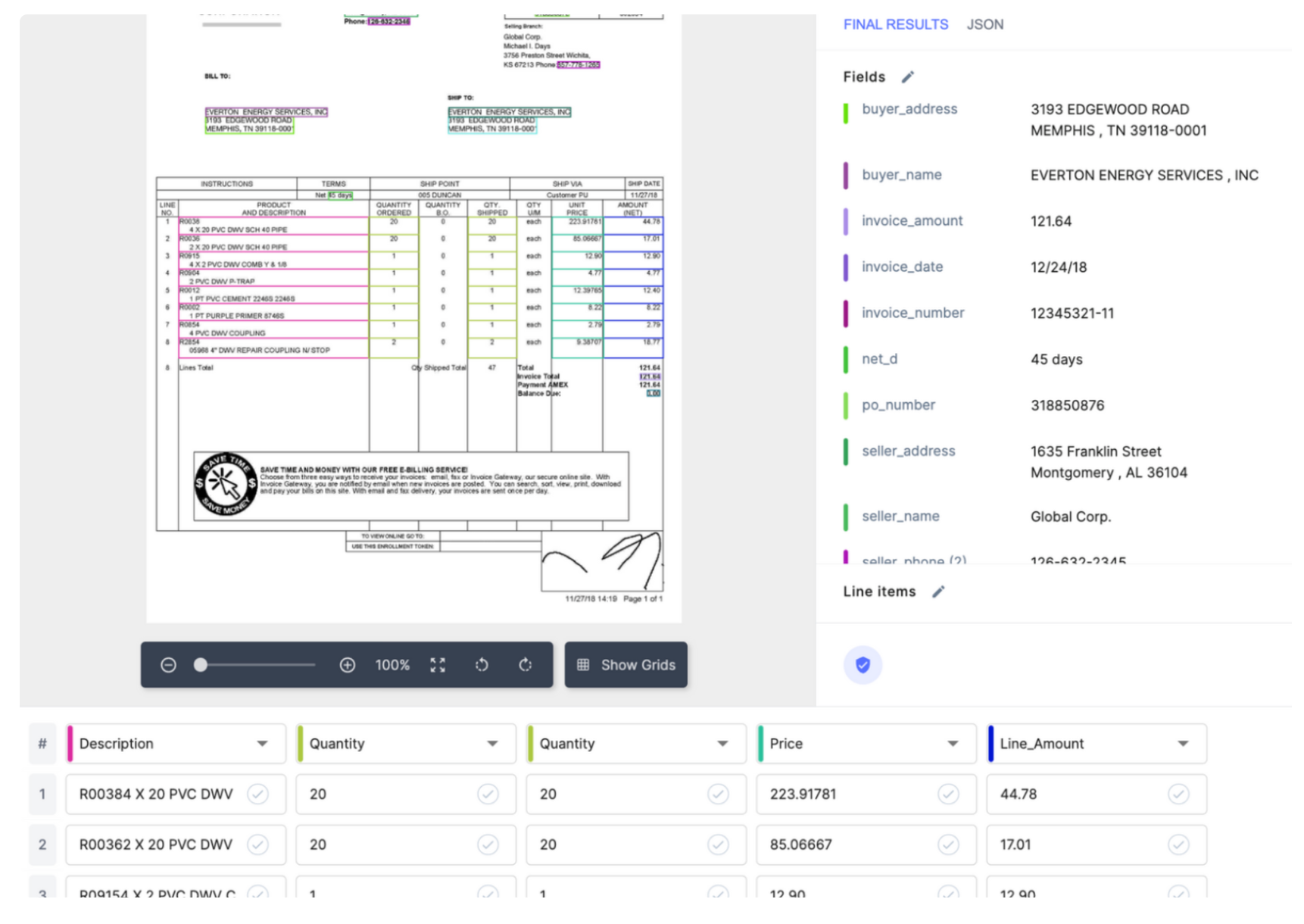

Nanonets is an Intelligent Financial Workflow automation platform. Nanonets focuses on information extraction from paperwork, turning unstructured information into structured information research, boasting an accuracy of 99% whereas doing so. Nanonets is a key platform for accounting teams that face a extreme amount of transactions that need reconciling on the end of the month.

For example, for instance you get charged for a software program program subscription. The paperwork or information components that it’s important to consolidate in (real-time) order to hold out financial institution card reconciliation are:

- The invoice will get generated by means of the software program program provider.

- Importing the invoice into your accounts payable system or your fundamental ledger

- When the price is on the market in by means of the financial institution card, accumulate the receipt to hold out the match.

The reconciliation course of entails matching the invoice, the price made with the financial institution card, and the receipt to ensure that all paperwork are fixed and that the price was precisely recorded.

On Nanonets, you might add your whole invoices in a single go; this can be inside the differ of 1000-10,000 paperwork (it will not matter). Nanonets’ Invoice OCR routinely extracts all the data from the invoices into structured information for the required interval and retailers and converts them into tabular information, which is a predefined template that is rather a lot easier to eat. Typically invoices have completely completely different codecs and languages, nonetheless they don’t matter; on Nanonets, organizations can acquire as a lot as 99% accuracy by automating information information entry and saving time inside the course of.

Now, acquire the financial institution card assertion that your financial institution card issuer has supplied you for the required time interval. As quickly as uploaded to Nanonets, as soon as extra the data seize course of begins and using superior matching algorithms Nanonets is able to ensure that each entry inside the financial institution card assertion corresponds to an invoice and a price file inside the accounts payable system.

This helps accountants save a bunch of time and assure accuracy on the end of the month when confronted with an infinite load of transactions that must be reconciled.

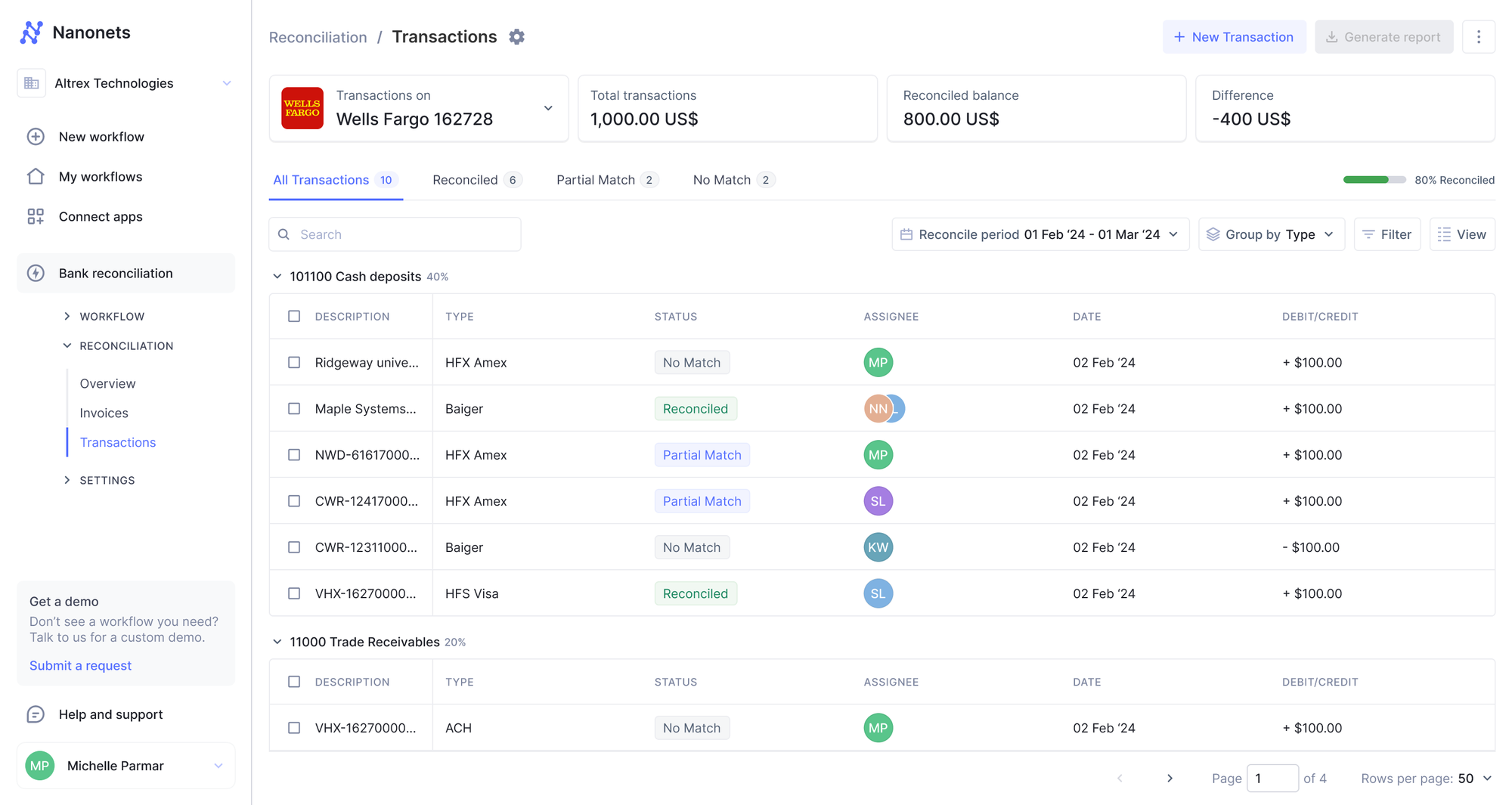

Nanonets Precise-Time Reply:

For example instead of reconciling your financial institution card transactions on the end of the month; you wish to acquire doing this in real-time. That’s how the strategy could be achieved on Nanonets.

Mix your organization financial institution card on Nanonets using workflow automation. In order quickly as an employee costs your financial institution card, they acquire automation on their textual content material message or their workplace like Slack to attach a receipt for the financial institution card expense.

As quickly as that’s accomplished, Nanonets’ Receipt OCR can extract information from these receipts and consolidate them inside the dashboard. Nanonets then pull information from the financial institution card assertion issuer (each by importing the financial institution card assertion manually or requesting a custom-made integration on the platform).

After getting every databases ready, Nanonet’s advanced matching algorithm can perform automated matching and set off workflow and alerts wherever there is a discrepancy, and the associated people are flagged to look into it.

Conclusion

Financial institution card reconciliation is a crucial course of in financial administration, significantly for firms engaged in B2B transactions. It ensures that every one transactions recorded inside the accounts payable system align with the exact funds made by means of the financial institution card and the corresponding documentation resembling invoices and receipts.

By incorporating an automated reply like Nanonets, firms can streamline the reconciliation course of, decreasing the information effort required and minimizing the hazard of errors. This not solely enhances effectivity however moreover ensures that financial info are right and up-to-date, lastly supporting increased financial decision-making and compliance.